What Is An Options Analytics Platform And How Can It Help Traders?

Discover how options analytics platforms boost trading with real-time data, advanced charting & risk analysis. Make informed decisions with Greeks!

March 5, 2025

An options analytics platform provides real-time data and risk analysis tools to help traders make informed decisions. It helps identify trends, optimise strategies, and manage risk efficiently. With features like Greeks, IV analysis, Options pricing calculator, Pivot points calculator, and Fibonacci retracement calculator, traders can enhance precision and maximise profitability.

Content:

- What Is Options Trading And Analytics?

- What Is An Options Analytics Platform?

- Features Of An Options Analytics Platform

- How Does An Options Analytics Platform Work?

- Types Of Data Provided By Options Analytics Tools

- Why Traders Use Options Analytics Platforms?

- How An Options Analytics Platform Helps In Risk Management?

- Common Mistakes Traders Make When Using Options Analytics

- Options Analytics Platform? - Quick Summary

- Options Analytics Platform Meaning - FAQs

What Is Options Trading And Analytics?

Options trading allows investors to buy or sell contracts at a set price, offering strategic flexibility. Analytics enhances decision-making by providing insights into market trends, volatility, and risk management. With tools like Greeks, implied volatility, and Fibonacci calculator, traders can refine strategies and maximise profits efficiently.

Using a robust platform like 1lyOptions (https://www.1lyoptions.com/), traders access real-time data, historical trends, and sentiment analysis. Advanced tools help evaluate delta, gamma, and vega to fine-tune risk exposure. By leveraging these insights, traders can enhance their strategies, minimise risks, and stay ahead of market movements with precision-based analytics.

The platform provides a seamless experience with intuitive dashboards and specifically three essential calculators: Options pricing calculator, Pivot points calculator, and Fibonacci retracement calculator. Traders can visualise trade scenarios, test strategies, and manage portfolios effectively. Its fast execution, advanced tools, and completely free access make it an ideal choice for traders seeking an edge in options trading.

What Is An Options Analytics Platform?

This platform provides traders with real-time data and risk management tools. It helps assess market conditions, predict price fluctuations, and optimise strategies. Key features include Greek analysis, implied volatility tracking, and trade simulations, enabling traders to make smarter and more profitable decisions.

1lyOption integrates powerful analytics, offering live market insights and advanced scenario planning. With detailed risk assessment tools, traders can optimise entry and exit points. The platform's intuitive design ensures seamless navigation, making trading more efficient and data-driven for both beginners and experienced traders.

With this platform, traders gain access to premium analytics and three essential calculators: Options pricing calculator, Pivot points calculator, and Fibonacci retracement calculator. Being completely free to use, along with fast execution and focused features, it empowers users to navigate market complexities confidently. The platform equips traders with essential tools for success in options trading.

Features Of An Options Analytics Platform

The main features include real-time market data, risk analysis with Greeks, implied volatility tracking, Options pricing calculator, Pivot points calculator, and Fibonacci retracement calculator. These help traders optimise strategies, assess trade probabilities, and execute informed decisions with precision for better risk management and profitability.

- Real-Time Market Data: The platform provides live updates on prices, volume, and volatility, ensuring traders have the latest market insights. This helps them react quickly to price changes and make informed trading decisions with accuracy.

- Risk Analysis with Greeks: The platform calculates delta, gamma, theta, and vega, helping traders understand price sensitivity, time decay, and volatility impact. This enables risk assessment and adjustments to strategies based on changing market conditions.

- Implied Volatility Tracking: Traders monitor implied volatility to gauge market sentiment and predict price fluctuations. By analysing IV, they can select the best options contracts, optimise premiums, and manage risks efficiently in volatile conditions.

How Does An Options Analytics Platform Work?

The platform works by collecting real-time market data, analysing price movements, and providing insights on volatility and risk factors. It integrates advanced tools like the Greeks and Fibonacci calculator, enabling traders to assess potential trade outcomes with precision and efficiency.

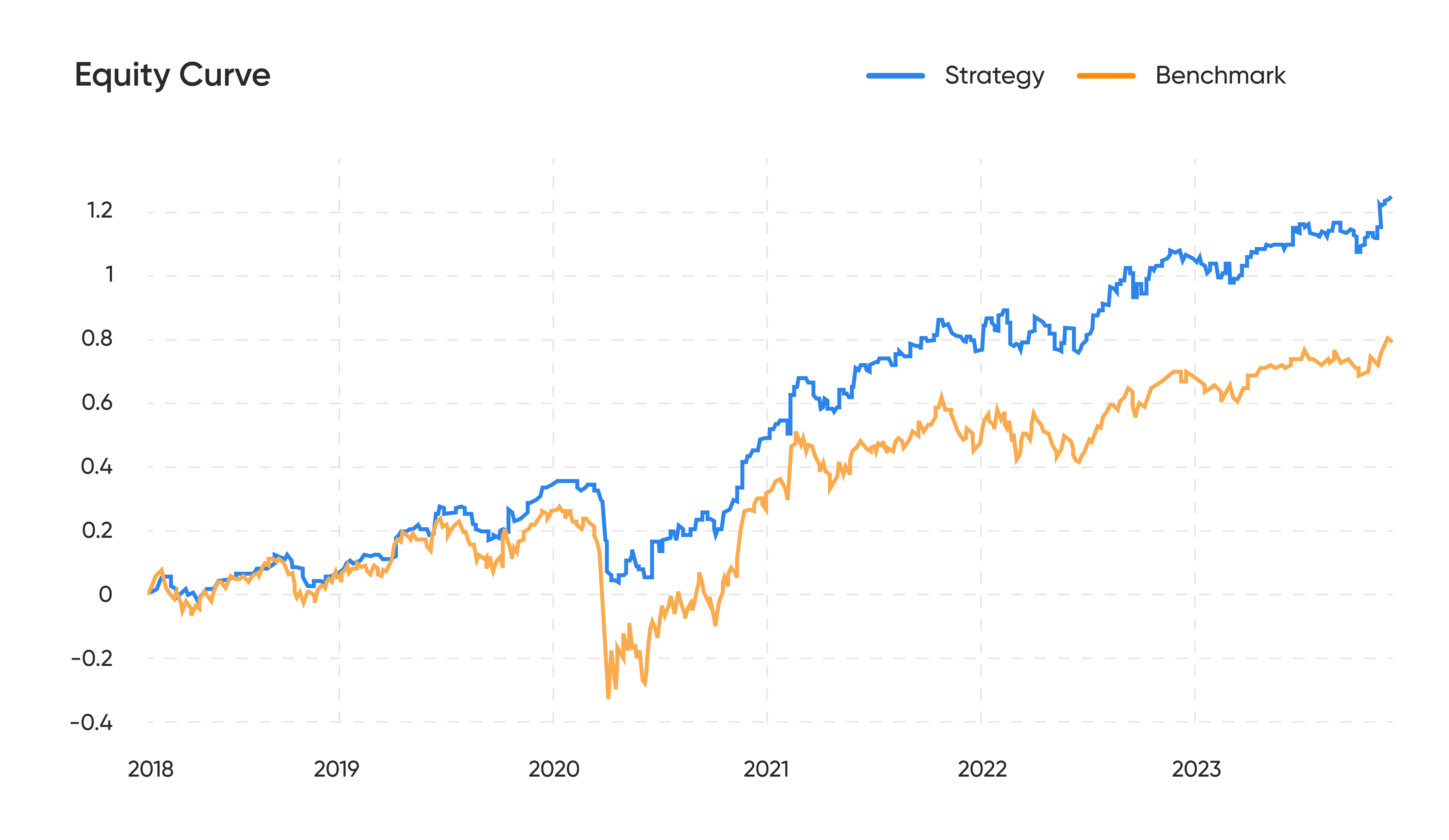

It processes historical and live data to generate actionable insights. It evaluates market trends, tracks liquidity, and identifies optimal entry-exit points. Through scenario analysis, traders can simulate strategies, backtest trades, and adjust positions based on real-time market fluctuations.

Types Of Data Provided By Options Analytics Tools

The main types of data include real-time price updates, historical volatility trends, option Greeks, implied volatility analysis, and profit-loss projections. These insights help traders evaluate market conditions, assess risk, and optimise trading strategies with accurate, data-driven decision-making.

- Real-Time Price Updates: These tools provide live pricing data for options contracts, helping traders track market movements instantly. This enables quick decision-making, allowing traders to capitalise on price fluctuations and execute trades at optimal levels.

- Historical Volatility Trends: These tools analyse past market behaviour to identify volatility patterns. By assessing historical trends, traders can predict future price movements, select appropriate strike prices, and manage risk effectively based on market fluctuations.

- Option Greeks Data: Traders access delta, gamma, theta, and vega metrics to measure price sensitivity, time decay, and volatility impact. This helps optimise strategies, assess trade risks, and adjust positions based on changing market dynamics.

- Implied Volatility Analysis: By tracking implied volatility, traders gauge market expectations for future price swings. This helps in selecting options with favourable premiums, identifying potential breakouts, and managing exposure to unexpected volatility shifts.

- Profit-Loss Projections: Tools simulate different market scenarios to estimate potential profits and losses. Traders can adjust strategies, test risk-reward ratios, and make informed trading decisions before executing positions in live markets.

Why Traders Use Options Analytics Platforms?

Traders use these platforms to gain real-time insights, assess market trends, and optimise trading strategies. They provide tools for risk management, probability analysis, and trade simulations, helping traders make data-driven decisions and maximise profitability in dynamic market conditions.

With the analytics platform, traders access advanced analytics, including Greeks, implied volatility tracking, and profit-loss estimations. The platform's intuitive interface and fast execution enable seamless strategy adjustments, ensuring traders stay ahead of market fluctuations and capitalise on high-potential opportunities efficiently. As a free platform, 1lyOptions makes these tools accessible to all traders without subscription costs.

By leveraging 1lyOptions (https://www.1lyoptions.com/screeners/scanners) cutting-edge tools, traders enhance decision-making, minimise risks, and execute trades with precision. The platform's focused data insights and user-friendly features make it the perfect free choice for both beginners and experienced traders aiming for consistent success.

How An Options Analytics Platform Helps In Risk Management?

The platform helps traders manage risk by providing real-time data, volatility tracking, and probability calculations. These tools allow traders to assess market conditions, adjust positions, and mitigate potential losses by making informed, data-driven decisions in fluctuating market environments.

By analysing Greeks such as delta, gamma, and theta, traders can evaluate price sensitivity and time decay. This insight helps them structure strategies that balance risk and reward, reducing exposure to sudden market movements and optimising trade performance effectively.

Features like the three specific calculators (Options pricing, Pivot points, and Fibonacci retracement) and scenario analysis further enhance risk management. Traders can simulate different market conditions, identify potential downside risks, and refine strategies before execution, ensuring they maintain a well-protected and profitable trading portfolio.

Common Mistakes Traders Make When Using Options Analytics

One common mistake is relying solely on historical data without considering current market conditions. Traders must combine past trends with real-time insights to make accurate predictions, as markets are constantly evolving, and old patterns may not always repeat.

Ignoring key metrics like implied volatility and Greeks can lead to poor trade execution. Many traders overlook these critical factors, leading to misjudged option pricing, incorrect strike selections, and increased risk exposure, ultimately affecting profitability.

Another mistake is overcomplicating strategies by using excessive indicators. While analytics tools provide valuable insights, traders should focus on relevant data points instead of overcrowding analysis with unnecessary metrics, ensuring clarity in decision-making and effective trade execution.

Options Analytics Platform? - Quick Summary

- An options analytics platform provides real-time data and risk analysis tools for informed trading. Features like Greeks, IV analysis, Options pricing calculator, Pivot points calculator, and Fibonacci retracement calculator help traders refine strategies, optimise risk management, and maximise profitability with precise market insights.

- It helps traders assess market conditions, predict price fluctuations, and optimise strategies. Features like Greek analysis, IV tracking, and trade simulations enable data-driven decisions for smarter, more profitable options trading.

- 1lyOptions (https://www.1lyoptions.com/) offers advanced analytics, live market insights, and scenario planning as a completely free platform. With risk assessment tools it enhances decision-making, helping traders optimise entry, exit points, and strategy execution efficiently.

- The main features include real-time market data, Greeks analysis, IV tracking, and three specific calculators (Options pricing, Pivot points, and Fibonacci retracement). These tools help traders assess trade probabilities, manage risk, and execute informed decisions efficiently.

- The main data types include real-time price updates, historical volatility trends, option Greeks, IV analysis, and profit-loss projections. These insights help traders evaluate market conditions, assess risk, and optimise trading strategies effectively.

- Traders use these platforms to gain real-time insights, analyse trends, and refine strategies. Risk management, probability analysis, and trade simulations help maximise profitability by enabling data-driven decisions in dynamic market conditions.

- One common mistake is relying only on historical data without considering current market conditions. Traders must combine past trends with real-time insights as markets evolve, and old patterns may not always repeat in new scenarios.

Options Analytics Platform Meaning - FAQs

What Is An Options Analytics Platform?

An options analytics platform is a specialised tool that provides real-time data, risk assessment, and strategy optimisation for traders. It offers insights on volatility, pricing, and probability analysis, helping traders make informed decisions and enhance their options trading performance.

How Does An Options Analytics Platform Help Traders?

It helps traders by providing real-time market data, implied volatility tracking, and strategy optimisation tools. It enhances decision-making, refines trade execution, and improves profitability by offering insights into risk assessment, option pricing, and market sentiment analysis. In the case of 1lyOptions (https://www.1lyoptions.com/), these capabilities are offered completely free of charge.

What Data Can Be Analyzed Using An Options Analytics Platform?

Traders can analyse real-time price movements, historical volatility, option Greeks, implied volatility, and profit-loss projections. This data helps traders evaluate market conditions, assess trade probabilities, and refine strategies for better decision-making and risk management in dynamic market environments.

Why Is Implied Volatility Important In Options Trading?

Implied volatility indicates expected market fluctuations, affecting option pricing and trade decisions. High IV suggests increased uncertainty, leading to higher premiums, while low IV indicates stability. Traders use IV to assess fair option values and time their trades effectively.

How Do Options Analytics Tools Improve Risk Management?

These tools improve risk management by analysing implied volatility, option Greeks, and historical data. They help traders assess potential losses, set stop-loss levels, and adjust strategies based on changing market conditions, ensuring better risk control and trade stability.

How Can Beginners Benefit From An Options Analytics Platform?

Beginners gain structured learning through real-time insights, risk assessment tools, and trade simulations. These platforms simplify complex strategies, allowing new traders to practice, analyse market trends, and develop confidence before executing real trades, reducing costly mistakes.

What Is The Future Of Options Analytics Platforms In Trading?

The main future includes enhanced automation and seamless integrations with trading platforms. Advanced risk management tools, real-time alerts, and customisable analytics will further empower traders, improving decision-making and expanding accessibility for both retail and institutional investors.

Disclaimer: The above article is written for educational purposes and the companies' data mentioned in the article may change with respect to time. The securities quoted are exemplary and are not recommendatory.

Don't let emotions take over your trades, take control now and become a tactical trader with 1lyOptions