Algo Trading: Ultimate Beginners Guide 2023

Executing strategic algorithms to automate trading decisions and optimize financial portfolios in real-time.

February 1, 2024

In the fast-paced world of finance, Algorithmic Trading, or algo trading, is gaining momentum as a powerful tool for both seasoned investors and beginners. This comprehensive guide will walk you through the basics and help you navigate the intricate landscape of algo trading.

What is Algo Trading?

Algorithmic Trading, or algo trading, involves using pre-programmed software to execute high-speed trading strategies in financial markets. These algorithms analyze market trends, make decisions, and execute trades, all at speeds impossible for human traders.

How Does it Work?

Complex Algorithms: Algo trading relies on intricate mathematical models and statistical analysis.

Optimal Speed: Automated systems execute trades at lightning speed, seizing market inefficiencies.

Advantages and Disadvantages

Advantages:

Increased Efficiency: Algo trading operates 24/7, executing trades with precision and speed.

Reduced Emotional Bias: Automated systems eliminate emotional decision-making, leading to more disciplined trading.

Diversification: Algo trading allows for simultaneous management of multiple strategies across various assets.

Disadvantages:

Technical Glitches: System errors and technical issues can lead to unexpected losses.

Over-Optimization Risks: Excessive tweaking of algorithms for replicating historical performance may not translate well to live markets.

Market Unpredictability: Algorithms might struggle during highly volatile or unprecedented market conditions.

Diversions in Algo Trading

Algo trading strategies come in various forms, each catering to different market conditions, themes and risk appetites.

Trend-Following: Strategies that capitalize on market trends.

Mean-Reversion: Techniques that anticipate a return to average prices after a deviation.

Statistical Arbitrage: Utilizing statistical models to identify trading opportunities.

Machine Learning-Based Models: Harnessing the power of artificial intelligence for predictive analysis.

Skills Needed for Algo Trading

While a deep understanding of financial markets is paramount, specific skills enhance your prowess in algo trading.

Programming Proficiency: Familiarity with languages like Python is crucial for implementing and modifying algorithms.

Statistical Knowledge: Understanding statistical concepts is essential for developing effective trading models.

Is Algo Trading Hard?

The difficulty of algo trading depends on various factors:

Learning Curve: Algo trading has a steeper learning curve compared to traditional trading. It involves understanding programming, statistics, and market dynamics.

Continuous Learning: Markets evolve, and so should your strategies. Keeping up with the latest trends and technologies is essential.

Technical Challenges: Dealing with complex algorithms and potential technical glitches requires a certain level of technical proficiency.

However, with dedication and a commitment to learning, many find the challenges of algo trading to be rewarding.

How to Begin Algo Trading Safely? Using Inuvest platform

For beginners, platforms like Inuvest provide essential features for a secure start-

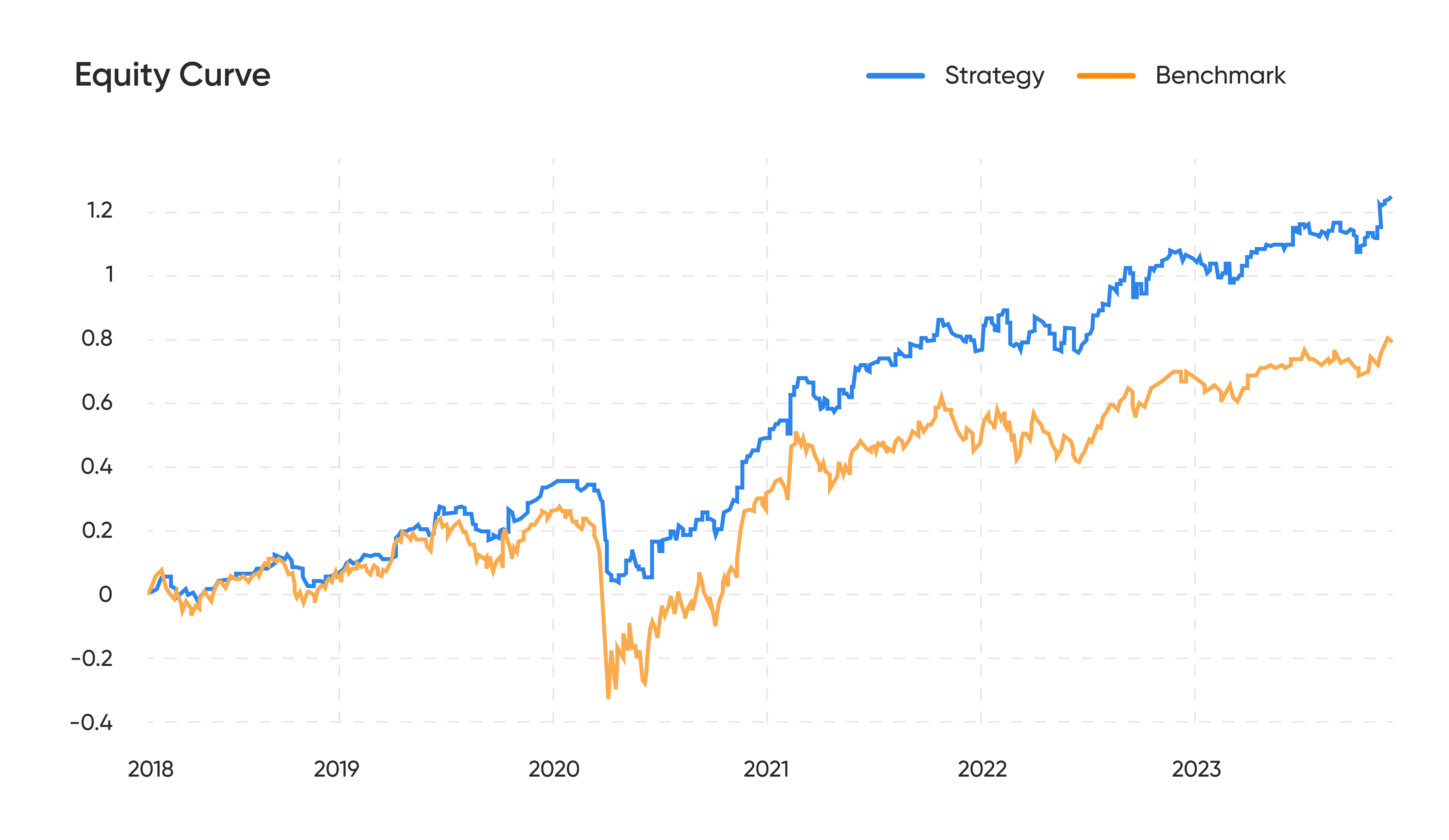

Backtesting: Simulate trading strategies with historical data to assess their viability.

Virtual Trading: Practice trading in real market conditions without risking real money.

In conclusion, algo trading is a captivating avenue for those eager to explore the dynamic landscape of financial markets. While it demands a learning curve, the potential for increased efficiency and profitability makes it a compelling venture for individuals ready to delve into the world of algorithmic trading. Dive in, learn, and let your algorithms navigate the exciting waters of modern finance!

Don't let emotions take over your trades, take control now and become a tactical trader with 1lyOptions