Selling Options No Longer Rewarding in the Indian Markets?

India Vix of the IV of Nifty is at an all-time low.

September 11, 2023

The allure of options trading has been historically irresistible to many traders, both institutional and retail. The sale of options can generate immediate income, leveraging the time decay factor intrinsic to all options. In India, a growing number of market participants have embraced options as an integral part of their trading strategy. However, recent murmurs suggest that selling options may not be as rewarding as it once was. Let's delve into the reasons behind this sentiment:

- Increased Market Efficiency: Over the past few years, algorithmic and high-frequency trading have become dominant in global markets, including India. Of late, there has been a rise in the number of retail investors who were historically buyers of options and are now writers of options.

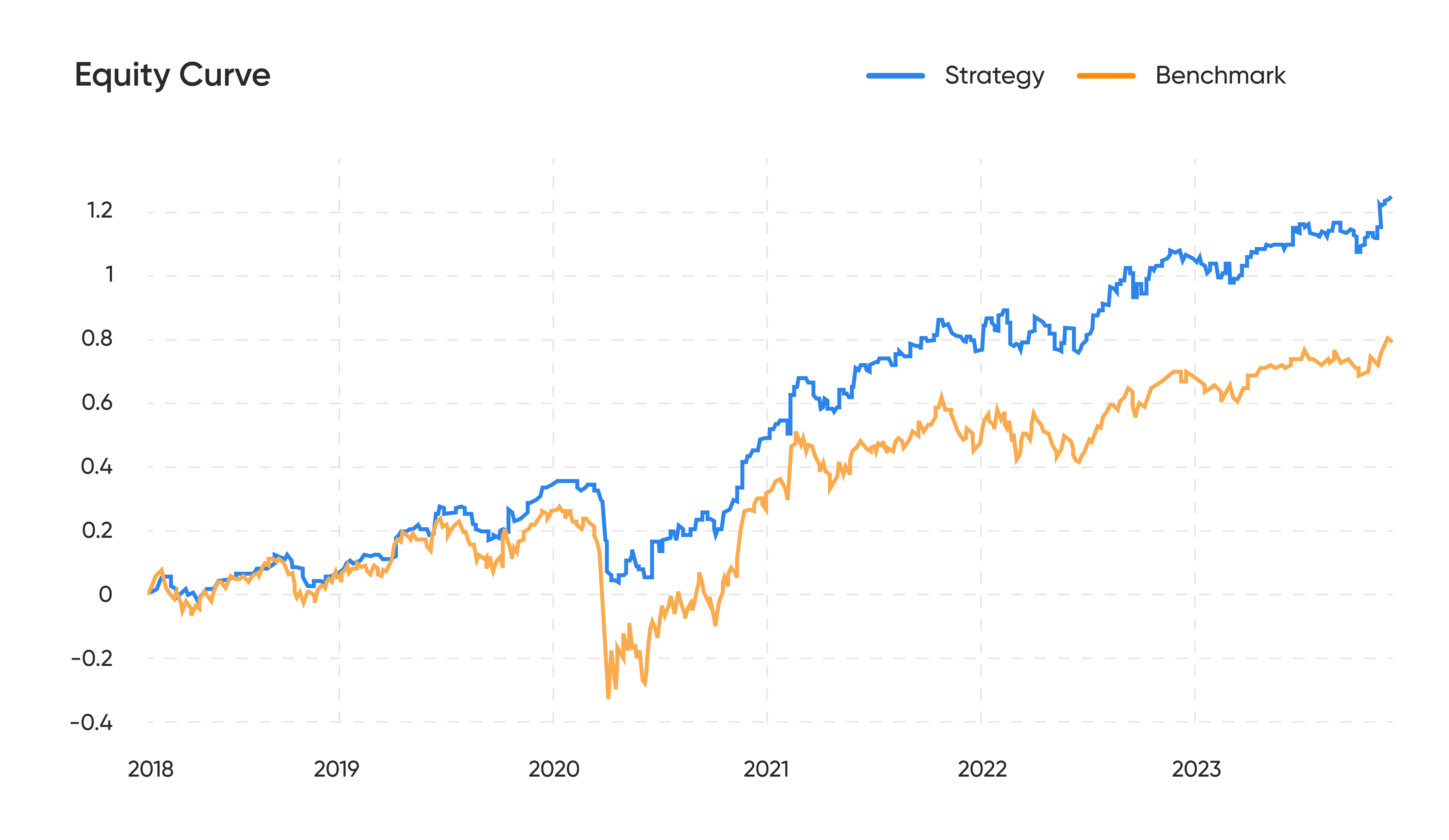

- All-time low Volatility: India's financial markets have witnessed periods of heightened volatility during COVID-19 and a few years following it. Option selling is highly rewarding during panic or times of uncertainty. Currently, the markets are at an all-time high and the India VIX is at an all-time low. India VIX is been consistently below 12 since June 23. During such times, option ppremiums being lowest which makes it difficult for sellers are there is little decay impact. A small move in the underlying could impact the seller's profit by a larger extent.

- Regulatory Changes: SEBI (Securities and Exchange Board of India) has periodically introduced changes to margin requirements, making it more capital-intensive to sell options. Higher margin requirements mean traders have to commit more capital for the same positions, impacting returns on capital.

- Increased Competition: As the Indian markets mature, there's a proliferation of sophisticated traders and institutions in the options segment. Increased competition invariably leads to reduced premiums and narrower spreads, diminishing the rewards for option sellers.

- Low-Interest Rate Environment: With central banks globally maintaining low interest rates to boost economic recovery, the opportunity cost of committing capital to options selling is reduced. However, the reduced rate also impacts the risk-free rate component in option pricing models, leading to slightly lower option premiums.

- Maturity of the Indian Markets: As the Indian market matures, information asymmetry decreases. The advent of information technology, financial literacy campaigns, and general market awareness means that retail and institutional traders are often on a more level playing field, leading to compressed premiums.

So, What's the Verdict?

While the landscape for selling options in the Indian market is certainly evolving, it doesn't necessarily mean that it's no longer profitable. Instead, it suggests a need for option sellers to adapt and evolve their strategies. Here are a few considerations for modern-day option sellers:

- Risk Management: Always prioritize risk management over potential returns. Use stop losses, hedge where necessary, and be aware of the potential for black swan events.

- Continued Learning: The market landscape is ever-evolving. Keeping abreast of changes in market dynamics, regulatory environment, and global events is crucial.

- Diversification: Consider diversifying strategies to include both option selling and buying, or even look at other financial instruments.

In conclusion, while challenges persist, like all trading methodologies, it requires adaptation, continuous learning, and prudent risk management to navigate the ever-shifting sands of the financial markets.

Don't let emotions take over your trades, take control now and become a tactical trader with 1lyOptions