Short Straddle

A Short straddle is considered neutral or non-directional because it profits from minimal price movement in the underlying asset.

A short straddle is an options trading strategy that involves simultaneously selling both a call option and a put option with the same strike price and expiration date on the same underlying asset. This strategy is used when the trader expects the underlying asset to have low volatility and remain relatively stable in price until the options expire.

Here's how a short straddle works:

- Options Selection:

- Choose an underlying asset that you believe will have minimal price movement or remain range-bound over the duration of the options' life.

- Option Selling:

- Sell a call option: By selling a call option, you are obligating yourself to sell the underlying asset at the strike price if the option buyer decides to exercise it.

- Sell a put option: By selling a put option, you are obligating yourself to buy the underlying asset at the strike price if the option buyer decides to exercise it.

- Same Strike and Expiration:

- Ensure that both the call and put options have the same strike price and expiration date. This creates a symmetrical position.

- Premium Collection:

- You receive premiums (fees) from both the call and put option buyers when you sell these options. This premium income is your initial profit.

The potential outcomes of a short straddle strategy are as follows:

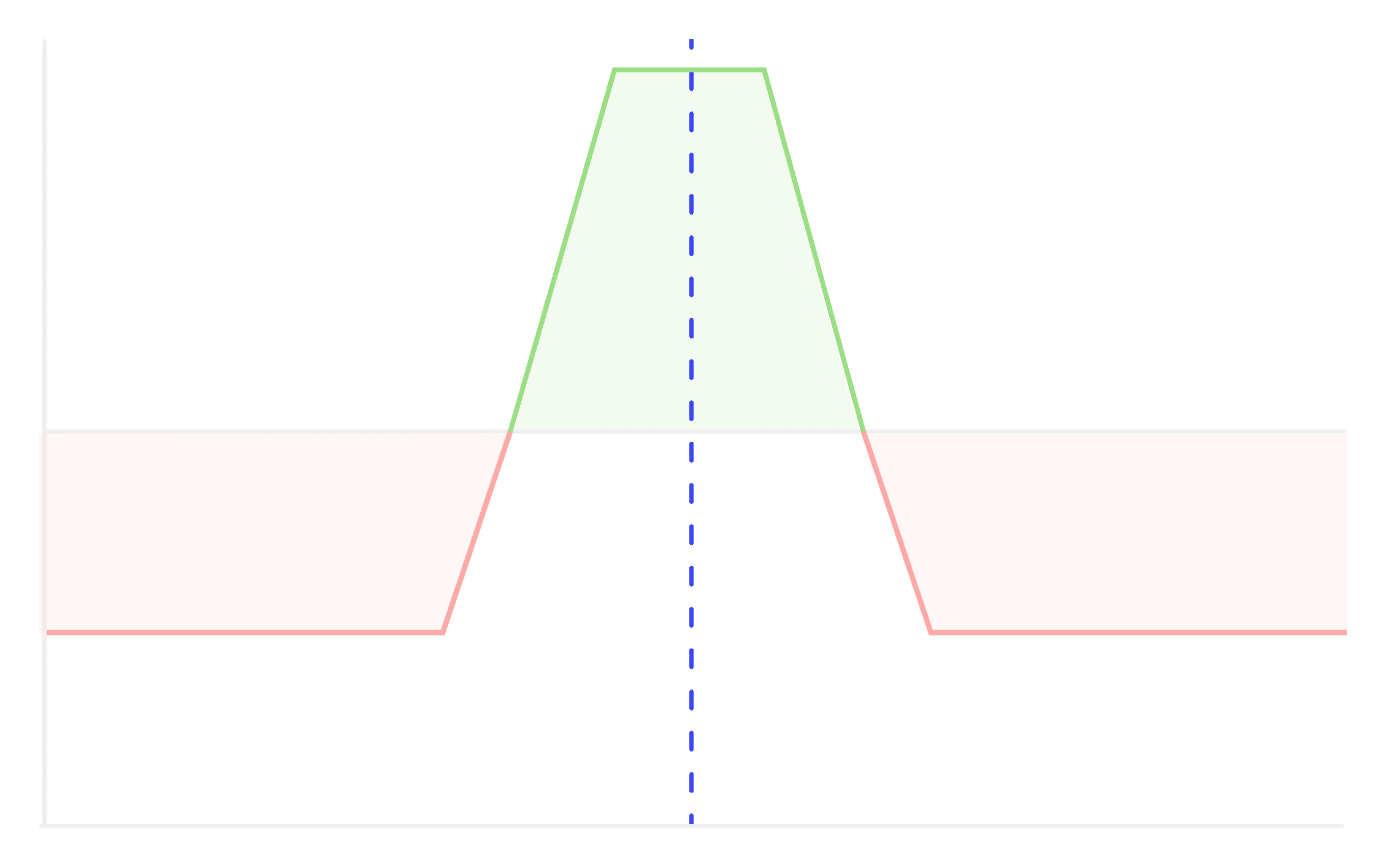

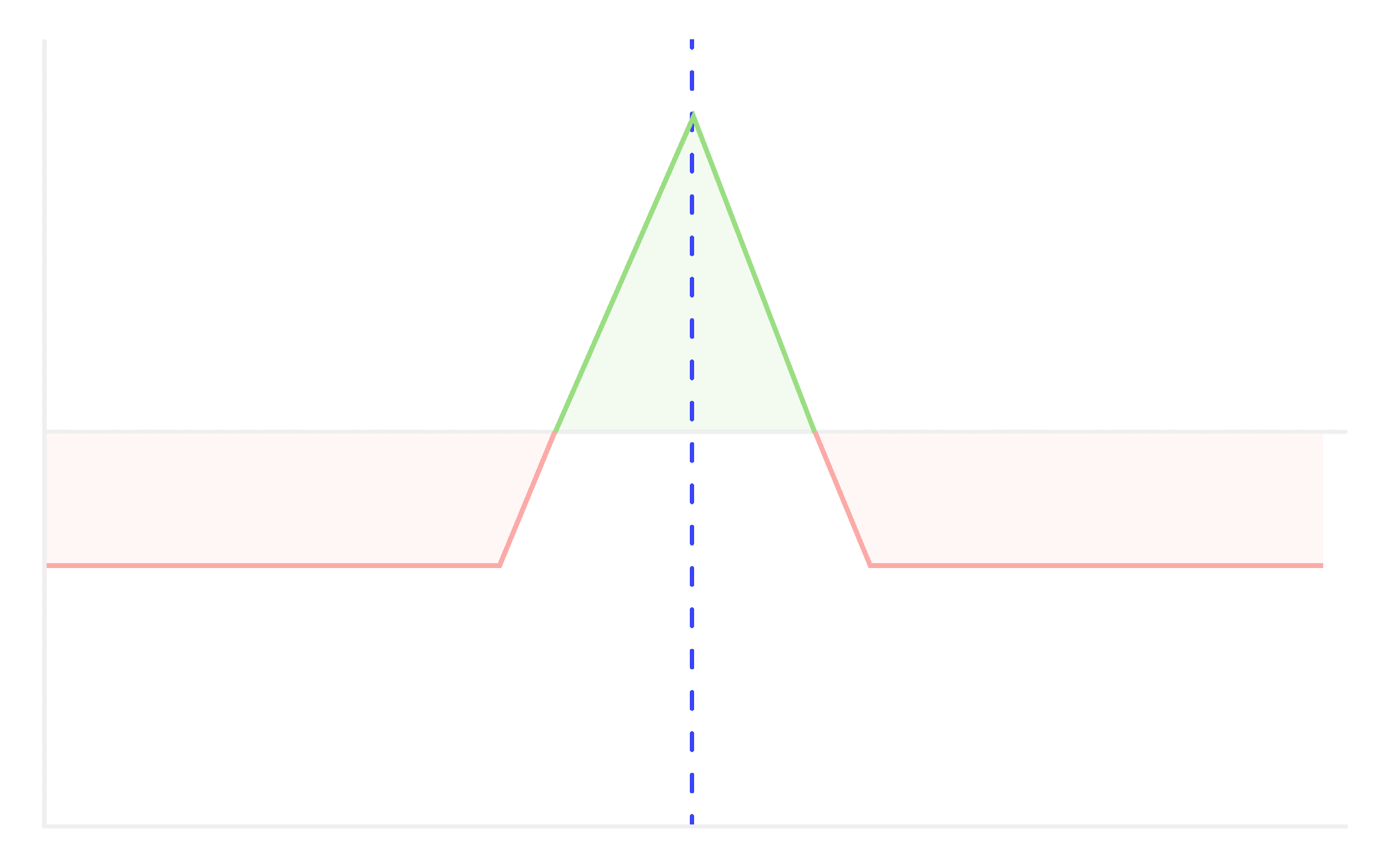

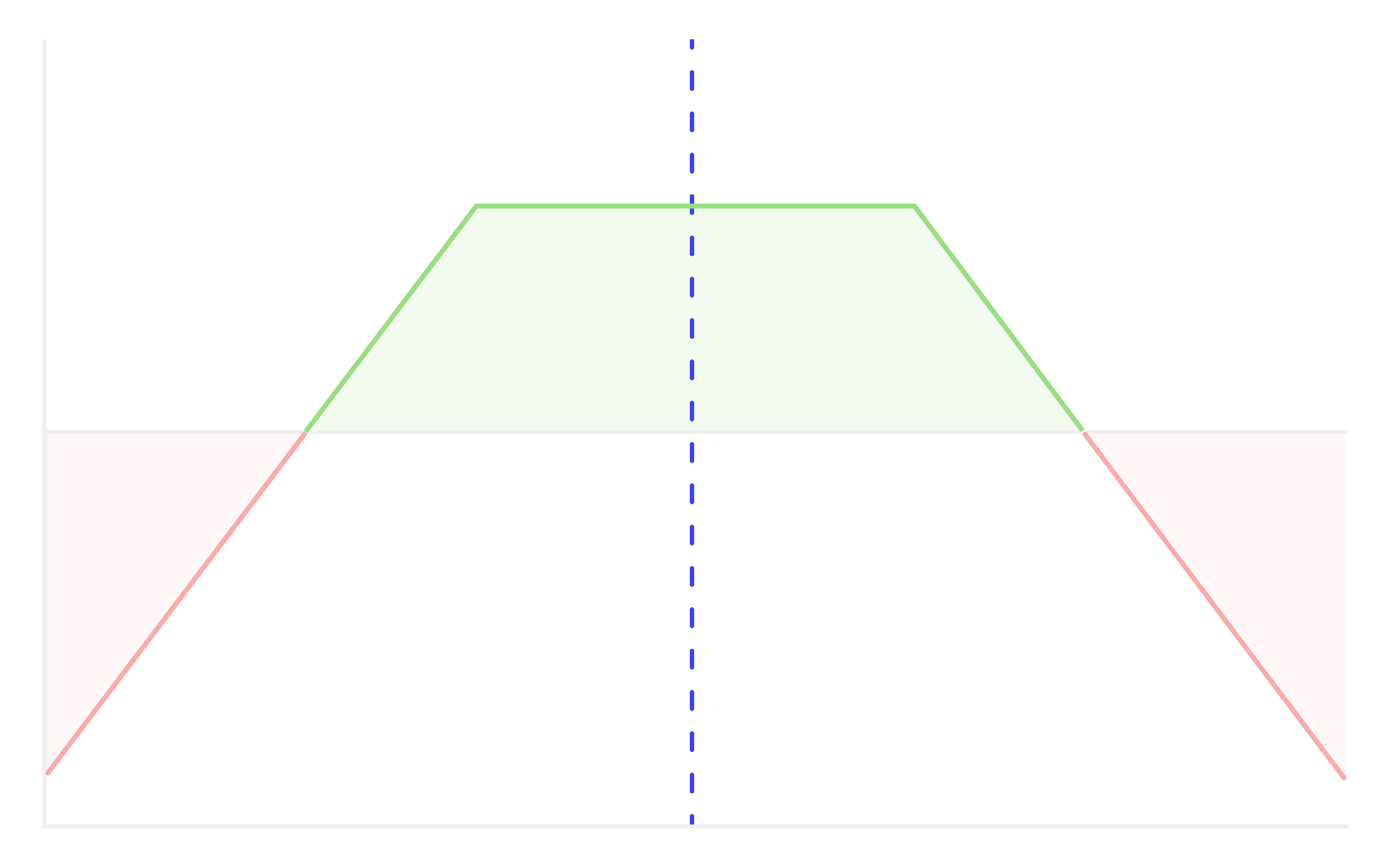

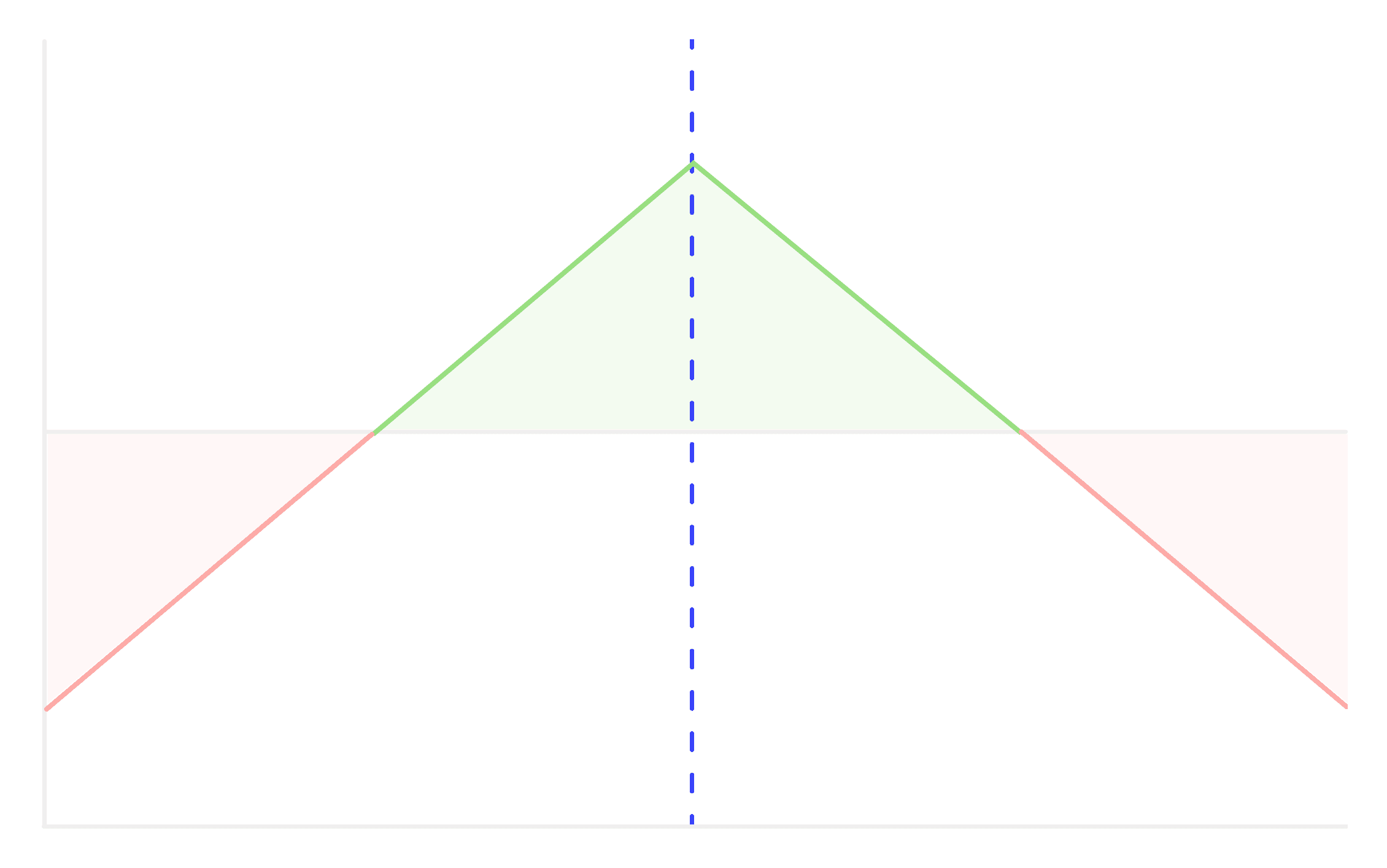

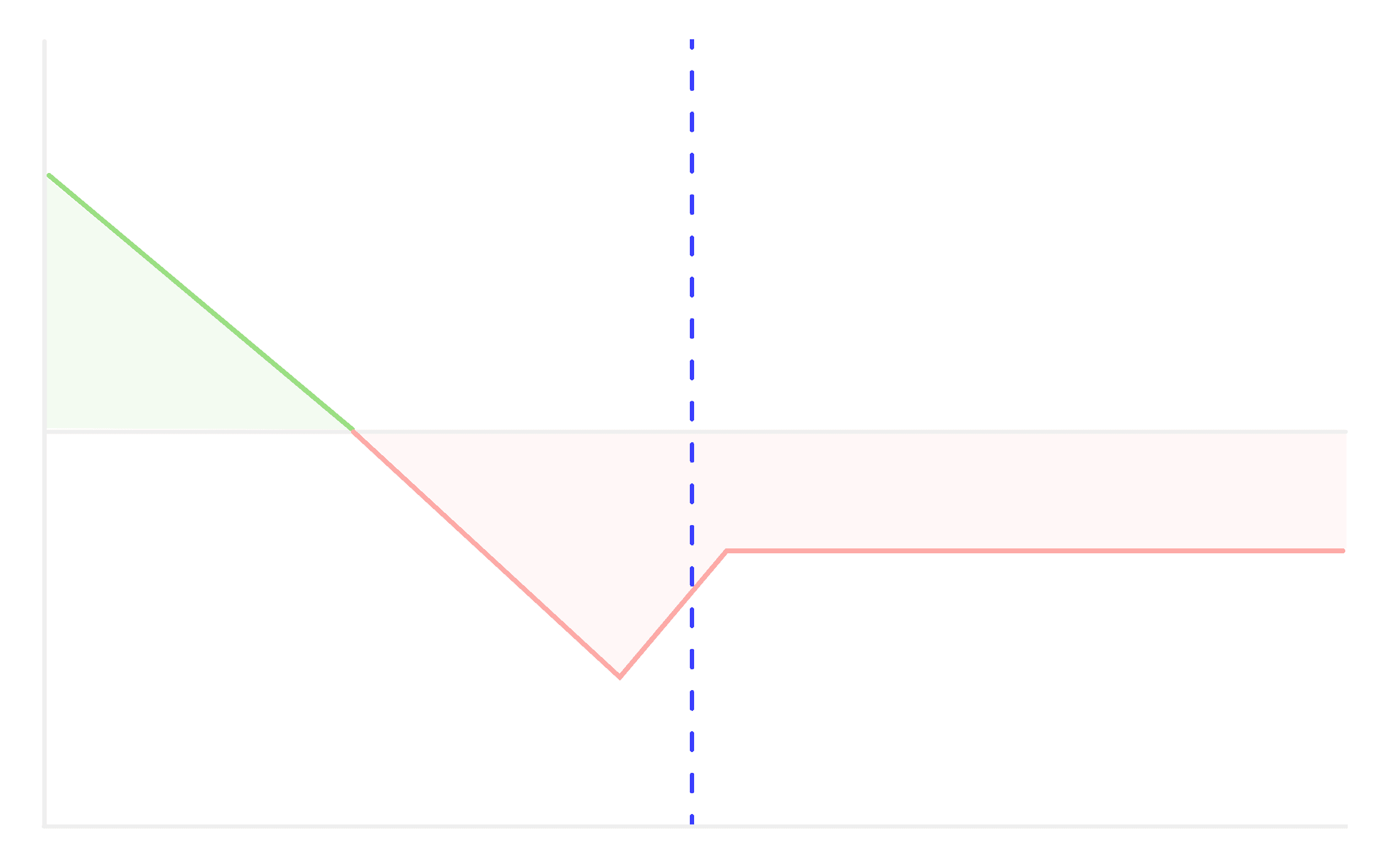

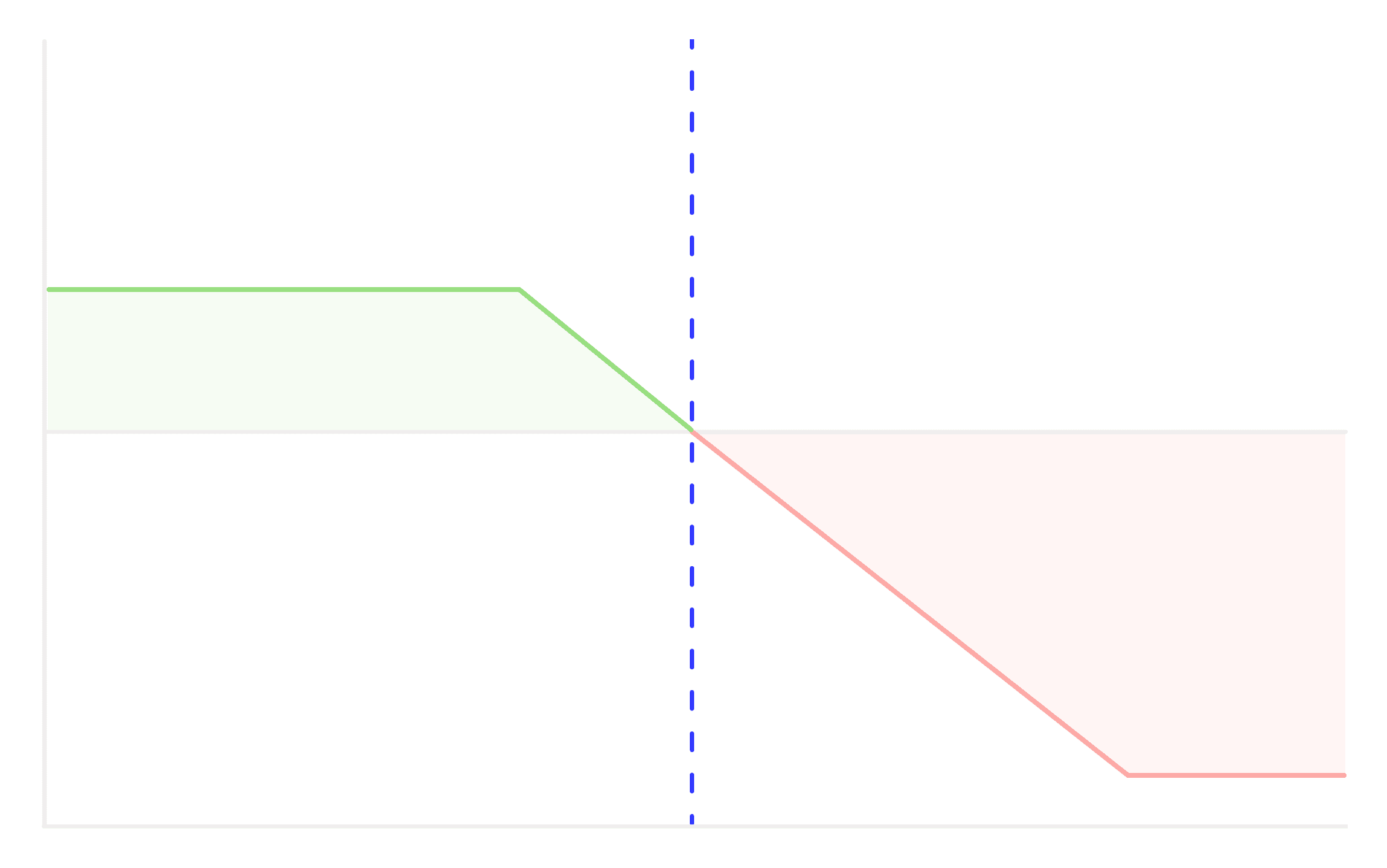

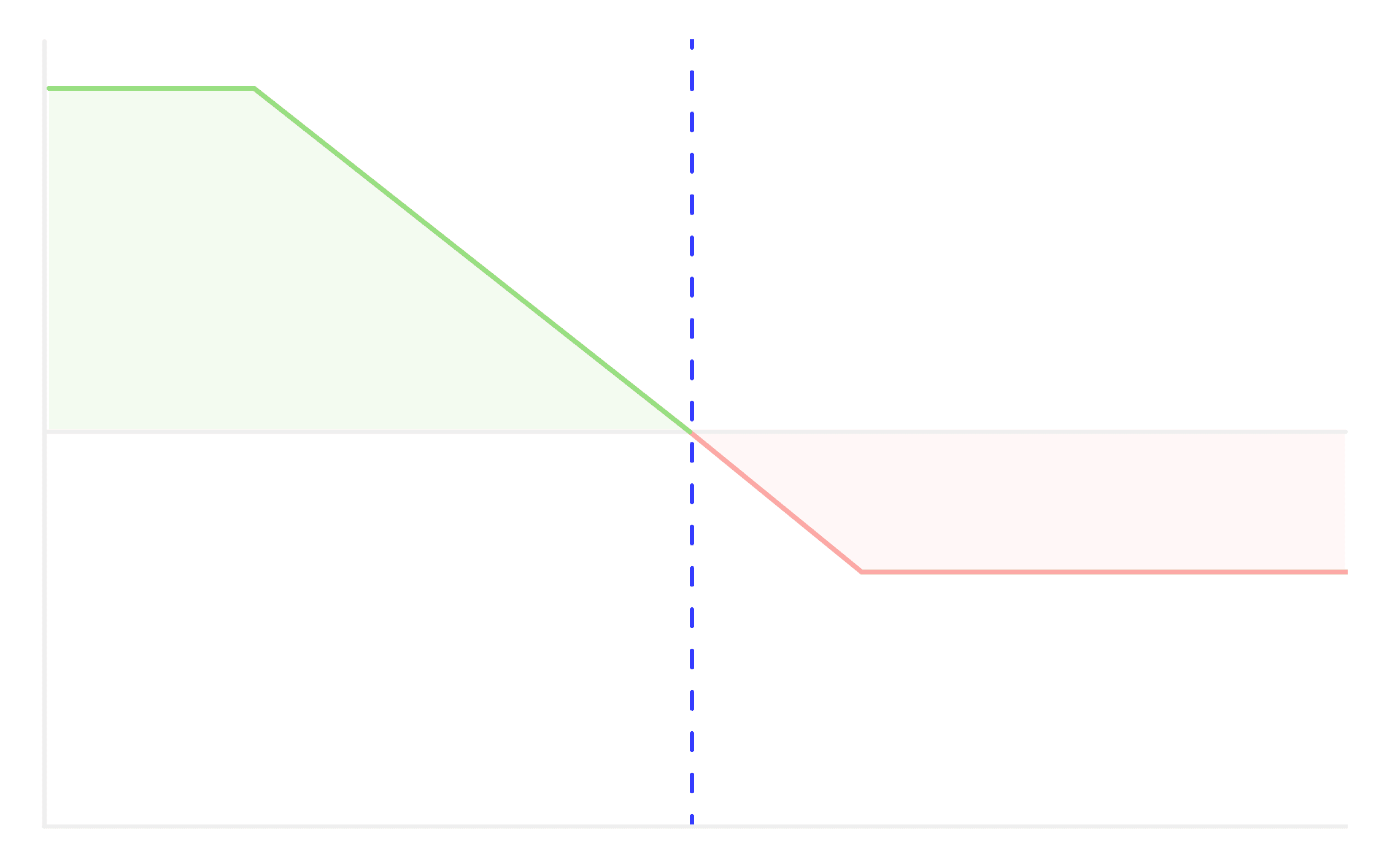

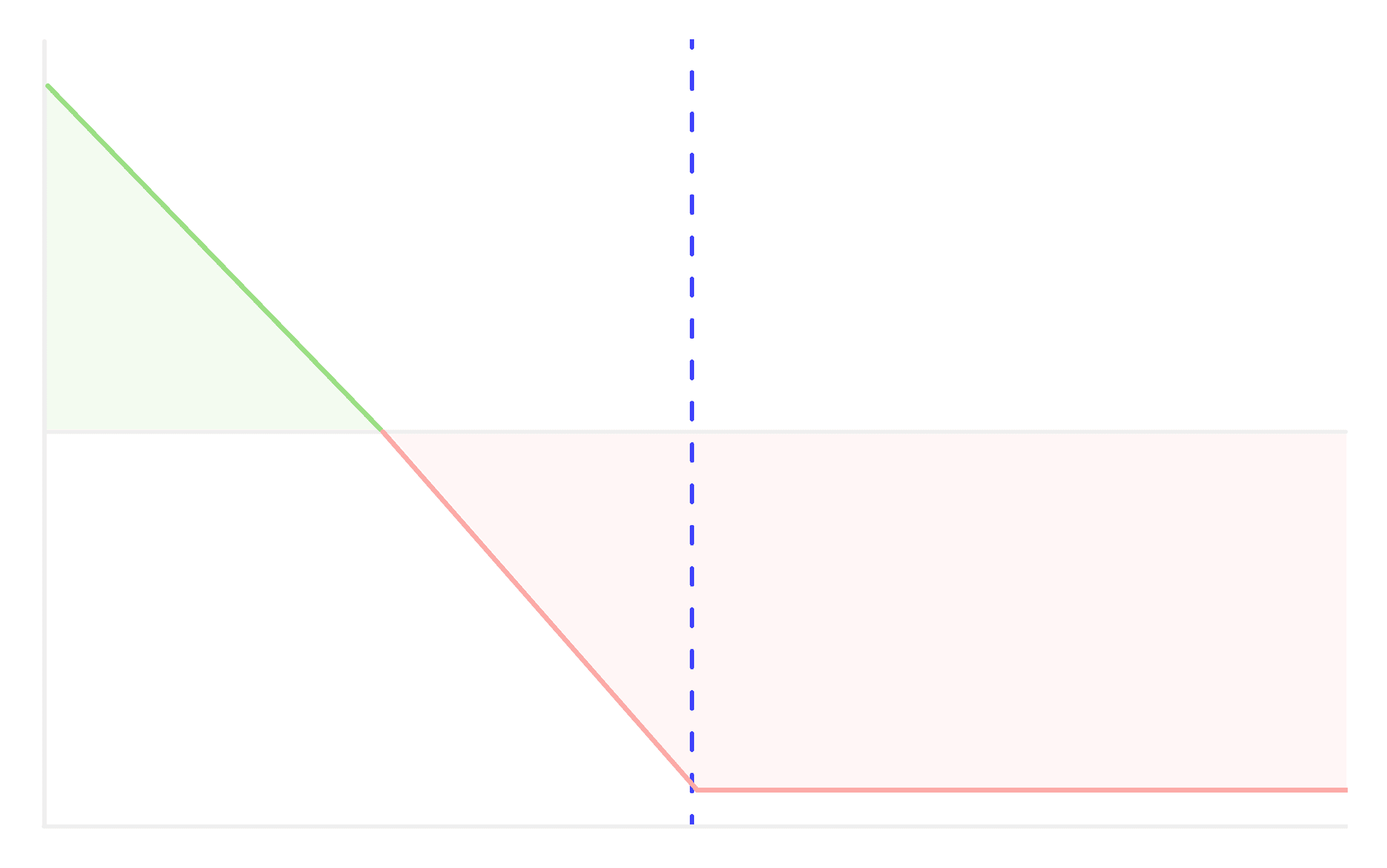

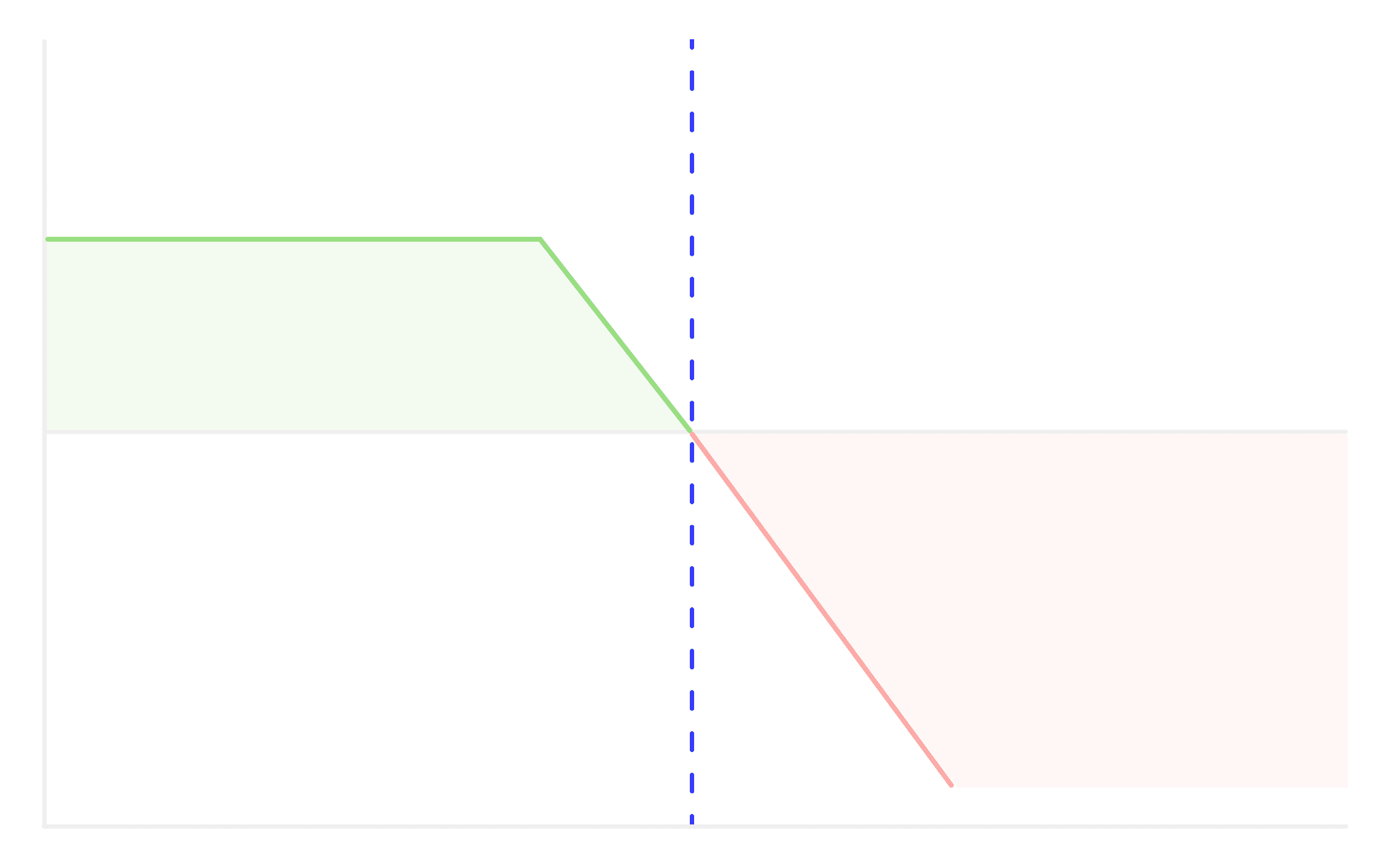

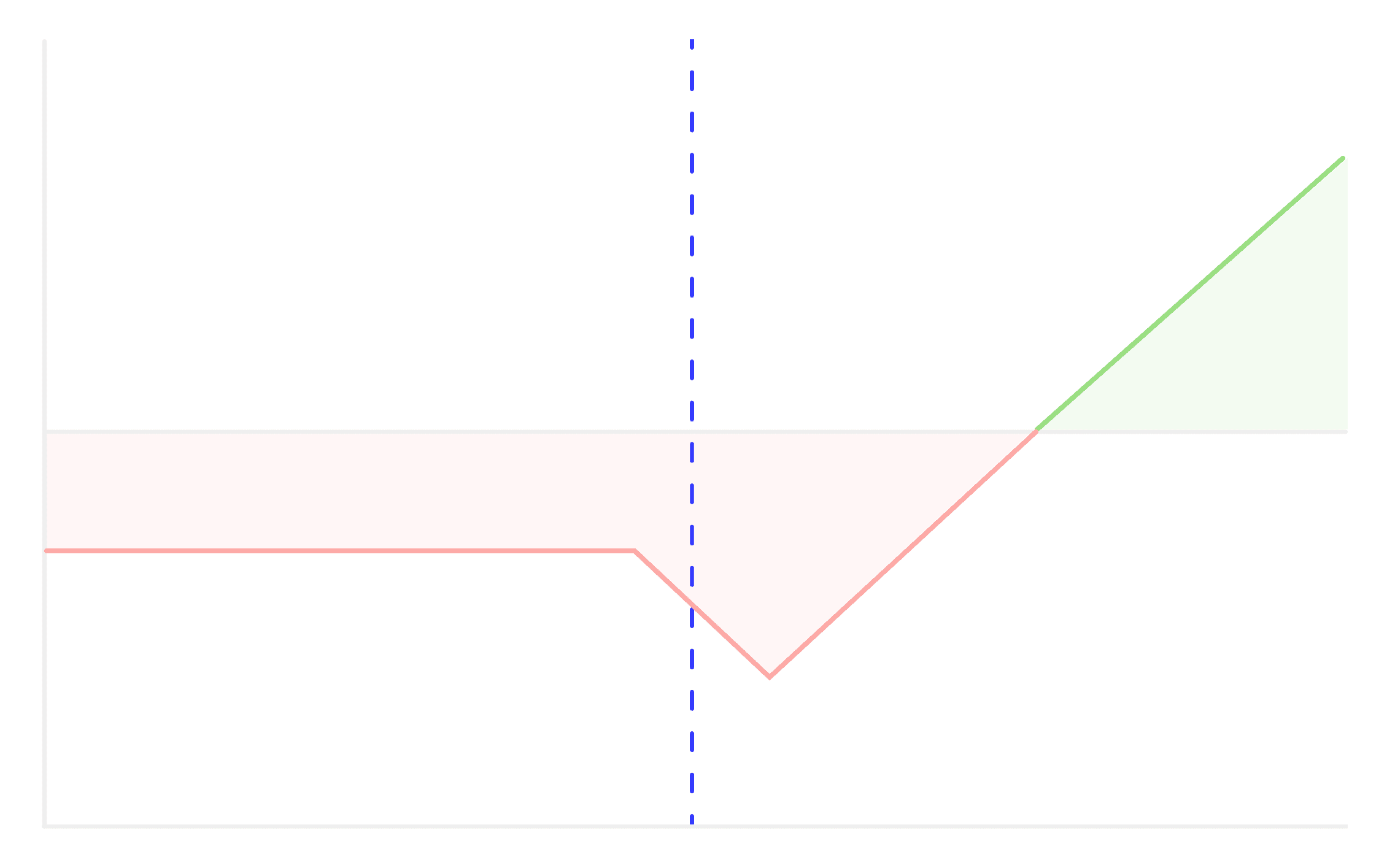

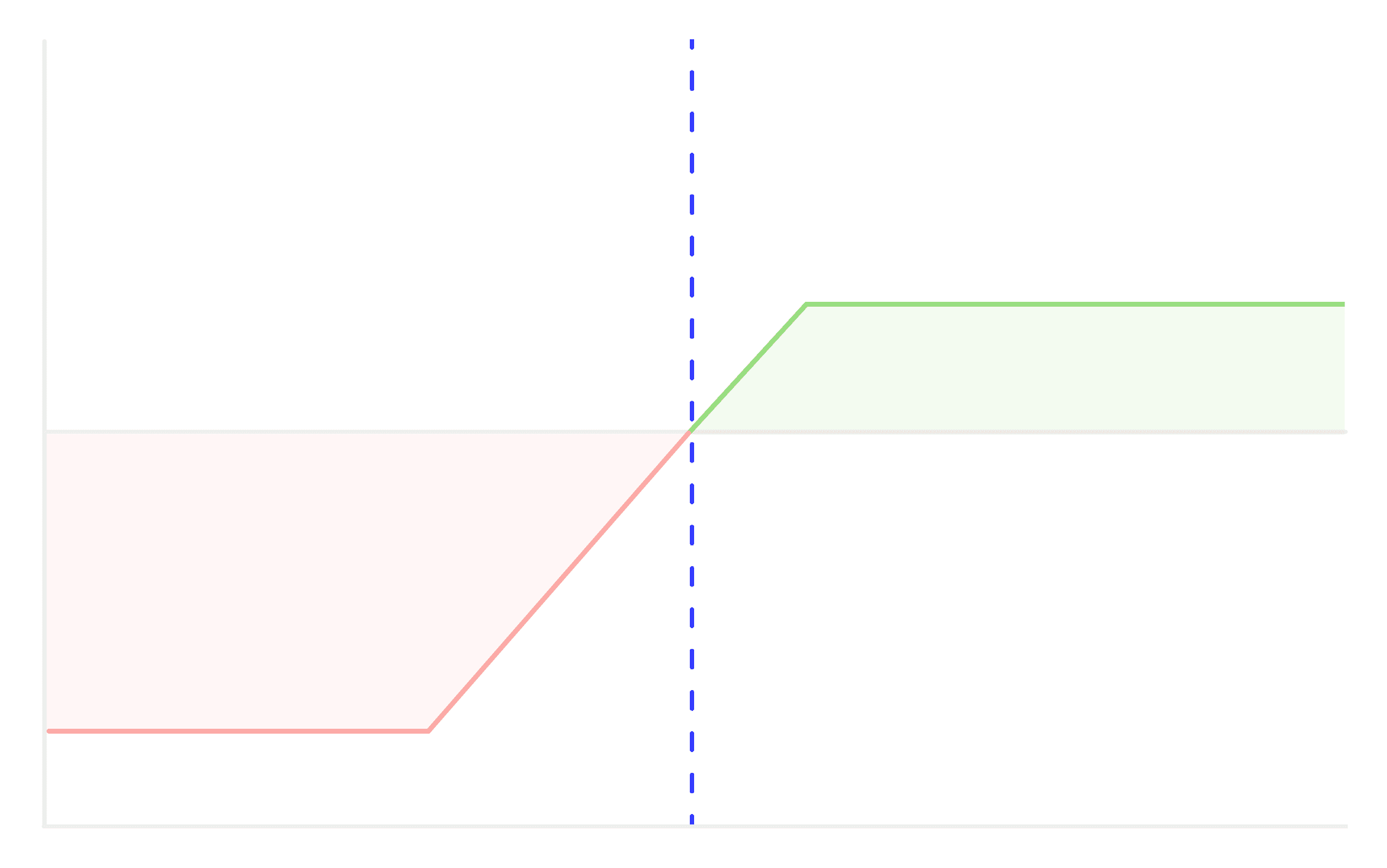

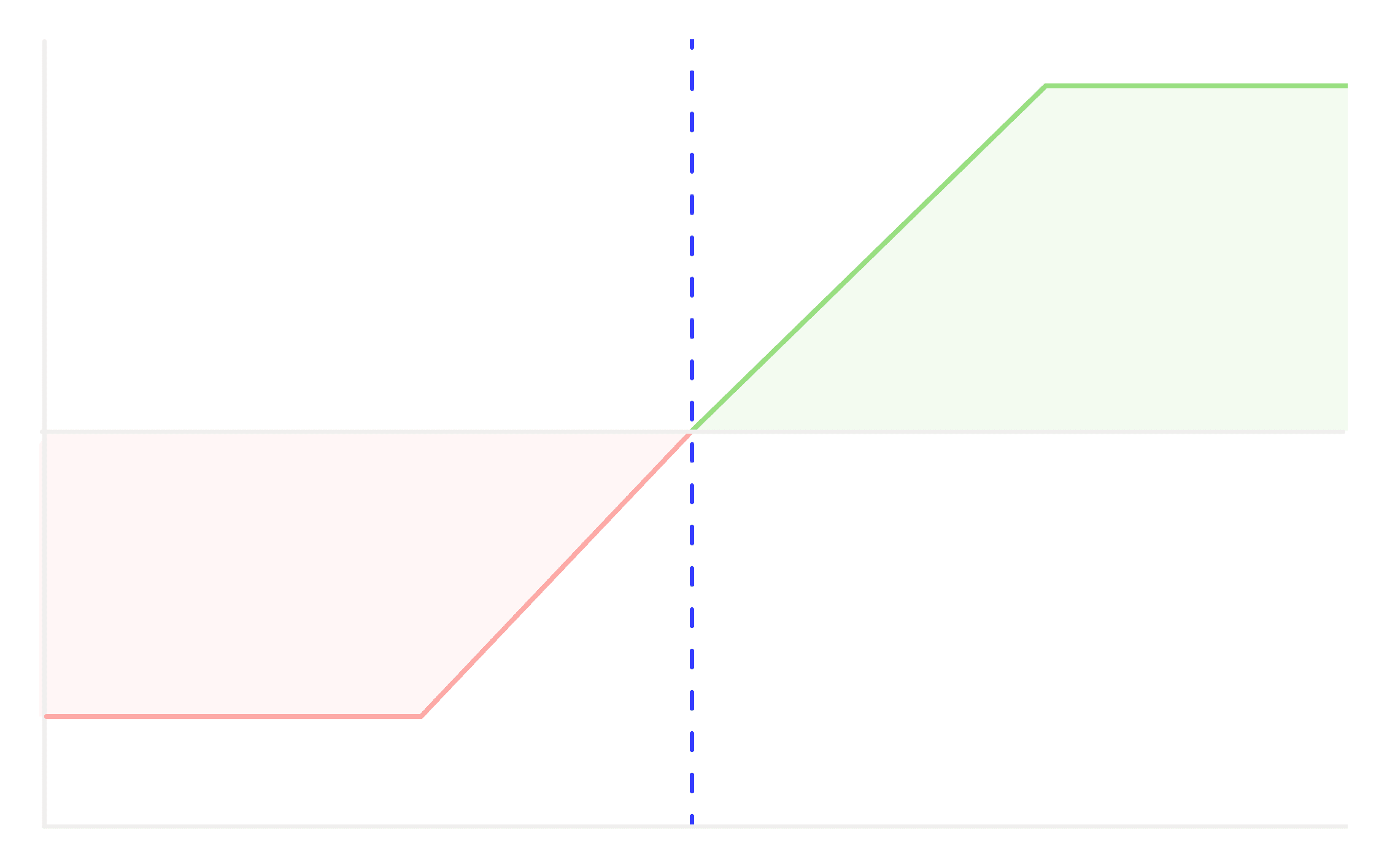

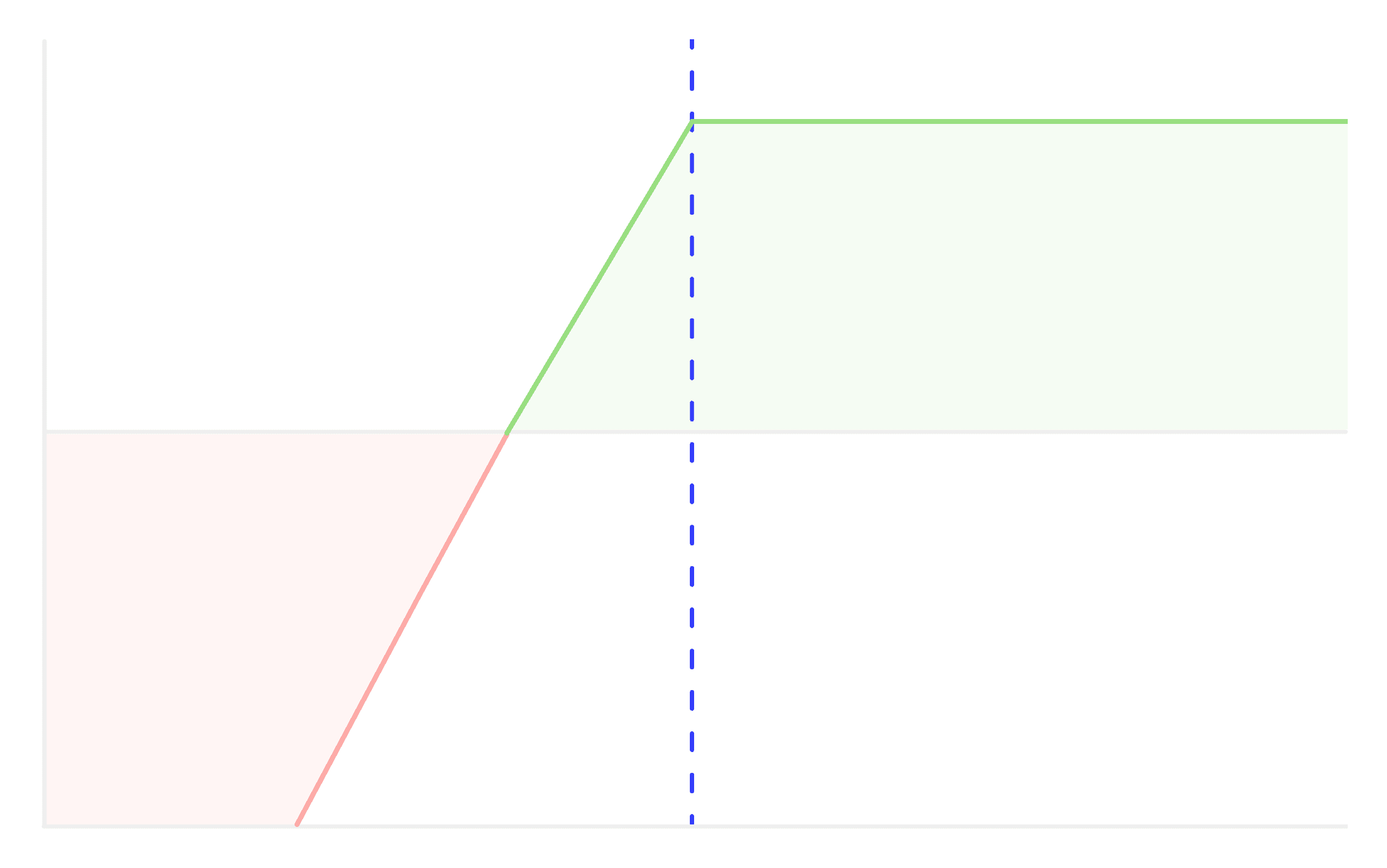

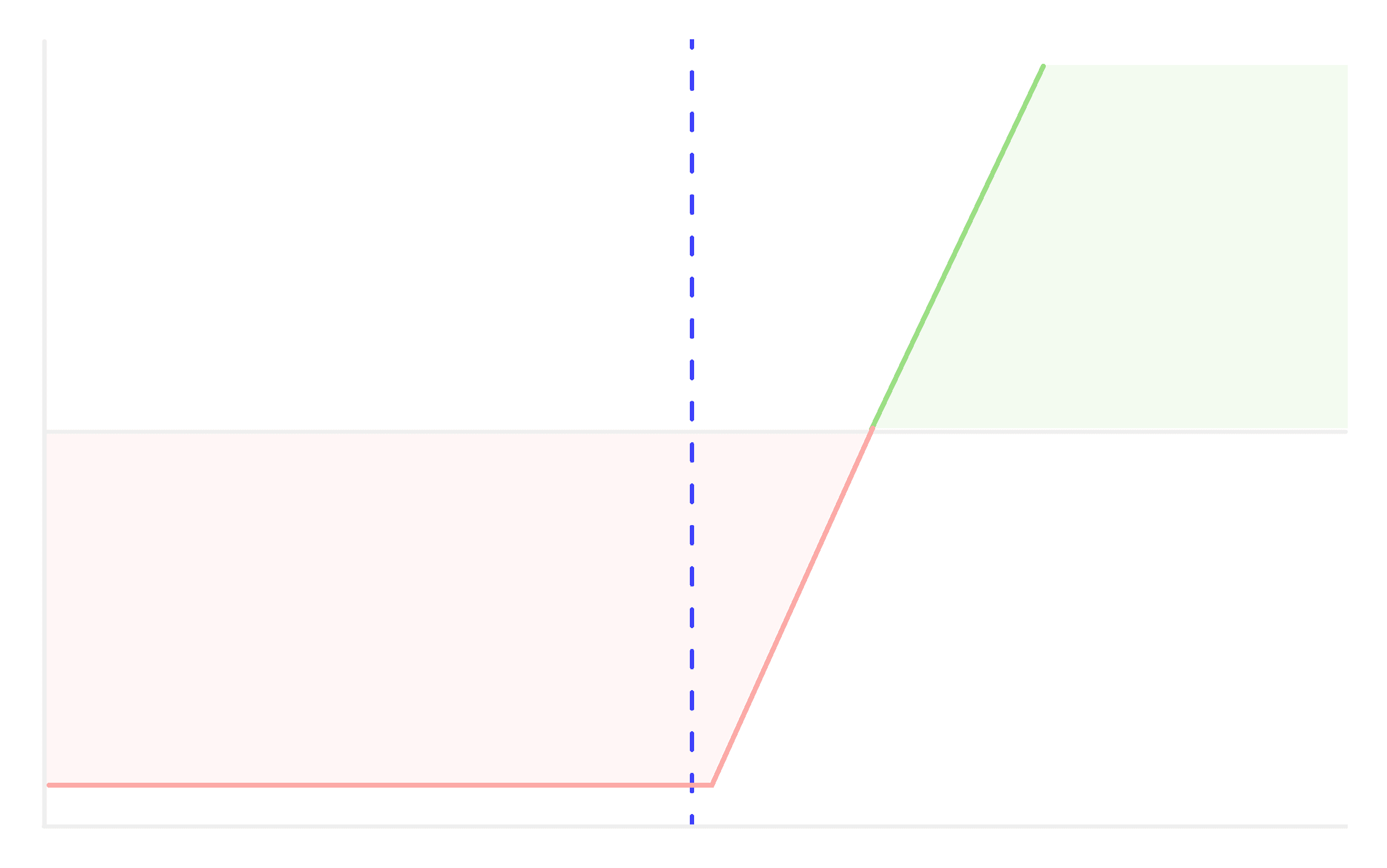

- Maximum Profit: The maximum profit is achieved when the price of the underlying asset remains exactly at the strike price at expiration. In this case, both the call and put options expire worthless, and you keep the full premiums collected from selling the options.

- Maximum Loss: The maximum loss is theoretically unlimited on the upside and limited on the downside. If the price of the underlying asset makes a significant move in either direction away from the strike price, you will start incurring losses. The loss is capped at the strike price plus or minus the total premiums received for the short straddle, depending on the direction of the price movement.

- Breakeven Points: There are two breakeven points:

- Upper Breakeven: The strike price plus the total premiums received.

- Lower Breakeven: The strike price minus the total premiums received.

The short straddle strategy can generate income for traders in a low-volatility environment. However, it involves a high level of risk, as significant price movements in the underlying asset can lead to substantial losses. Traders who use this strategy should closely monitor their positions and have a plan in place to manage potential losses, such as implementing stop-loss orders or rolling the options to adjust the position. Additionally, it's crucial to be aware of the potential for unlimited losses on the upside.

Let's illustrate a short straddle with an example:

Suppose you are a trader who believes that NIFTY is currently trading at ₹20,000 and will remain relatively stable in the short term. You decide to implement a short straddle strategy by selling both a call option and a put option on NIFTY with the following details:

- Strike Price: ₹20000

- Expiration Date: One month from today

- Current Stock Price (at the time of the trade): ₹20000

Here's what you do:

- Selling the Call Option:

- You sell a call option with a strike price of ₹20000.

- The call option premium you receive is ₹82 per lot.

- Selling the Put Option:

- You sell a put option with the same strike price of ₹20000.

- The put option premium you receive is ₹56 per lot.

- Premium Collection:

- You receive a premium of ₹82 per lot for selling the call option and another ₹56 per lot for selling the put option.

- In total, you collect ₹138 per lot in premiums .

Now, let's examine the potential outcomes of this short straddle:

- Maximum Profit: The maximum profit occurs if NIFTY price remains exactly at ₹20000 at the time of expiration. In this case, both the call and put options expire worthless, and you keep the entire ₹138 per share in premiums as your profit.

- Maximum Loss: The maximum loss is theoretically unlimited on the upside and limited on the downside. If NIFTY makes a significant move in either direction away from ₹20000, you will start incurring losses. For example, if the stock price rises to ₹20050 per share, you would lose ₹50 per lot (₹20050 - ₹20000), and your losses would continue to increase as the stock price goes higher.

- Breakeven Points:

- Upper Breakeven: ₹20000 (strike price) + ₹138 (total premiums received) = ₹20138 per lot

- Lower Breakeven: ₹20000 (strike price) - ₹138 (total premiums received) = ₹19862 per lot

So, in this example, your short straddle would start incurring losses if NIFTY moves above ₹20138 or below ₹19862 per lot.

If the stock price remains within this range, you would profit from the premiums collected, but significant price movements outside of this range could result in losses.

It's essential to monitor the position and consider implementing risk management strategies, such as stop-loss orders or adjusting the position, to limit potential losses, especially in volatile markets. Short straddle strategies are not suitable for all market conditions and require careful risk management.

Other Strategies

Iron Condor

A strategy designed to profit from low volatility in the underlying asset, combining a bullish put credit spread and a bearish call credit spread to it.

Iron Butterfly

This is a strategy which profits from low volatility in the price of the underlying asset while minimizing risk.

Short Strangle

A short strangle is a non directional trading strategy where an investor sells an (OTM) call option and put option on the same underlying asset simultaneously.

Short Straddle

A Short straddle is considered neutral or non-directional because it profits from minimal price movement in the underlying asset.

Put Ratio Backspread

The Put Ratio Backspread strategy involves selling and buying put options in a specific ratio.

Bear Call Spread

A Bear Call Spread is an options trading strategy that's used when a trader believes the price of an underlying asset will go down, but not significantly.

Bear Put Spread

A Bear Put Spread is a type of vertical spread strategy used in options trading.

Long Put

Long Put option is the most basic & simplest strategy. It is recommended or implemented when we expect the underlying asset to show significant downside move.

Short Call

Short Call strategy is employed in a bearish or neutral market outlook, where the underlying asset's price is expected to remain stable or fall.

Call Ratio Backspread

The Call Ratio Backspread strategy involves selling and buying call options in a specific ratio.

Bull Put Spread

A Bull Put Spread is a type of vertical spread strategy used in options trading

Bull Call Spread

A Bull Call Spread is an options trading strategy that's used when a trader believes the price of an underlying asset will go up, but not significantly.

Short Put

Short Put strategy is employed in a bullish or neutral market outlook, where the investor believes that the underlying asset's price will remain stable or rise.

Long Call

Long Call option' is the most basic & simplest strategy. It is recommended or implemented when we expect the underlying asset to show significant upside move.

Don't let emotions take over your trades, take control now and become a tactical trader with 1lyOptions