Navigating the Risks of Options Trading: A Comprehensive Analysis

Utilize advanced analytics to assess and mitigate risks effectively, ensuring a secure options trading experience.

January 5, 2024

Options trading has emerged as a dynamic and sophisticated financial market strategy, offering investors the potential for substantial returns. However, this lucrative field has its pitfalls. Understanding and navigating the risks associated with options trading is crucial for those seeking to engage in this complex financial arena.

Market Risk

At the core of options trading lies market risk. Options derive their value from the underlying assets, such as stocks, indices, or commodities. The inherent volatility of financial markets can lead to significant fluctuations in the prices of these assets, impacting the value of options. Traders need to be acutely aware of market trends, economic indicators, and geopolitical events that can influence the prices of the underlying assets, thereby affecting the performance of options.

Leverage Risk

One of the defining features of options trading is the use of leverage. Leverage allows traders to control a large position with a relatively small amount of capital. While this amplifies the potential for high returns, it also magnifies the risk of substantial losses. Traders must approach leverage with caution, understanding that the same multiplier effect that can increase profits can also lead to financial setbacks if the market moves unfavorably.

Time Decay Risk

Options come with an expiration date, and their value is intrinsically linked to time. Time decay is a critical factor that can erode the value of options as they approach their expiration. Traders need to factor in this time decay when formulating their strategies, as holding onto options for too long can result in diminishing returns. Effective risk management involves a keen understanding of how time decay impacts the value of options.

Volatility Risk

Volatility is a double-edged sword in options trading. On one hand, high volatility can create opportunities for traders, leading to increased option premiums. On the other hand, it amplifies the risk of rapid and unpredictable price movements. Conversely, low volatility can reduce option premiums, limiting potential profits. Successful options traders are those who can effectively analyze and manage volatility risk, adapting their strategies to different market conditions.

Interest Rate Risk

Interest rates play a subtle yet impactful role in options trading. Changes in interest rates can influence the cost of borrowing for investors using leverage, affecting their overall profitability. Traders should monitor interest rate trends and consider their potential impact on options positions. A rise in interest rates may increase the cost of financing, impacting the attractiveness of certain options strategies.

Counterparty Risk

While options contracts are typically traded on regulated exchanges, there is still a level of counterparty risk involved. In the unlikely event of a counterparty default, such as a brokerage or clearinghouse failure, traders may face challenges in executing trades or recovering their assets. It is imperative to choose reputable brokers and understand the safeguards in place to mitigate counterparty risk.

Lack of Understanding Risk

Options trading demands a deep understanding of financial markets, trading strategies, and the specific nuances of options contracts. Novice traders who lack knowledge and experience may make uninformed decisions, exposing themselves to substantial losses. Education and research are fundamental for minimizing the risks associated with a lack of understanding. Successful options traders invest time in learning about options pricing, strategies, and the broader financial landscape.

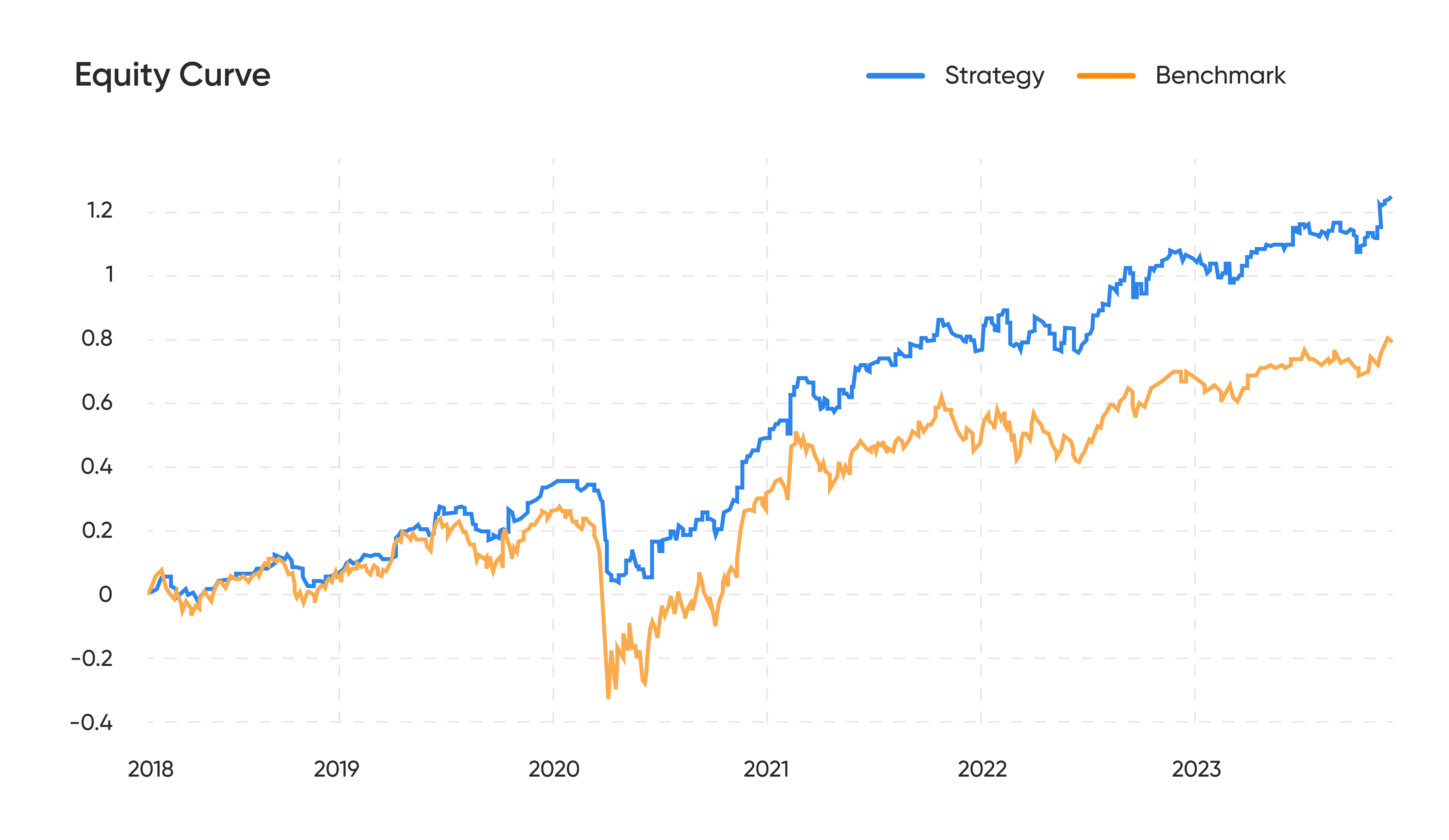

Risk Management in Trading

Effective risk management is paramount in trading to protect capital and navigate unpredictable markets. It ensures longevity and helps traders withstand inevitable fluctuations, minimizing potential losses.

How to Implement Risk Management:

1. Diversification: Spread investments across various assets to reduce exposure to a single risk.

2. Position Sizing: Determine the amount of capital to allocate to each trade, limiting potential losses.

3. Stop-Loss Orders: Set predefined exit points to automatically sell an asset, preventing substantial losses.

4. Risk-Reward Ratio: Assess potential gains against potential losses before entering a trade to maintain a favorable balance.

5. Continuous Monitoring: Regularly review and adjust risk management strategies in response to market changes.

1lyOptions: Enhancing Risk Management

1lyOptions offers unparalleled support for risk management in trading:

1. Advanced Analytics: Access cutting-edge analytics to assess market trends, enabling informed decisions.

2. Portfolio Diversification Tools: Utilize features that assist in diversifying your options portfolio effectively.

3. Risk Assessment Models: Benefit from tools that provide insights into potential risks associated with specific trades.

4. Automated Alerts: Receive real-time alerts for significant market movements, allowing prompt risk response.

5. Scenario Analysis: Simulate different market scenarios to anticipate potential risks and plan accordingly.

By integrating 1lyOptions into your trading strategy, you gain a powerful ally in risk management, empowering you to navigate the markets with confidence and safeguard your investments effectively.

Final Thoughts

Options trading presents an enticing landscape for investors seeking diversification and potential high returns. However, the allure of profits should not overshadow the risks inherent in this complex financial instrument. Market risk, leverage risk, time decay risk, volatility risk, interest rate risk, counterparty risk, and the risk associated with a lack of understanding are all factors that must be carefully considered and managed.

Traders must approach options trading with a combination of strategy, discipline, and risk management. A well-thought-out plan, continuous education, and a keen awareness of market dynamics are essential components of success in options trading.

By acknowledging and addressing these risks, investors can navigate the complexities of the options market with confidence and increase their likelihood of achieving profitable outcomes. Remember, in options trading, knowledge is not just power; it's the key to unlocking the full potential of this intricate financial landscape.

Don't let emotions take over your trades, take control now and become a tactical trader with 1lyOptions