Bear Call Spread

A Bear Call Spread is an options trading strategy that's used when a trader believes the price of an underlying asset will go down, but not significantly.

A Bear Call Spread is a vertical spread options strategy designed for traders who believe the price of an underlying asset will decline. It's achieved by selling a call option and buying another call option with a higher strike price, both having the same expiration date.

How It Works:

1. Sell a Call Option: The trader sells a call option with a specific strike price.

2. Buy a Call Option: Simultaneously, the trader buys another call option at a higher strike price.

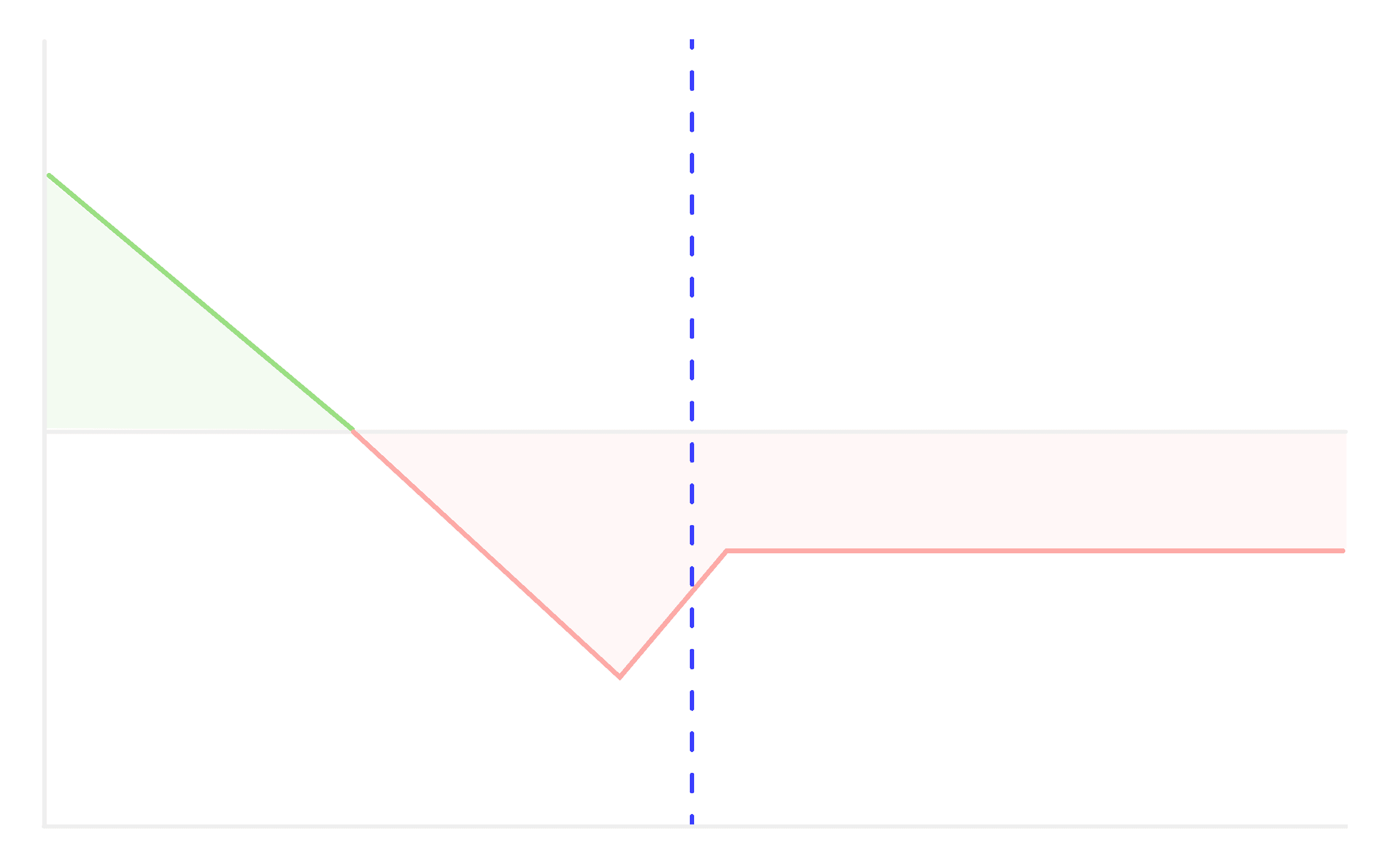

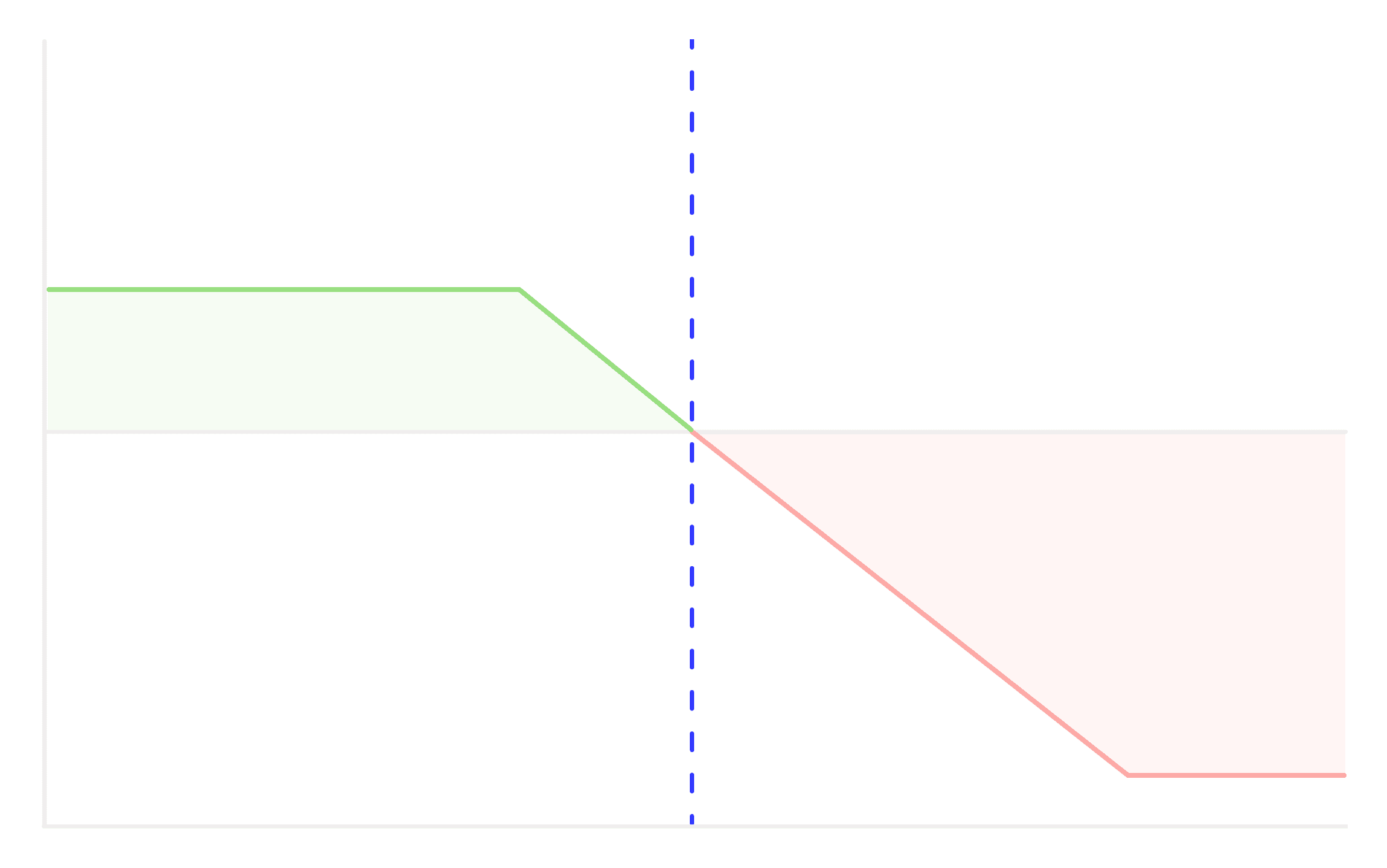

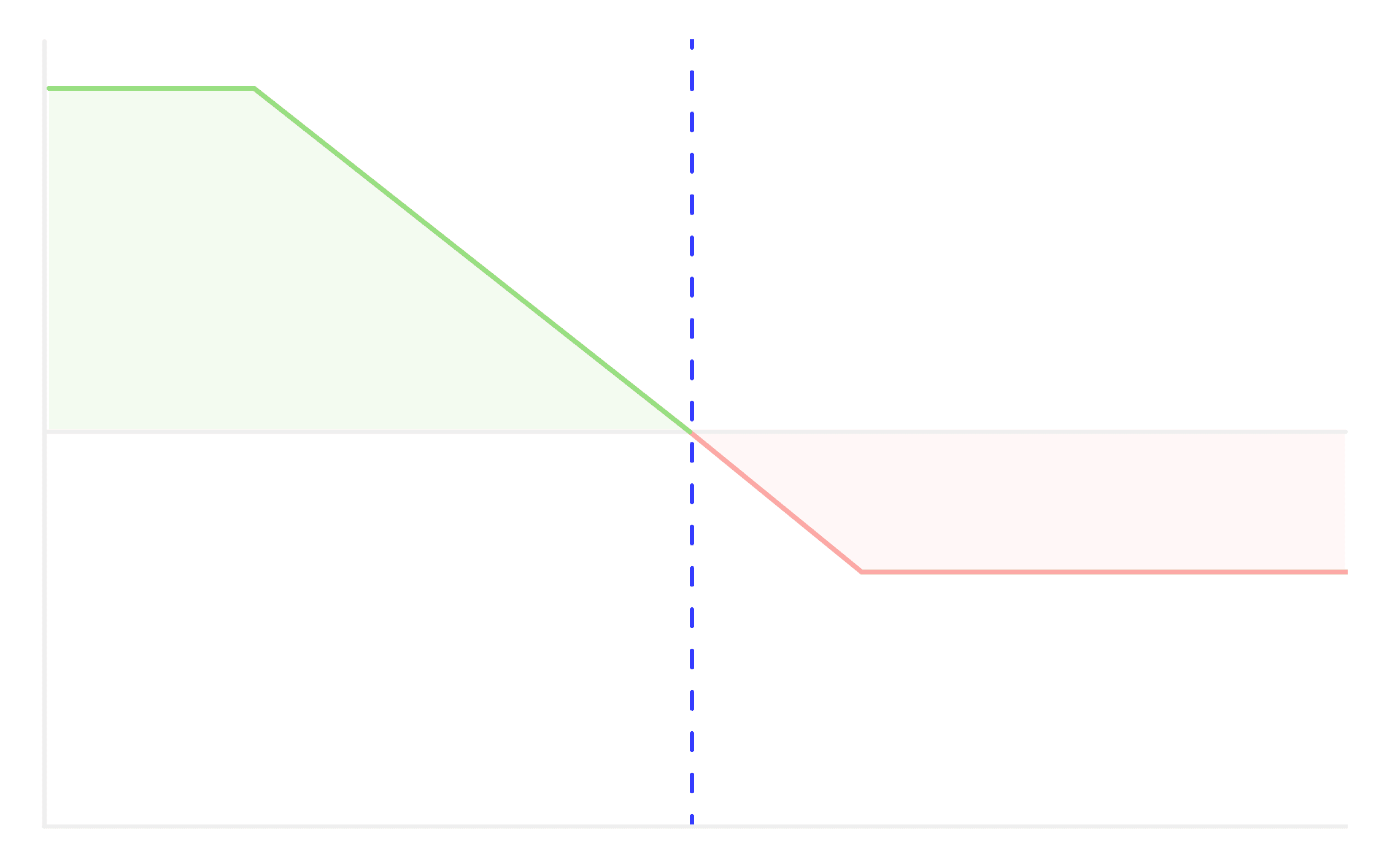

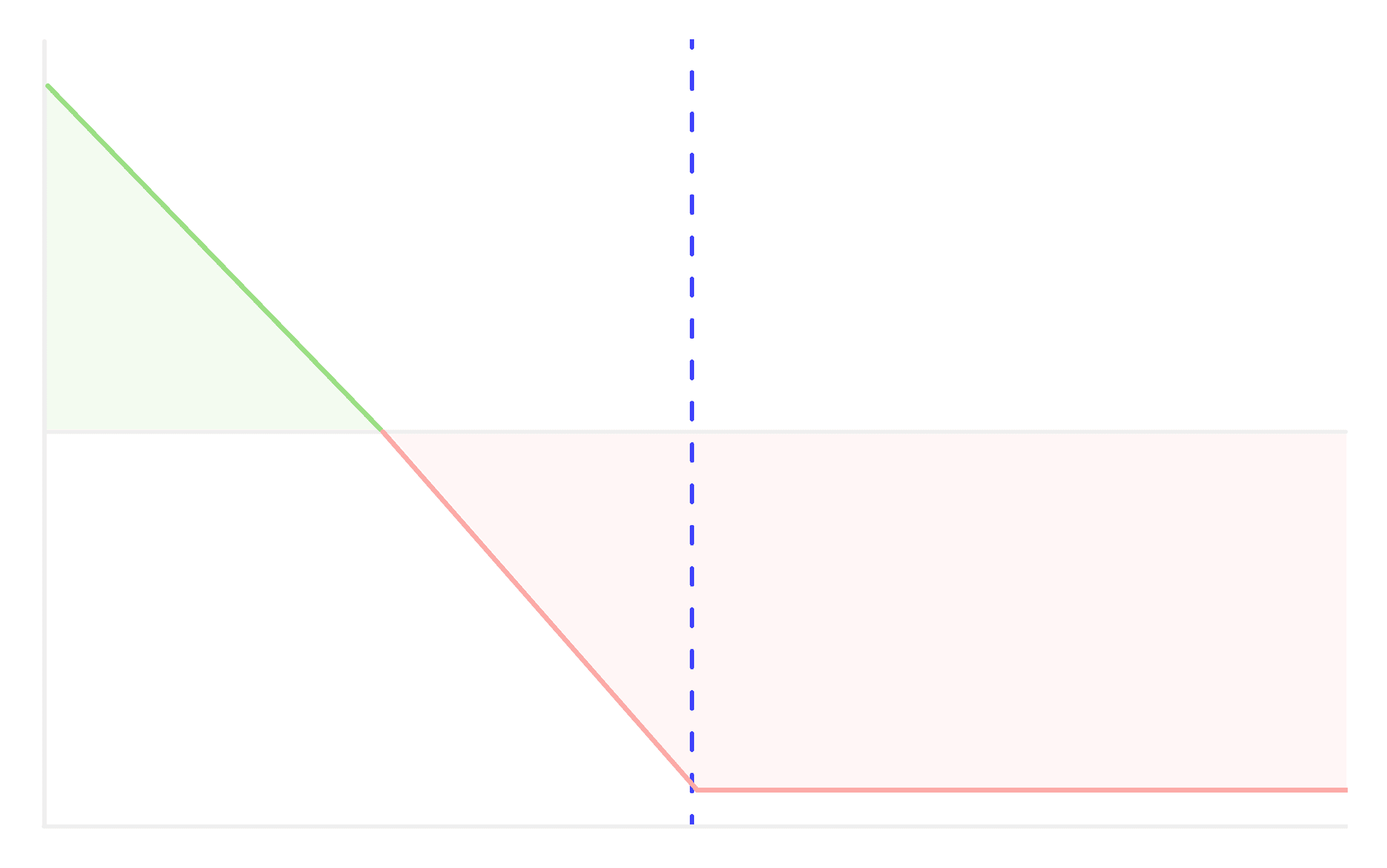

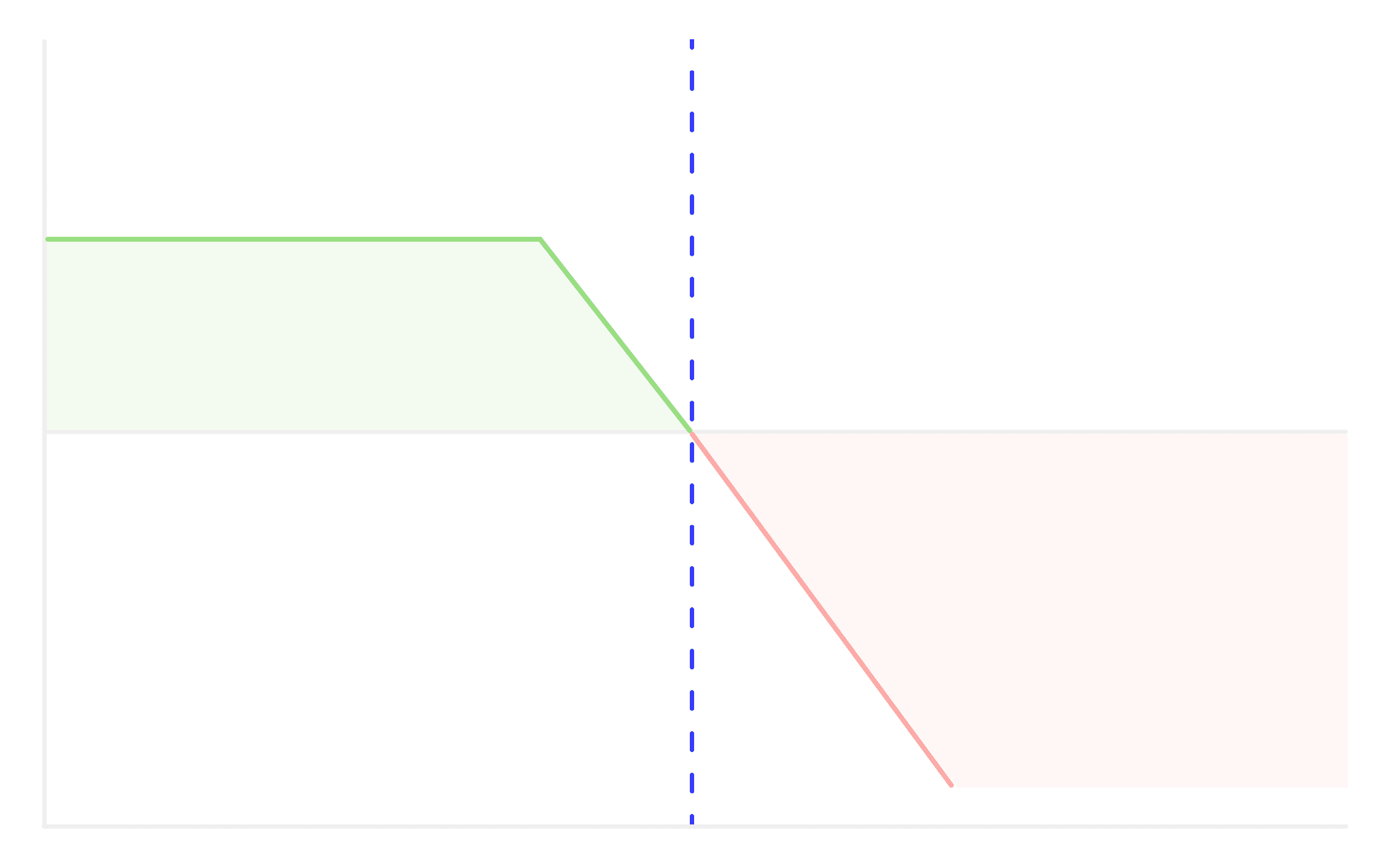

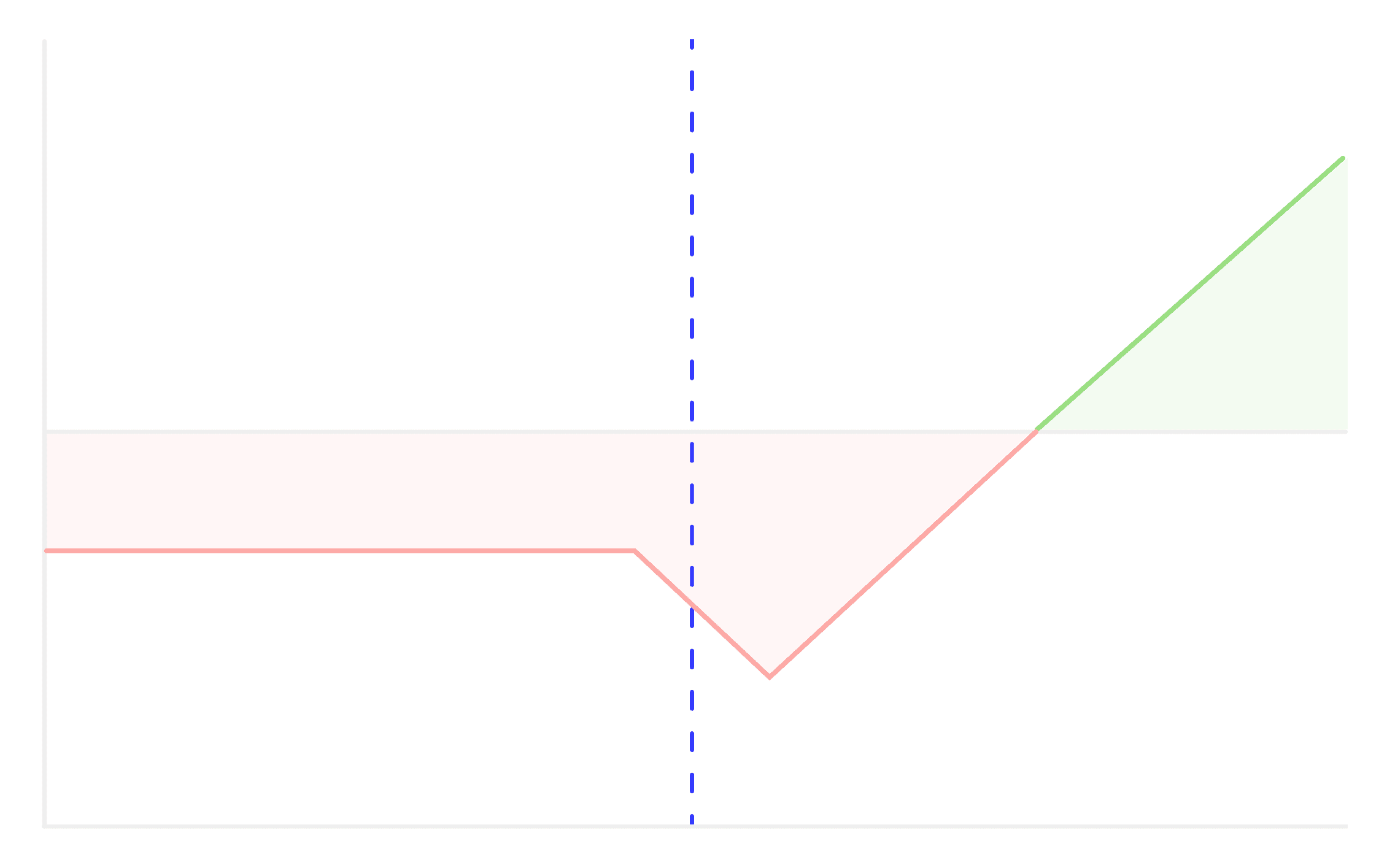

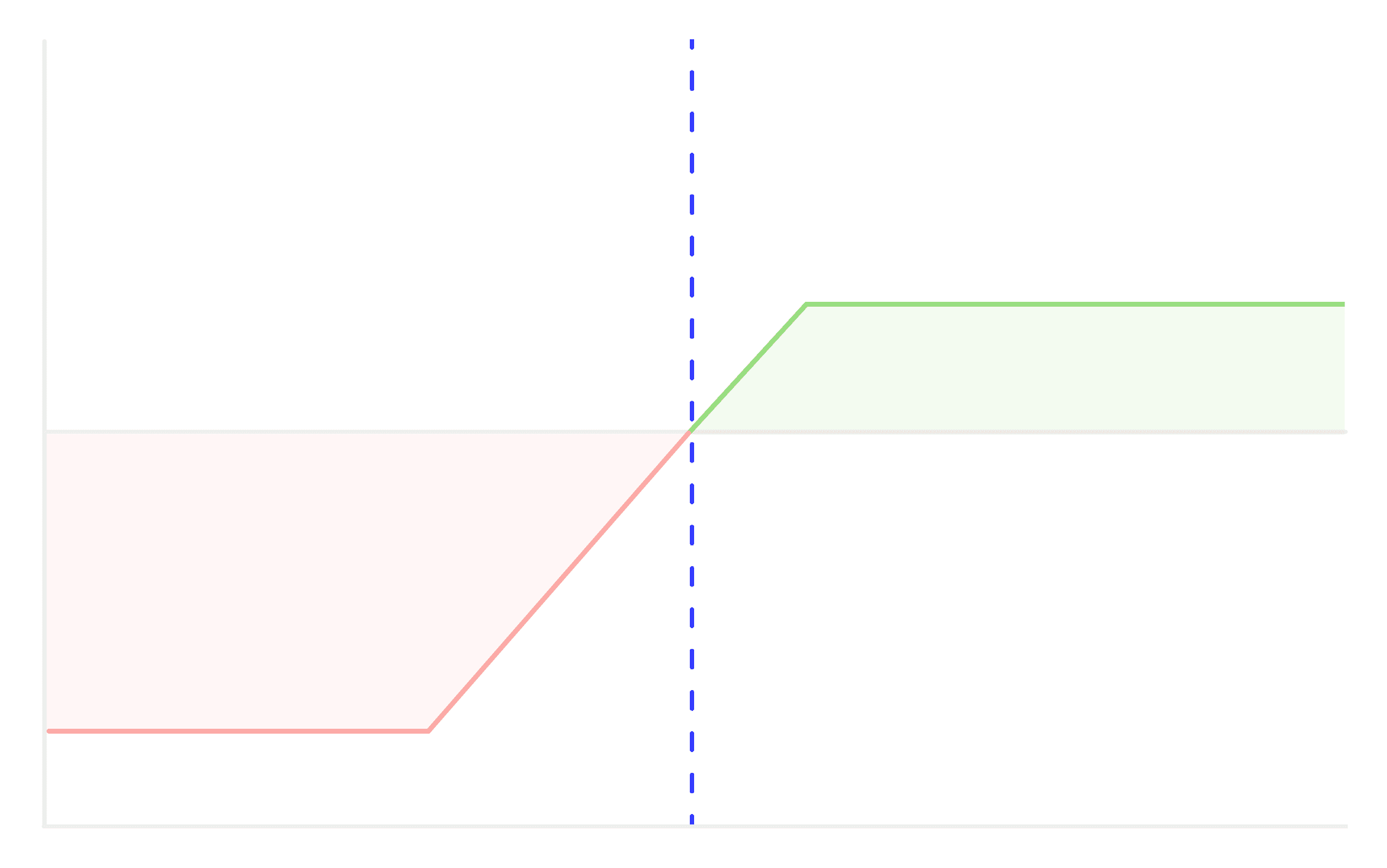

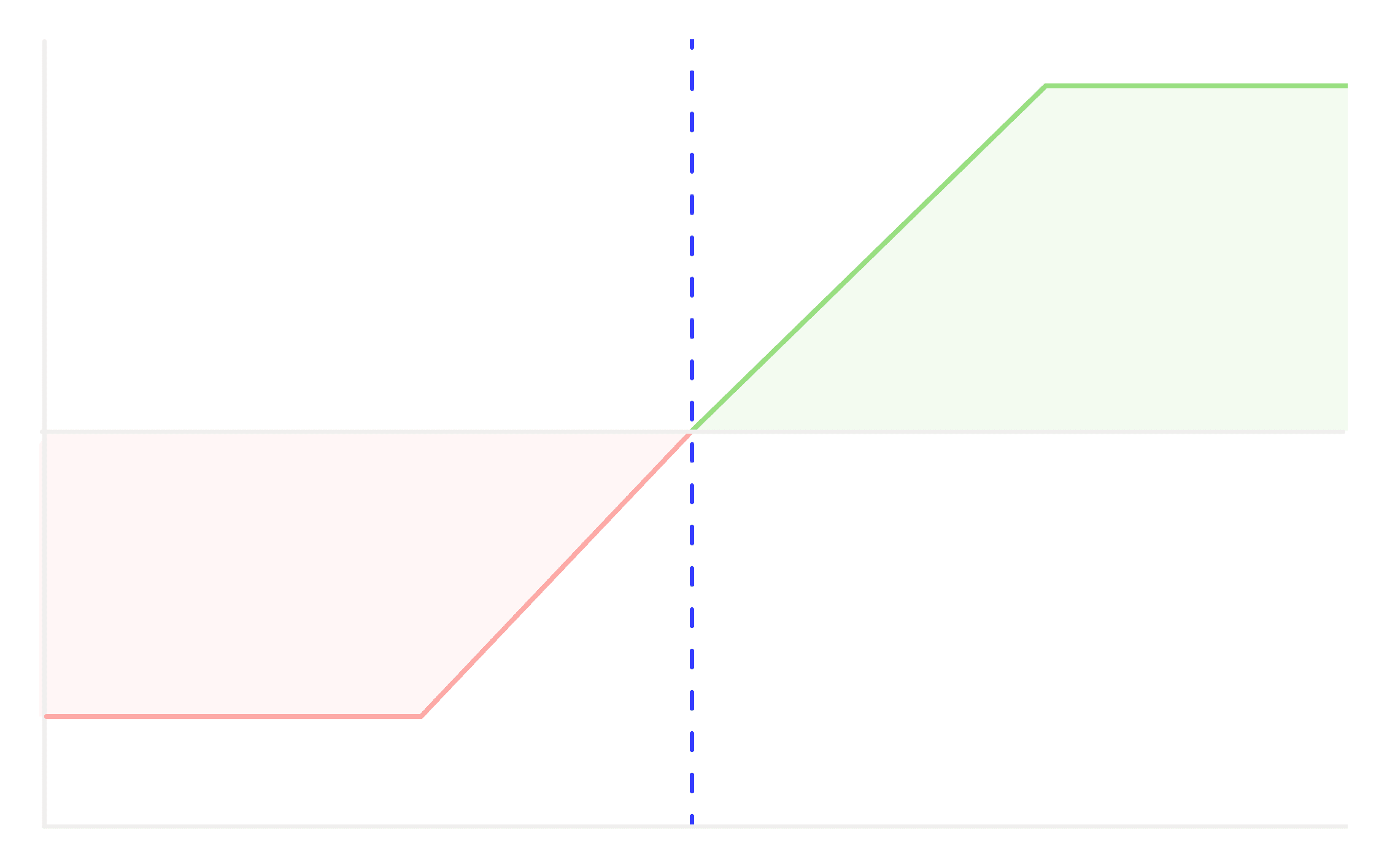

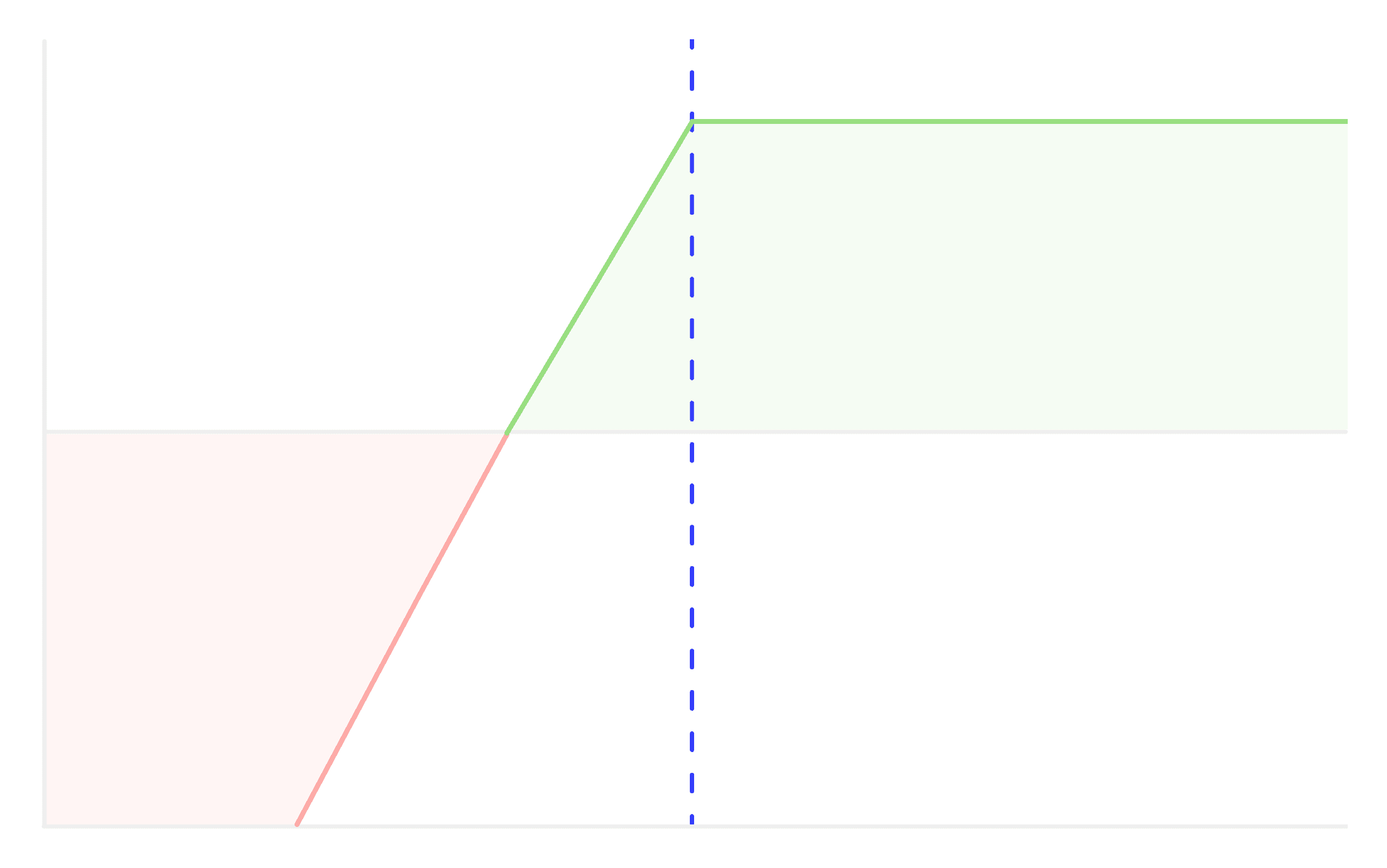

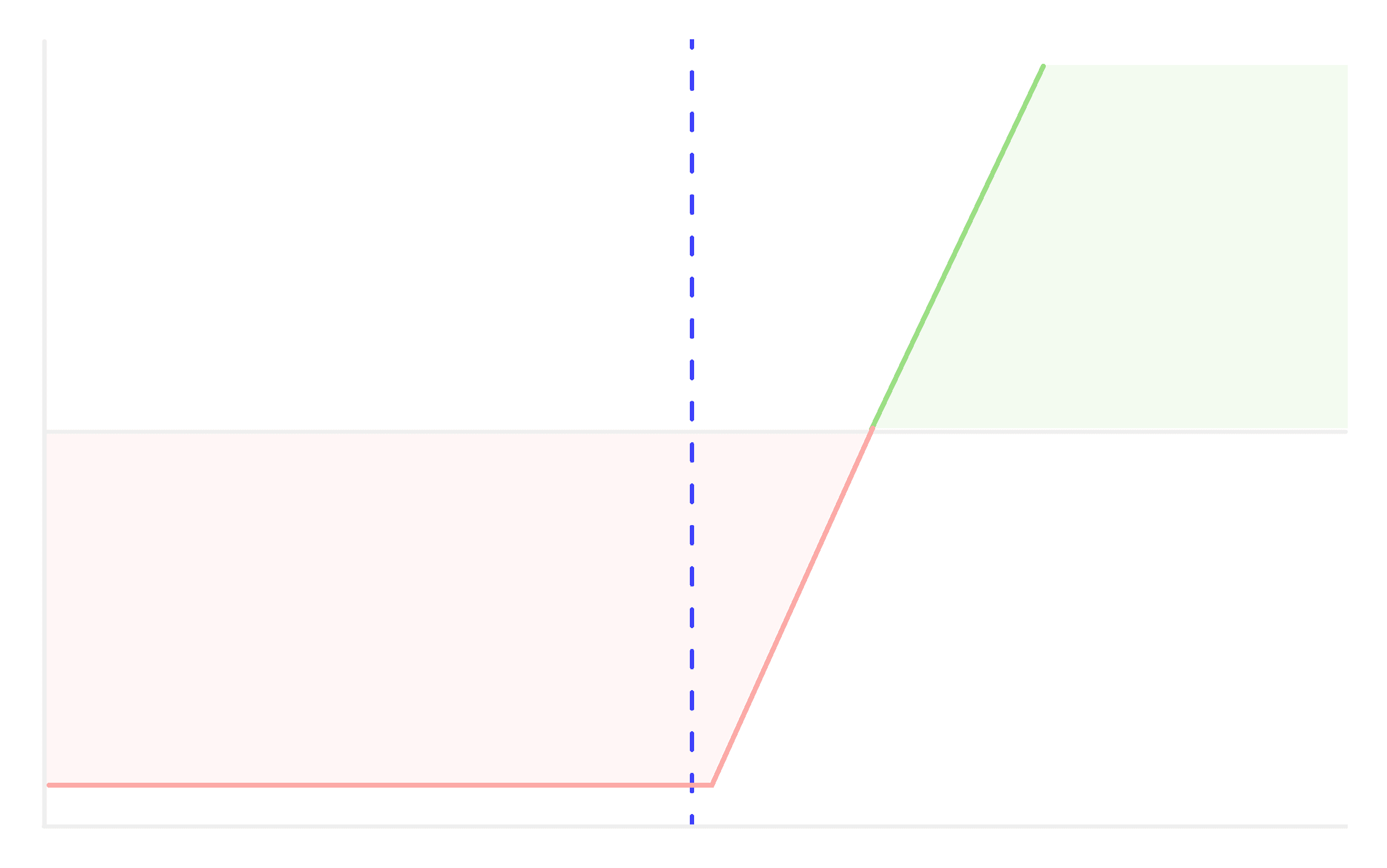

Potential Profit and Loss:

- Maximum Profit: Limited to the net premium received when initiating the spread. This profit is realized if the stock closes upon expiration at or below the strike price of the sold call.

- Maximum Loss: Limited to the difference between the two strike prices minus the net premium received.

Benefits:

- Premium Collection: By selling the lower strike call, the trader collects a premium, which can partially or entirely offset the cost of the higher strike call.

- Defined Risk: The maximum loss is capped, providing the trader with a clear risk profile.

Drawbacks:

- Capped Profit Potential: The maximum profit is limited to the net premium received.

- Exposure to Rising Prices: If the asset's price rises significantly beyond the higher strike price, the strategy reaches its maximum loss.

Example:

Imagine stock NIFTY is currently trading at ₹100:

1. Sell a ₹20000 call option for a premium of ₹90.15.

2. Buy a ₹20250 call option for a premium of ₹13.25.

Net premium received: ₹76.90 (₹90.15 - ₹13.25).

If NIFTY remains below ₹20000 at expiration, the trader keeps the ₹76.90 premium as profit. If NIFTY rises above ₹20000, the maximum loss of ₹173.1 will be incurred (₹250 difference between strikes - ₹76.90 net premium).

In conclusion, a Bear Call Spread is a strategy used when a trader has a moderately bearish outlook on an asset. It offers a way to earn a premium with a clearly defined risk, while hoping for a decline or limited movement in the underlying asset.

Other Strategies

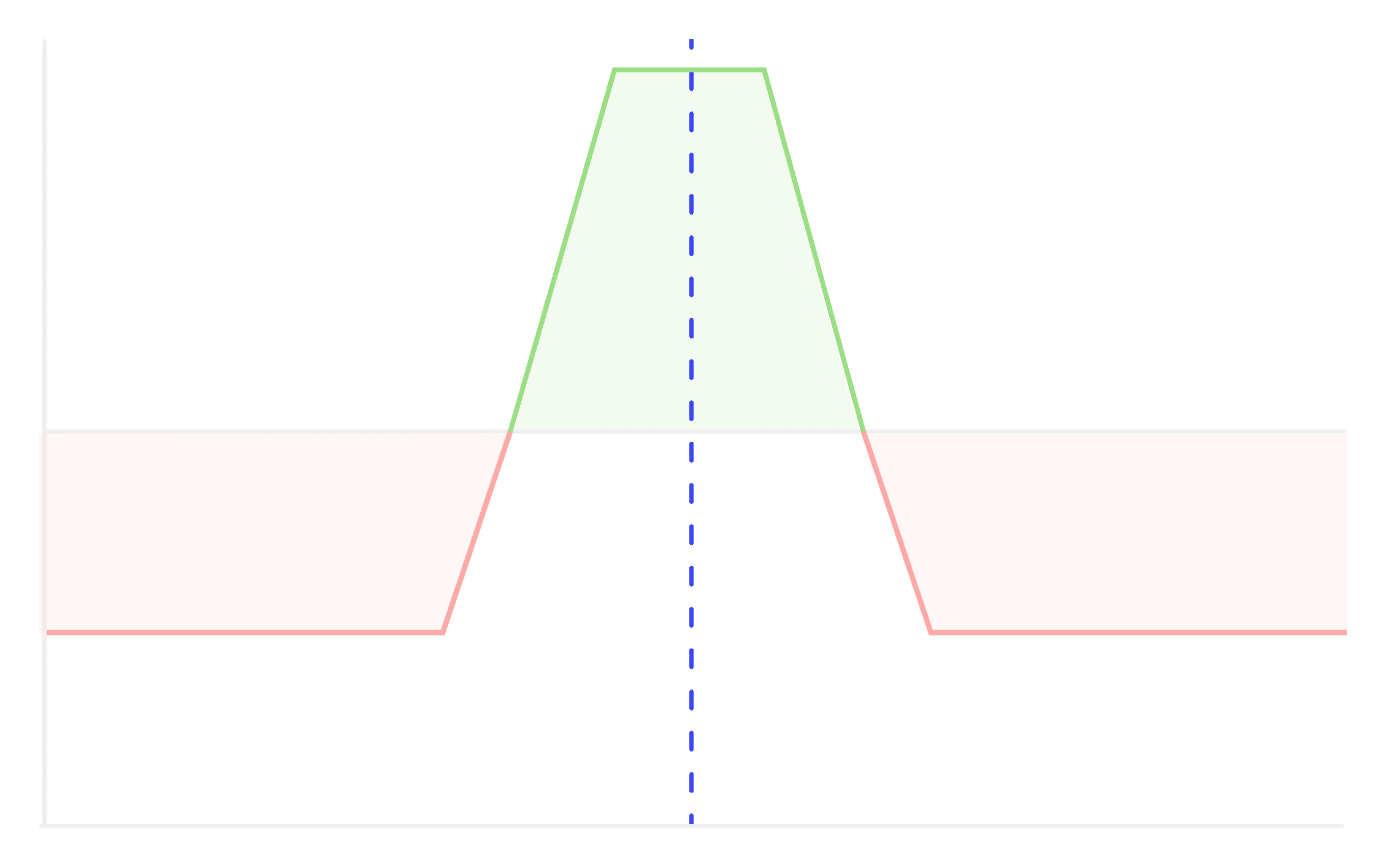

Iron Condor

A strategy designed to profit from low volatility in the underlying asset, combining a bullish put credit spread and a bearish call credit spread to it.

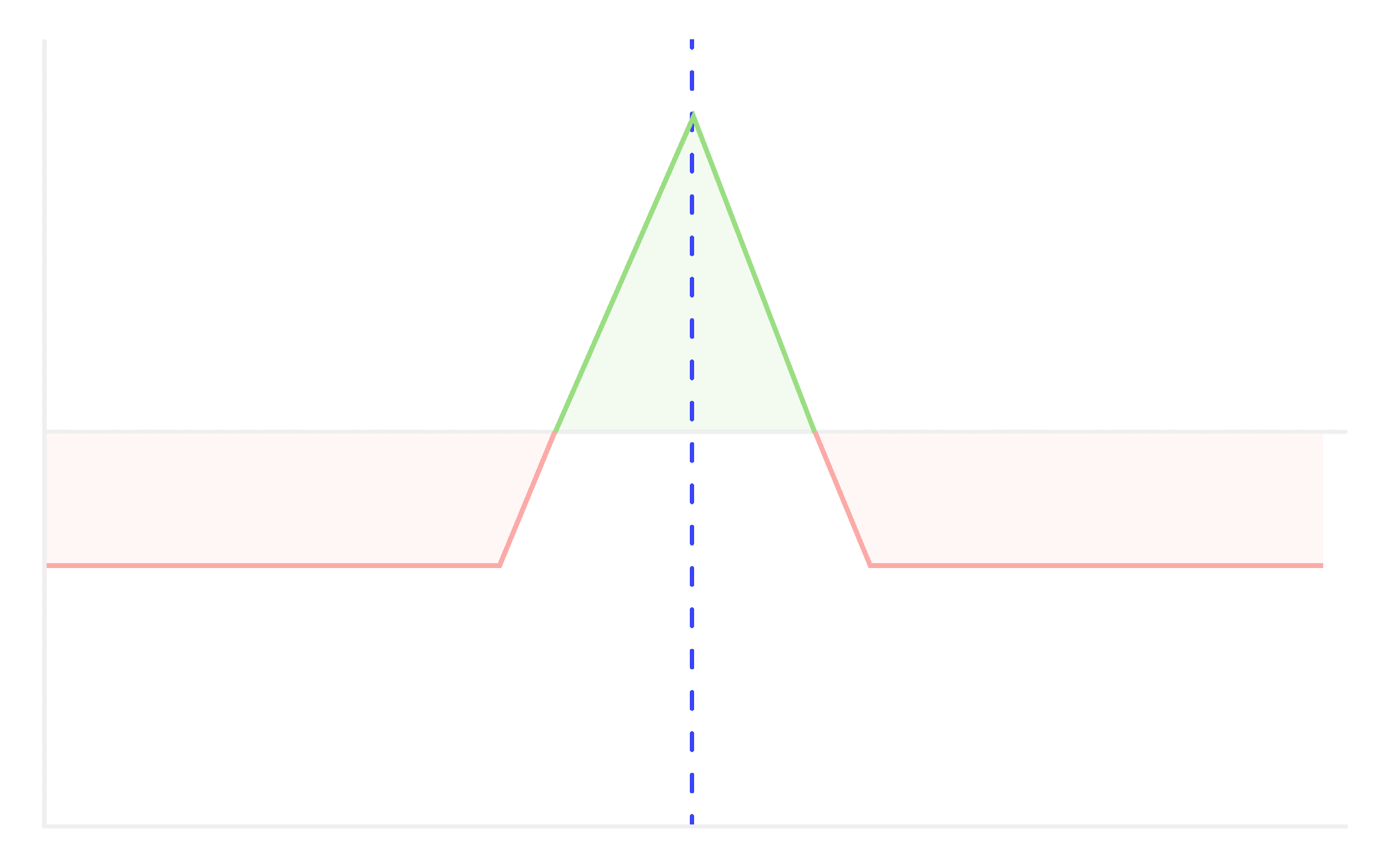

Iron Butterfly

This is a strategy which profits from low volatility in the price of the underlying asset while minimizing risk.

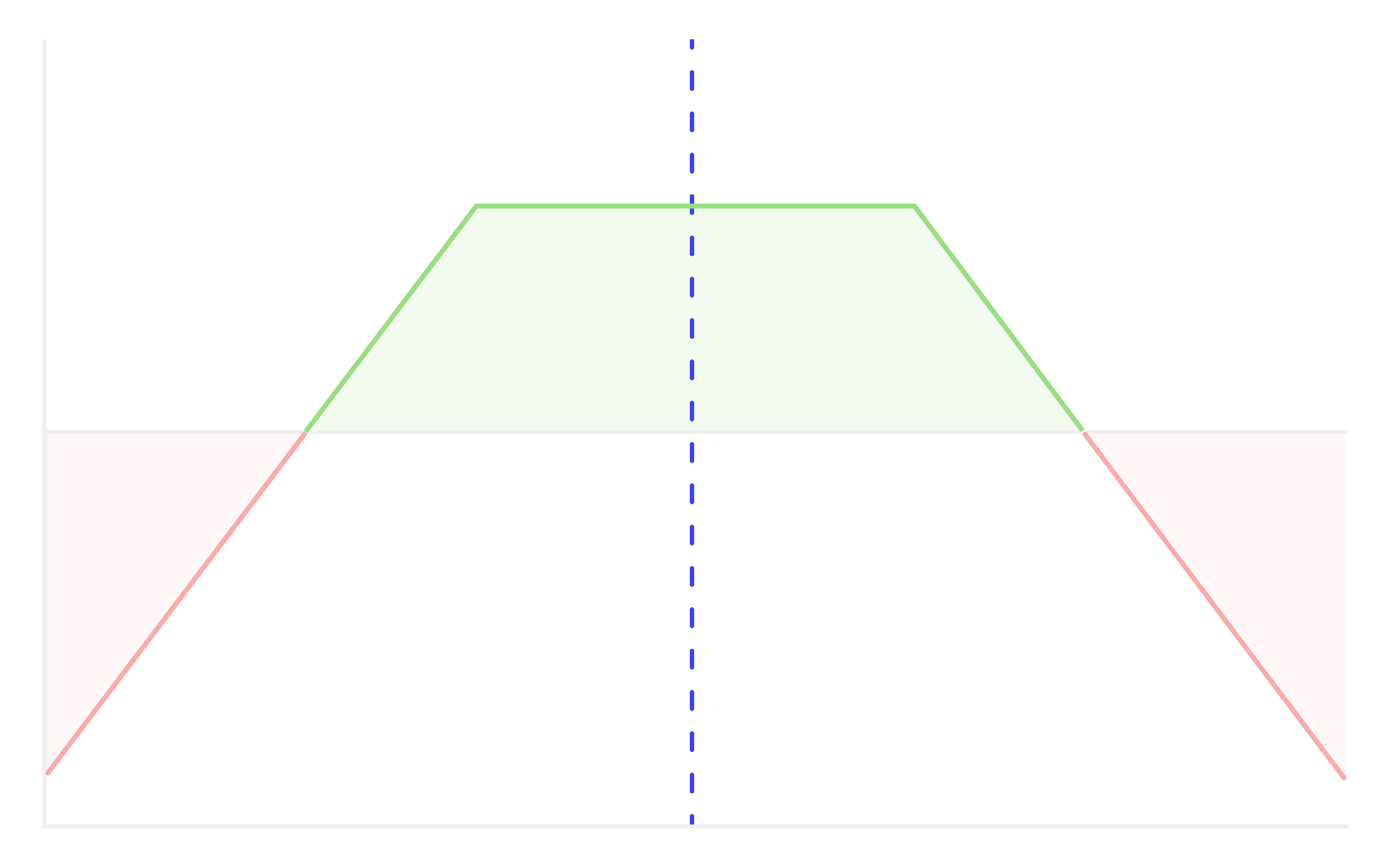

Short Strangle

A short strangle is a non directional trading strategy where an investor sells an (OTM) call option and put option on the same underlying asset simultaneously.

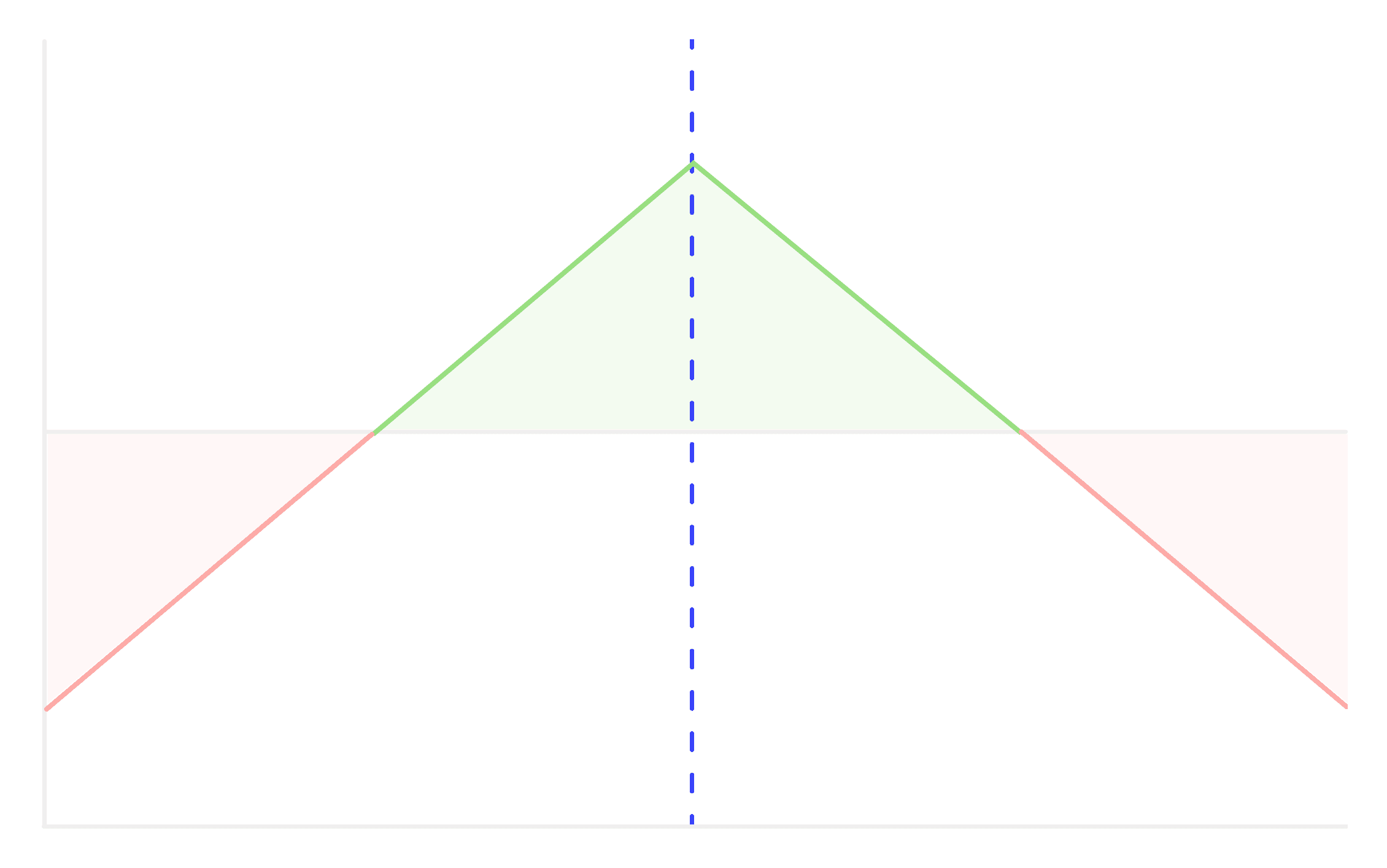

Short Straddle

A Short straddle is considered neutral or non-directional because it profits from minimal price movement in the underlying asset.

Put Ratio Backspread

The Put Ratio Backspread strategy involves selling and buying put options in a specific ratio.

Bear Call Spread

A Bear Call Spread is an options trading strategy that's used when a trader believes the price of an underlying asset will go down, but not significantly.

Bear Put Spread

A Bear Put Spread is a type of vertical spread strategy used in options trading.

Long Put

Long Put option is the most basic & simplest strategy. It is recommended or implemented when we expect the underlying asset to show significant downside move.

Short Call

Short Call strategy is employed in a bearish or neutral market outlook, where the underlying asset's price is expected to remain stable or fall.

Call Ratio Backspread

The Call Ratio Backspread strategy involves selling and buying call options in a specific ratio.

Bull Put Spread

A Bull Put Spread is a type of vertical spread strategy used in options trading

Bull Call Spread

A Bull Call Spread is an options trading strategy that's used when a trader believes the price of an underlying asset will go up, but not significantly.

Short Put

Short Put strategy is employed in a bullish or neutral market outlook, where the investor believes that the underlying asset's price will remain stable or rise.

Long Call

Long Call option' is the most basic & simplest strategy. It is recommended or implemented when we expect the underlying asset to show significant upside move.

Don't let emotions take over your trades, take control now and become a tactical trader with 1lyOptions