Open Interest

Analyse open interest buildups, spot support and resistance levels.

The Open Interest Analysis is a revolutionary tool designed to empower traders by providing extensive insights into current and historical open interest buildups in the options and futures market. It is crafted to aid users in recognizing critical market levels, including support and resistance, enabling them to make informed trading decisions and refine their trading strategies.

Key Features:

1. Current Open Interest Buildup Analysis:

The tool offers real-time analysis of open interest buildups, allowing users to assess the prevailing market sentiment and adjust their positions accordingly.

2. Historical Open Interest Data:

Users can access a rich repository of historical open interest data, enabling them to identify patterns, trends, and anomalies over different time frames, fostering a deeper understanding of market dynamics.

3. Support and Resistance Identification:

The tool excels in identifying potential support and resistance levels based on open interest buildups, which is crucial for predicting price movements and planning entry and exit points.

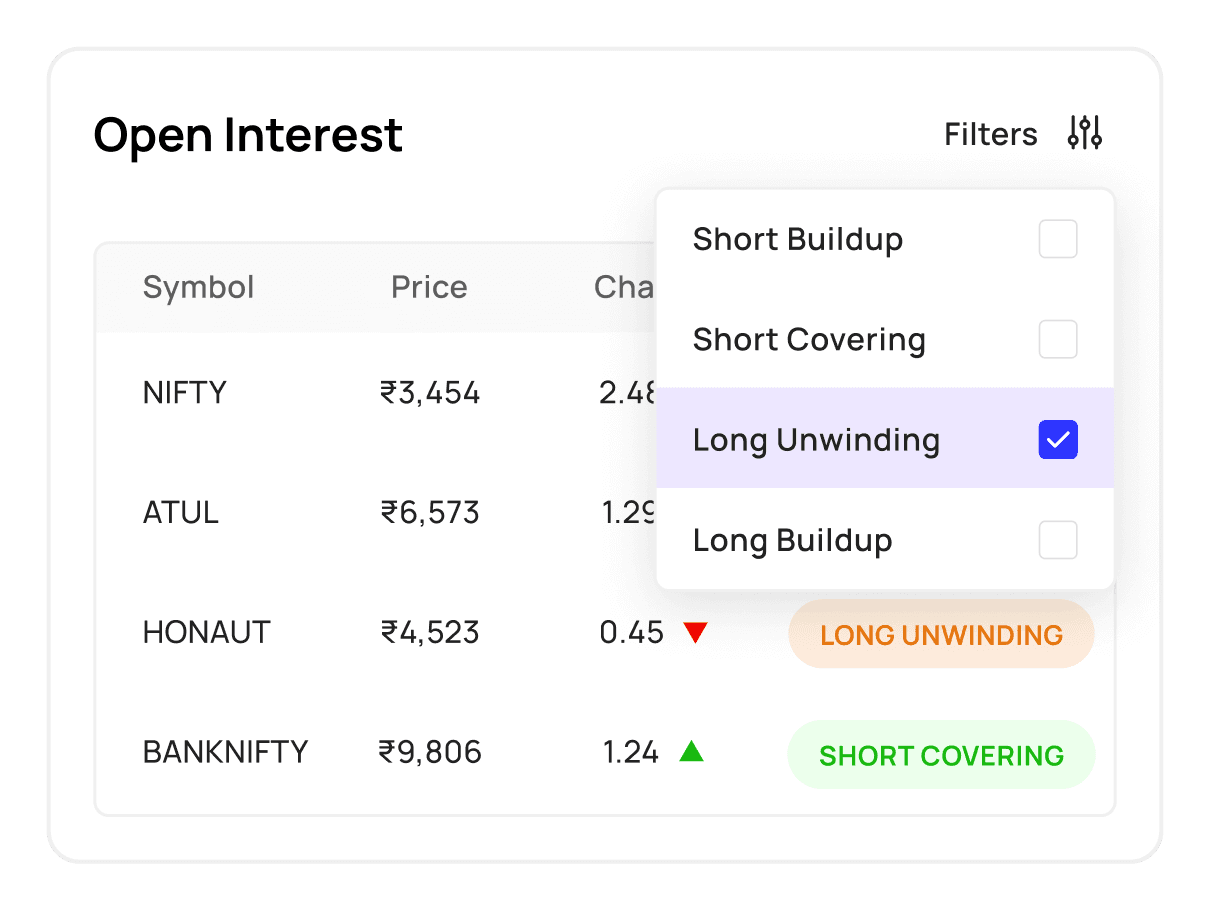

4. User-friendly Interface:

With its intuitive and clean interface, users can effortlessly navigate through the tool and access the required information and analyses promptly.

5. Customizable Parameters:

The tool allows users to modify parameters to suit their analytical needs, providing a tailored experience and more accurate insights related to open interest.

6. Visual Representation:

It employs graphical representations like charts and graphs for a better understanding of open interest data, enabling users to interpret complex information easily.

Benefits:

Strategic Trading:

By analyzing open interest buildups and recognizing support and resistance levels, traders can develop and optimize their trading strategies to enhance profitability and mitigate risks.

Informed Decision Making:

The amalgamation of current and historical open interest data enables users to make well-informed trading decisions based on comprehensive market analysis.

Market Sentiment Analysis:

Understanding open interest helps in deciphering whether money is flowing into or out of contracts and aids in determining bullish or bearish market sentiment.

Risk Management:

Identifying critical market levels and trends through the tool aids in better risk management by allowing users to set more accurate stop-loss and take-profit levels.

The Open Interest Analysis Tool is a versatile and indispensable asset for traders and investors seeking to enhance their market knowledge and trading acumen. It stands as a beacon for those aspiring to navigate the complexities of open interest in the options and futures market, facilitating strategic trading, risk mitigation, and informed decision-making. By leveraging this tool, users can unlock a new dimension of market analysis, refining their approach to trading and positioning themselves adeptly in the ever-evolving financial markets.

Don't let emotions take over your trades, take control now and become a tactical trader with 1lyOptions