Bull Call Spread

A Bull Call Spread is an options trading strategy that's used when a trader believes the price of an underlying asset will go up, but not significantly.

A Bull Call Spread or Call Debit Spread is an options trading strategy that's used when a trader believes the price of an underlying asset will go up, but not significantly. It involves buying and selling call options with the same expiration date but different strike prices.

How It Works:

- Buy a Call Option: The trader starts by buying a call option at a specific strike price. This is known as the "lower strike price."

- Sell a Call Option: Simultaneously, the trader sells another call option at a higher strike price. This is known as the "higher strike price."

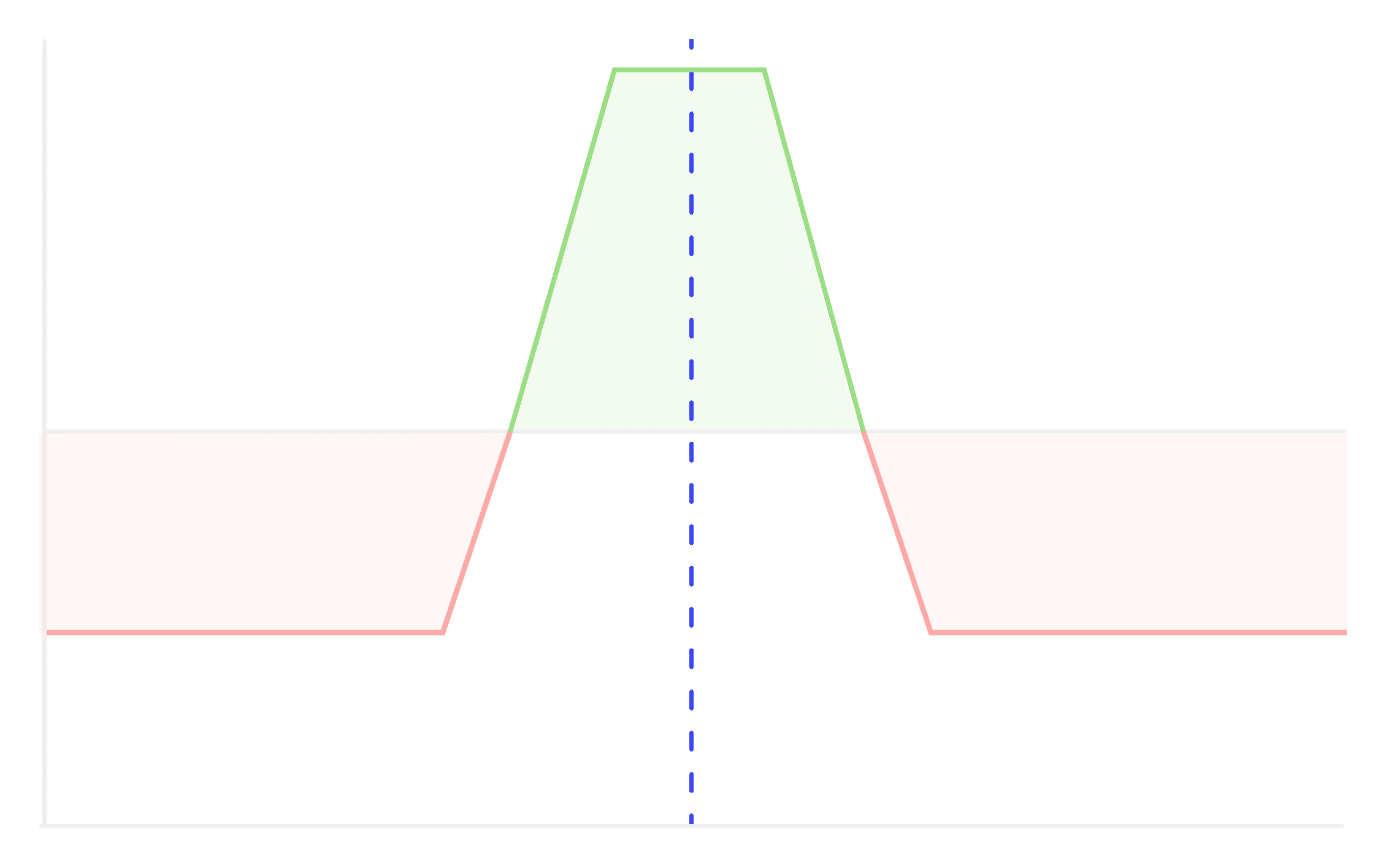

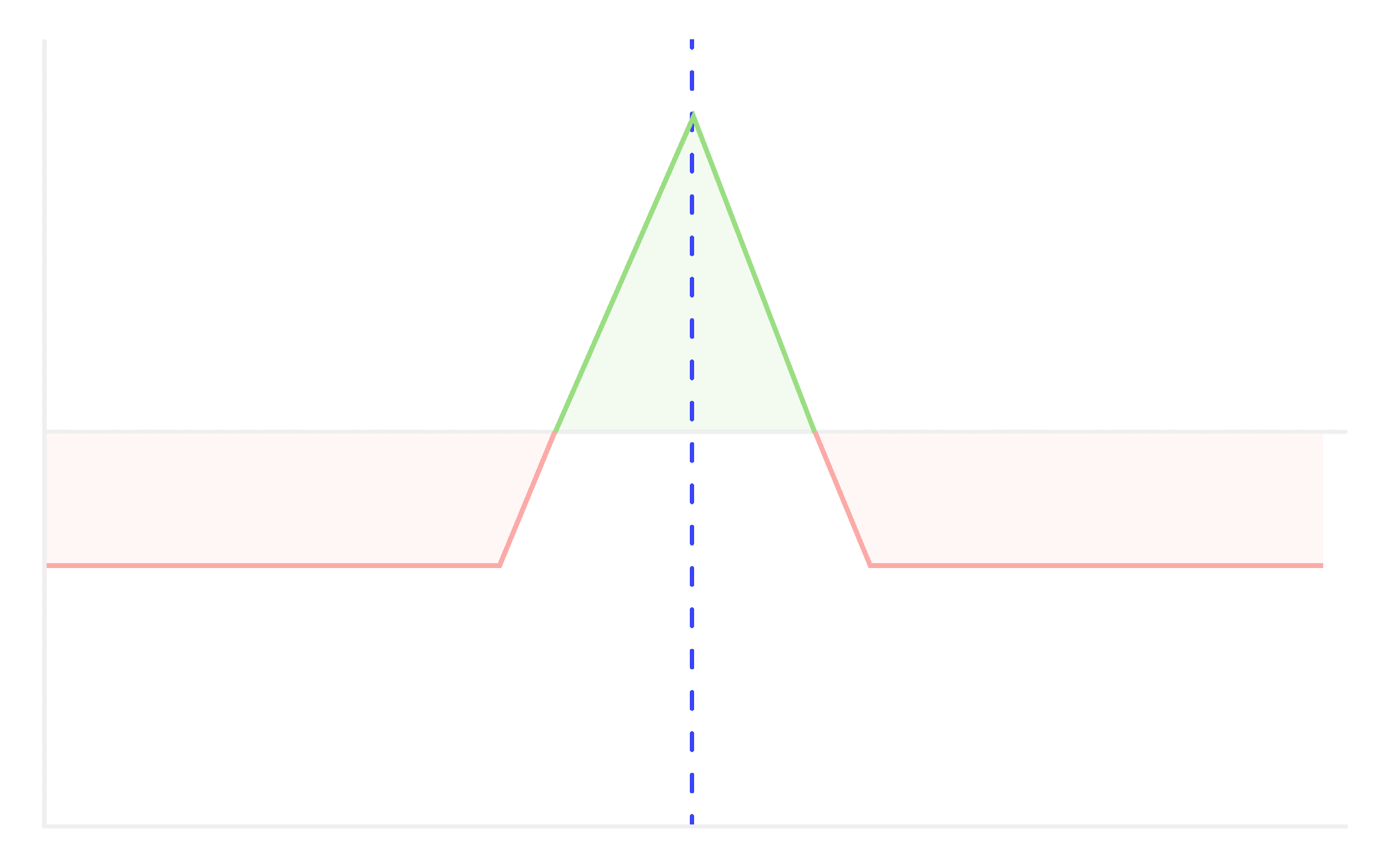

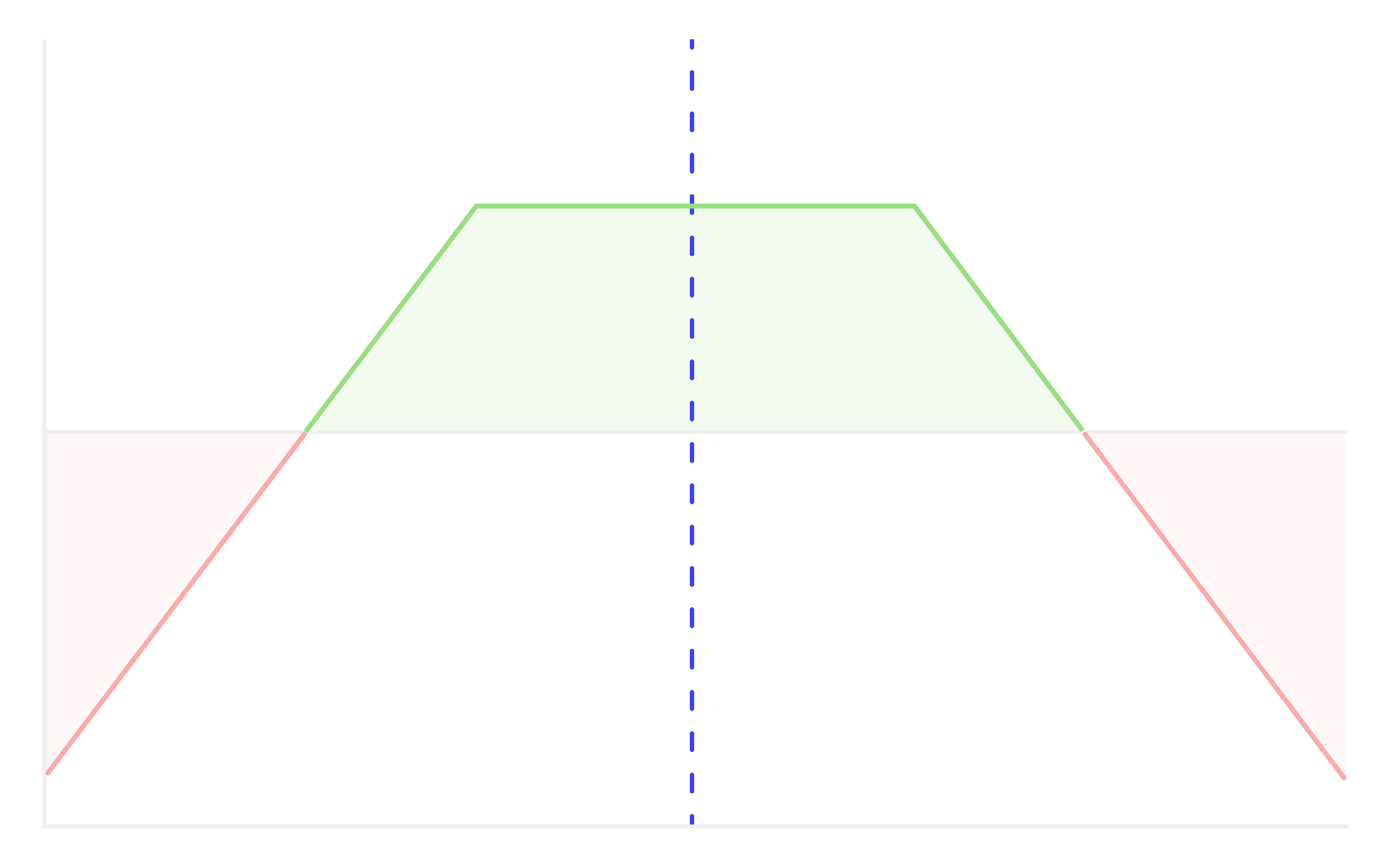

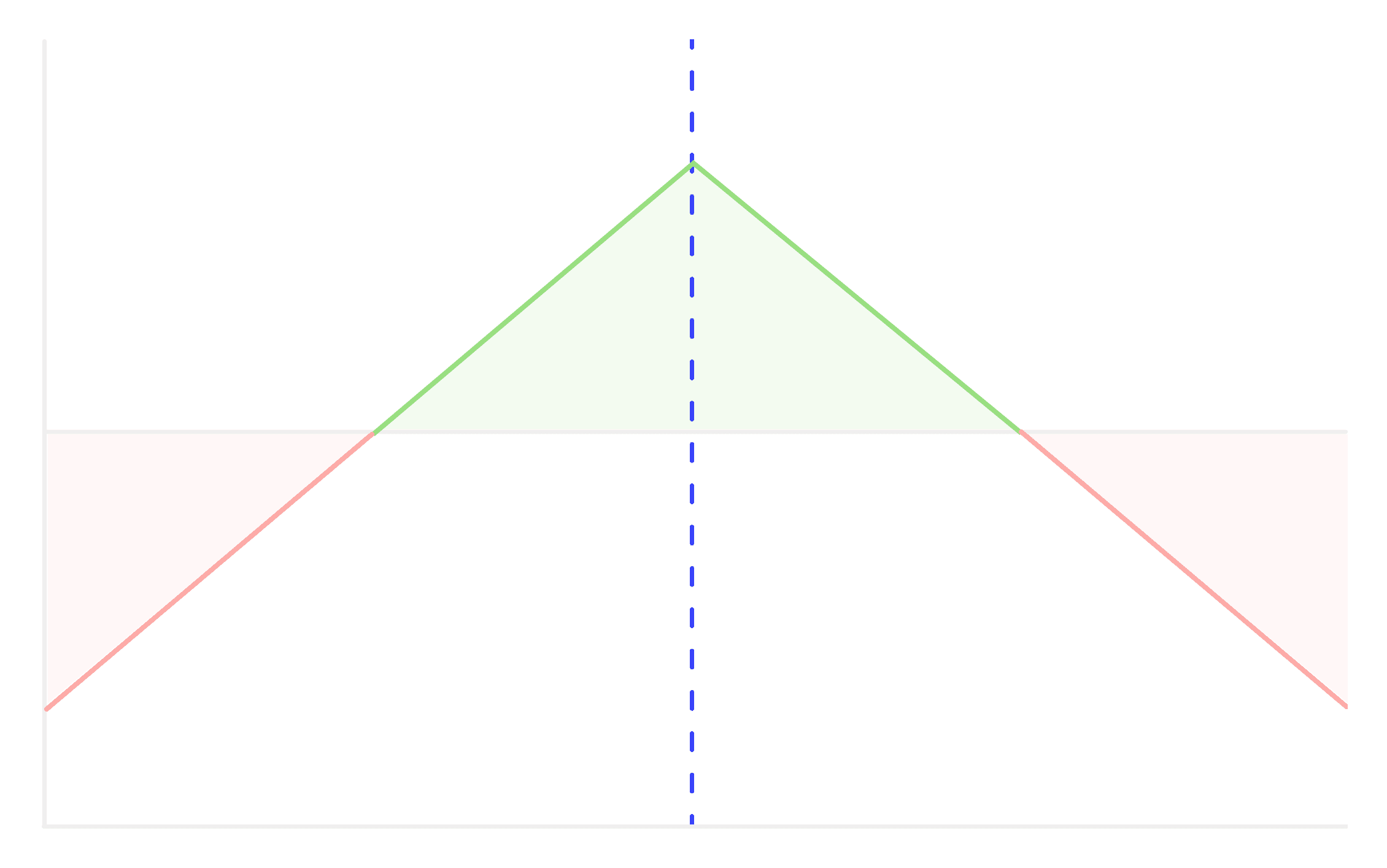

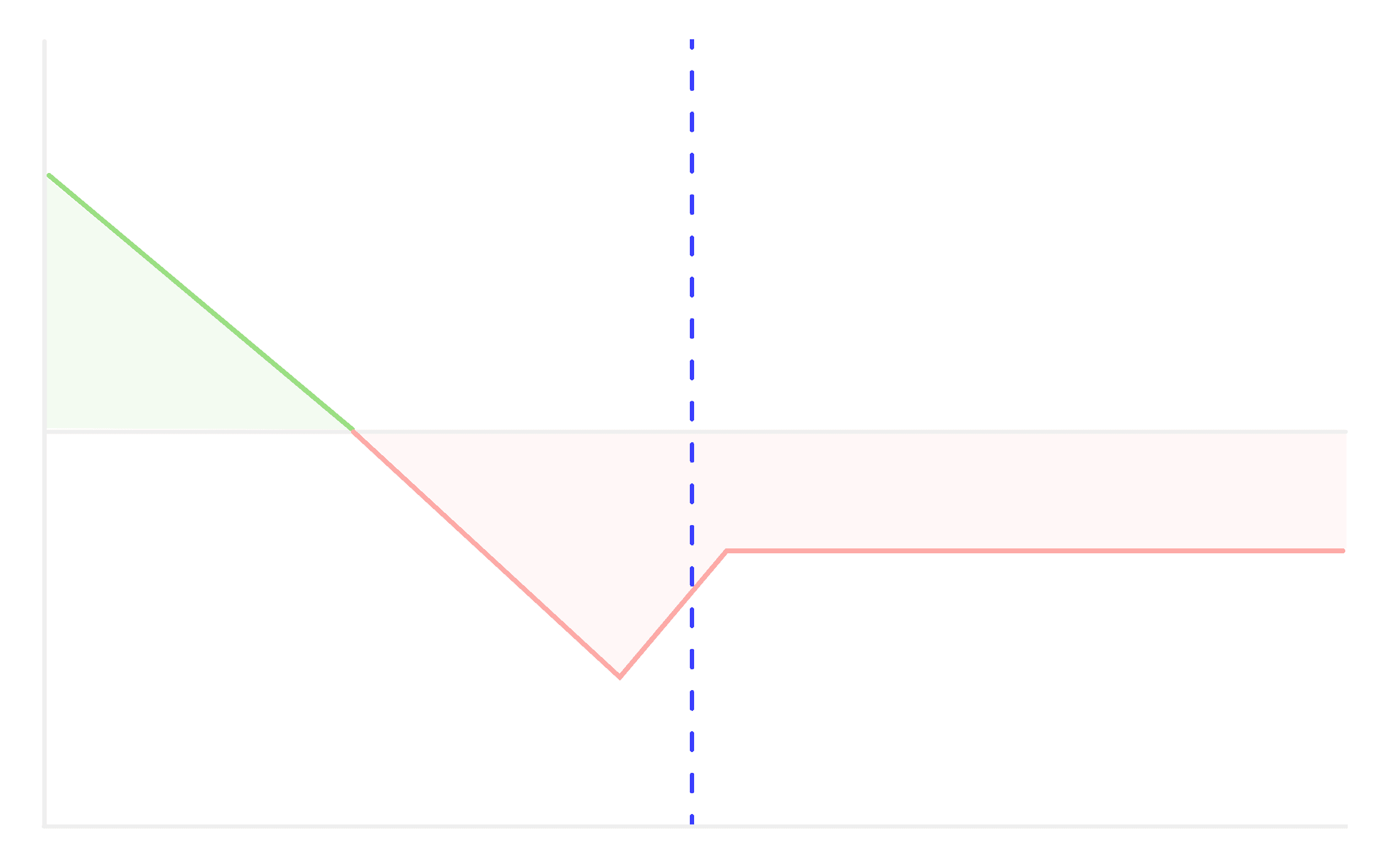

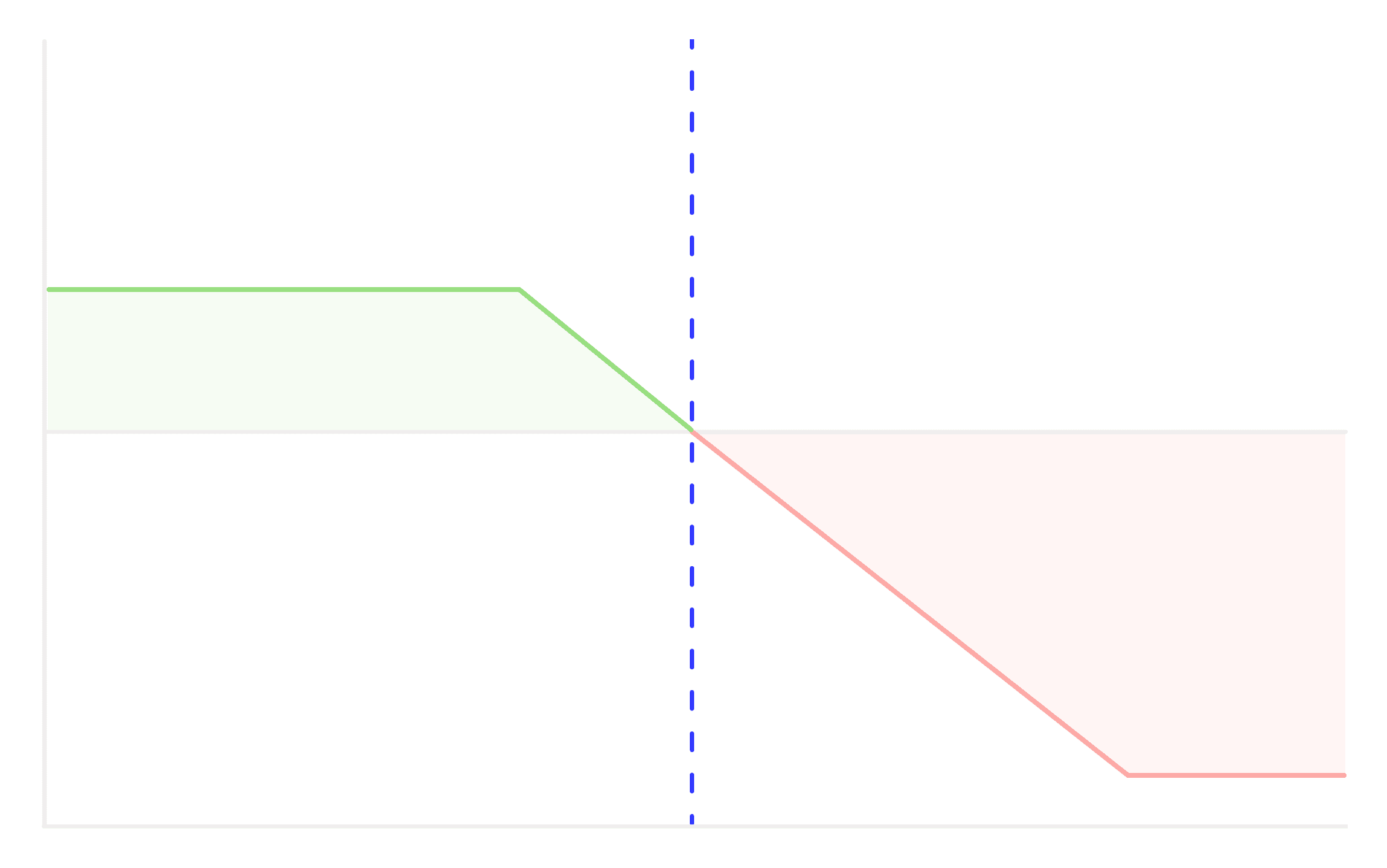

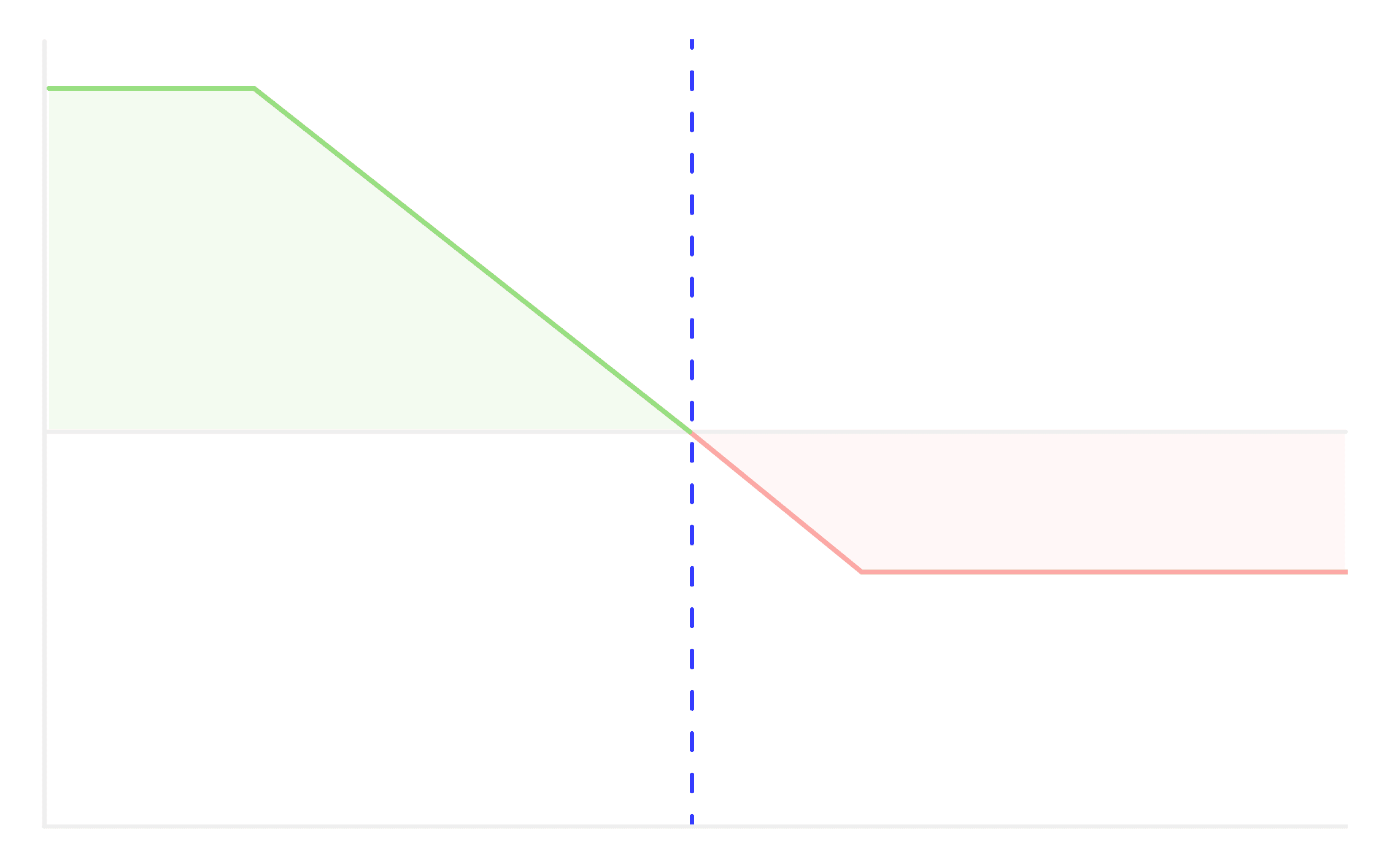

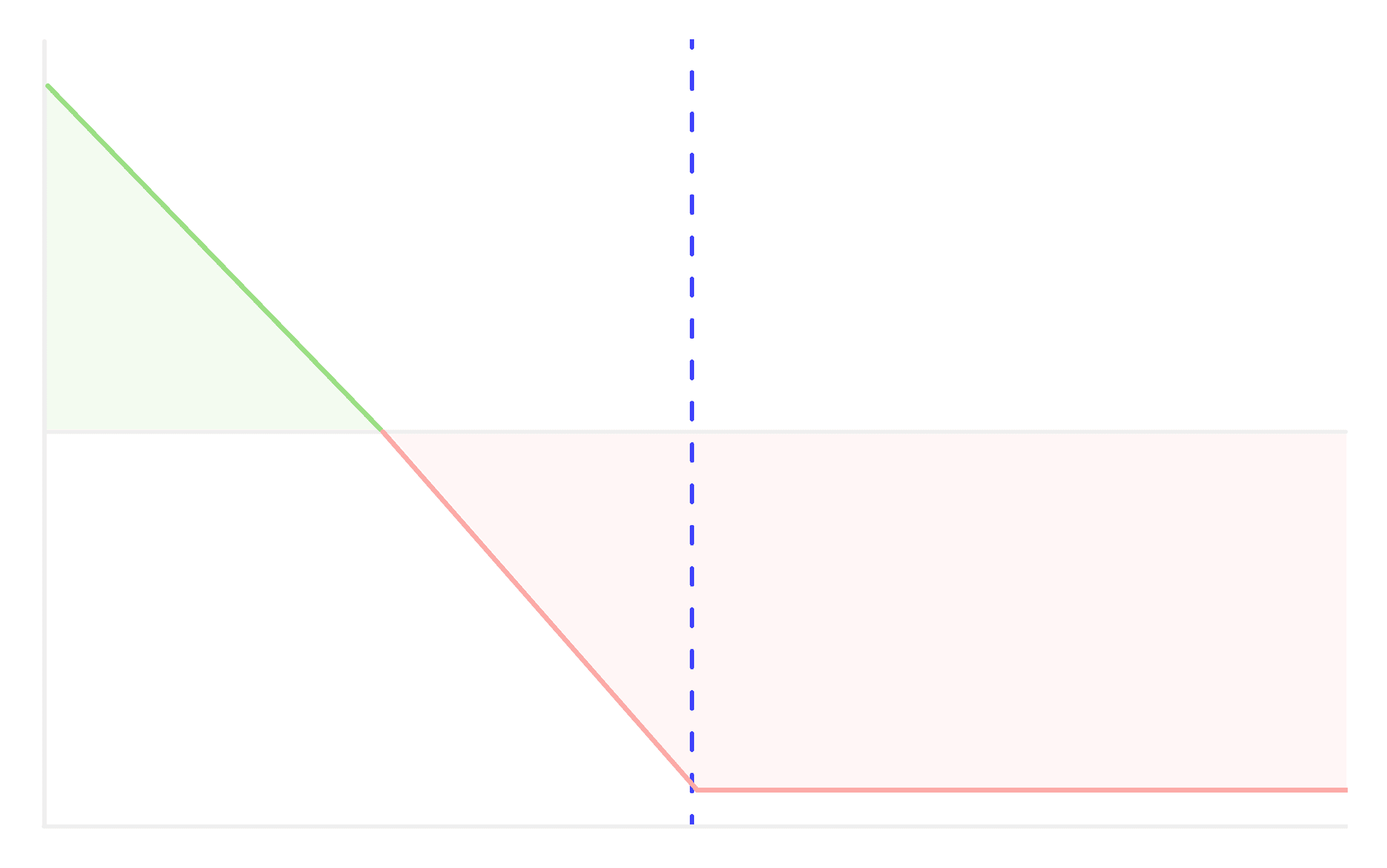

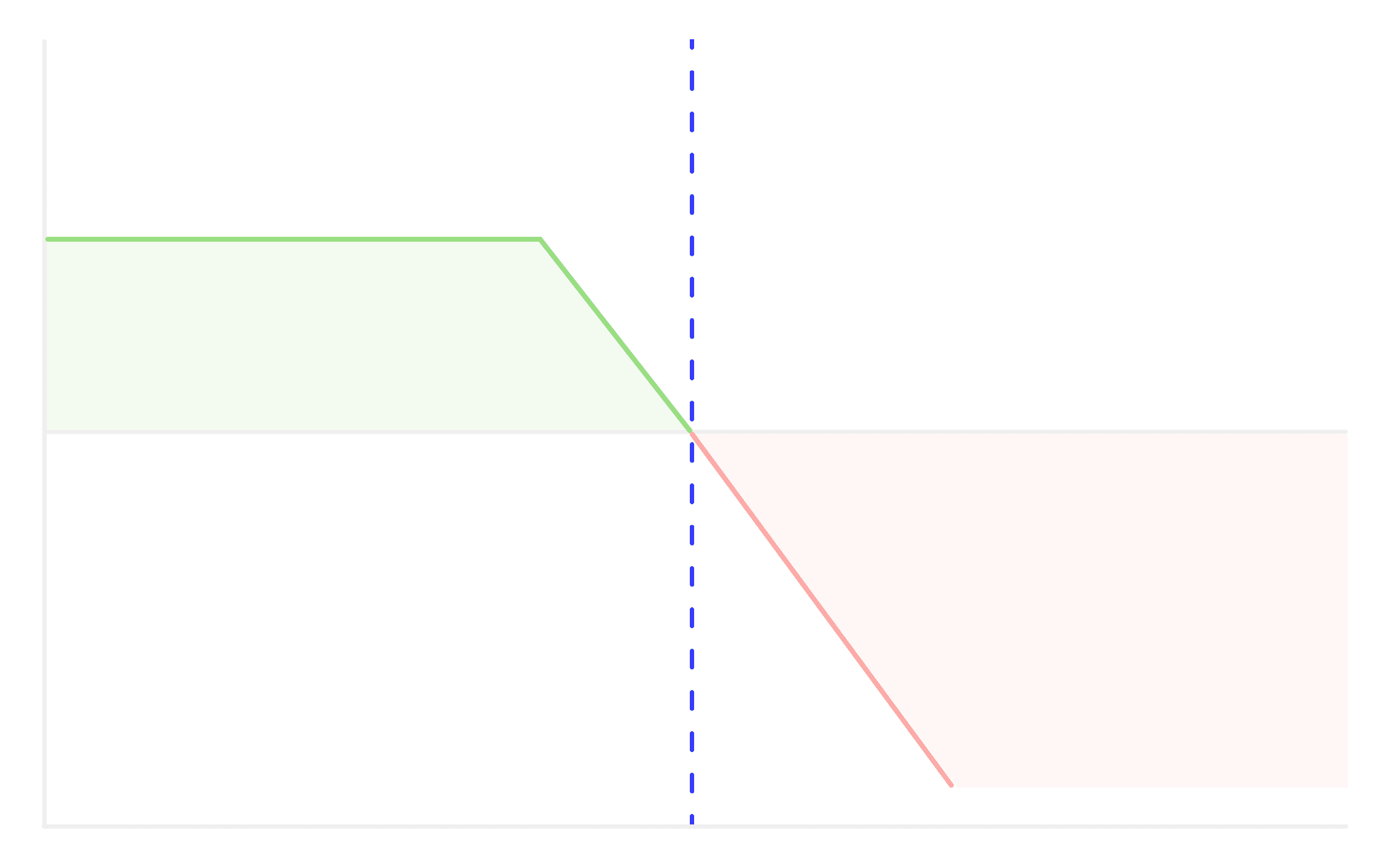

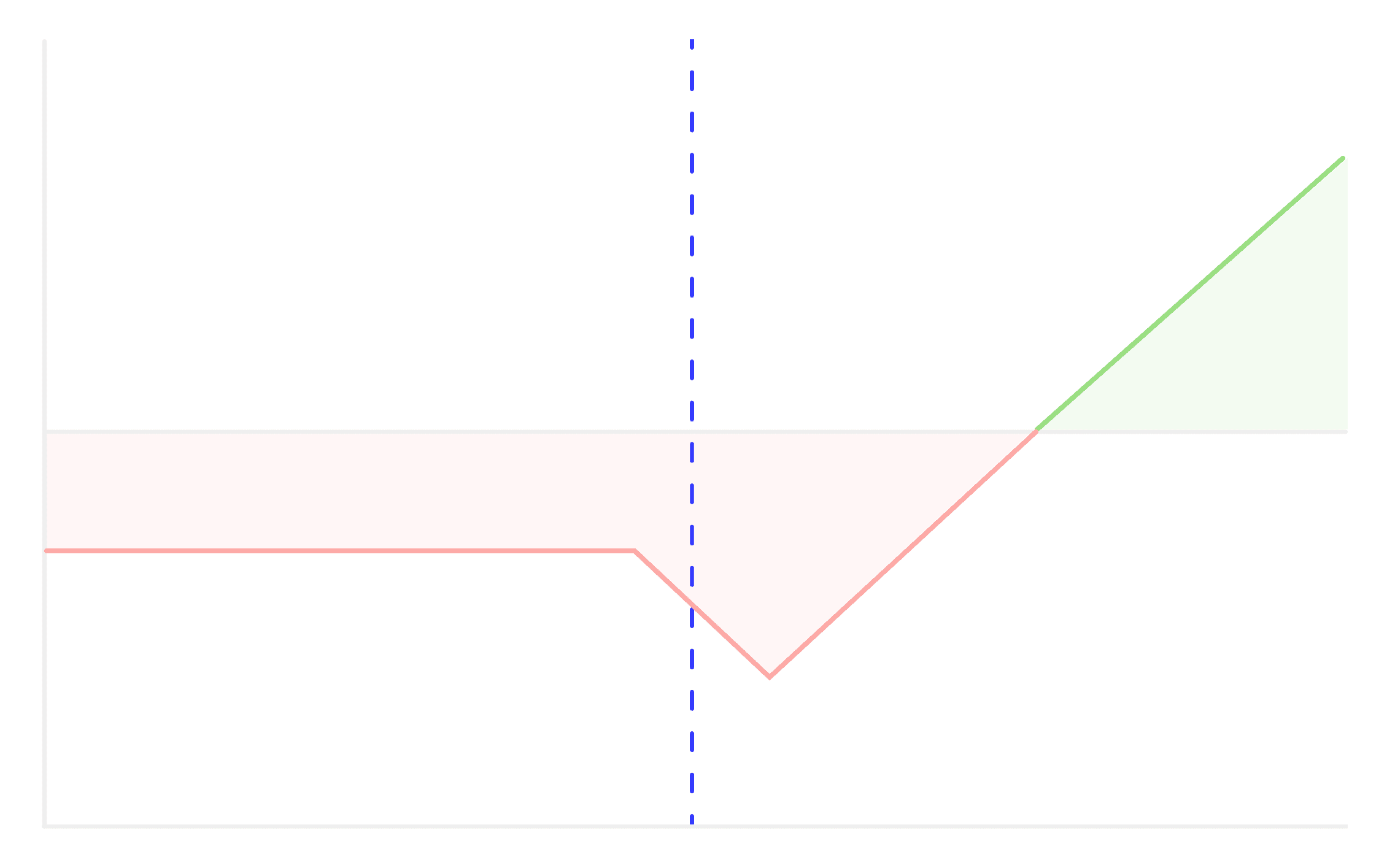

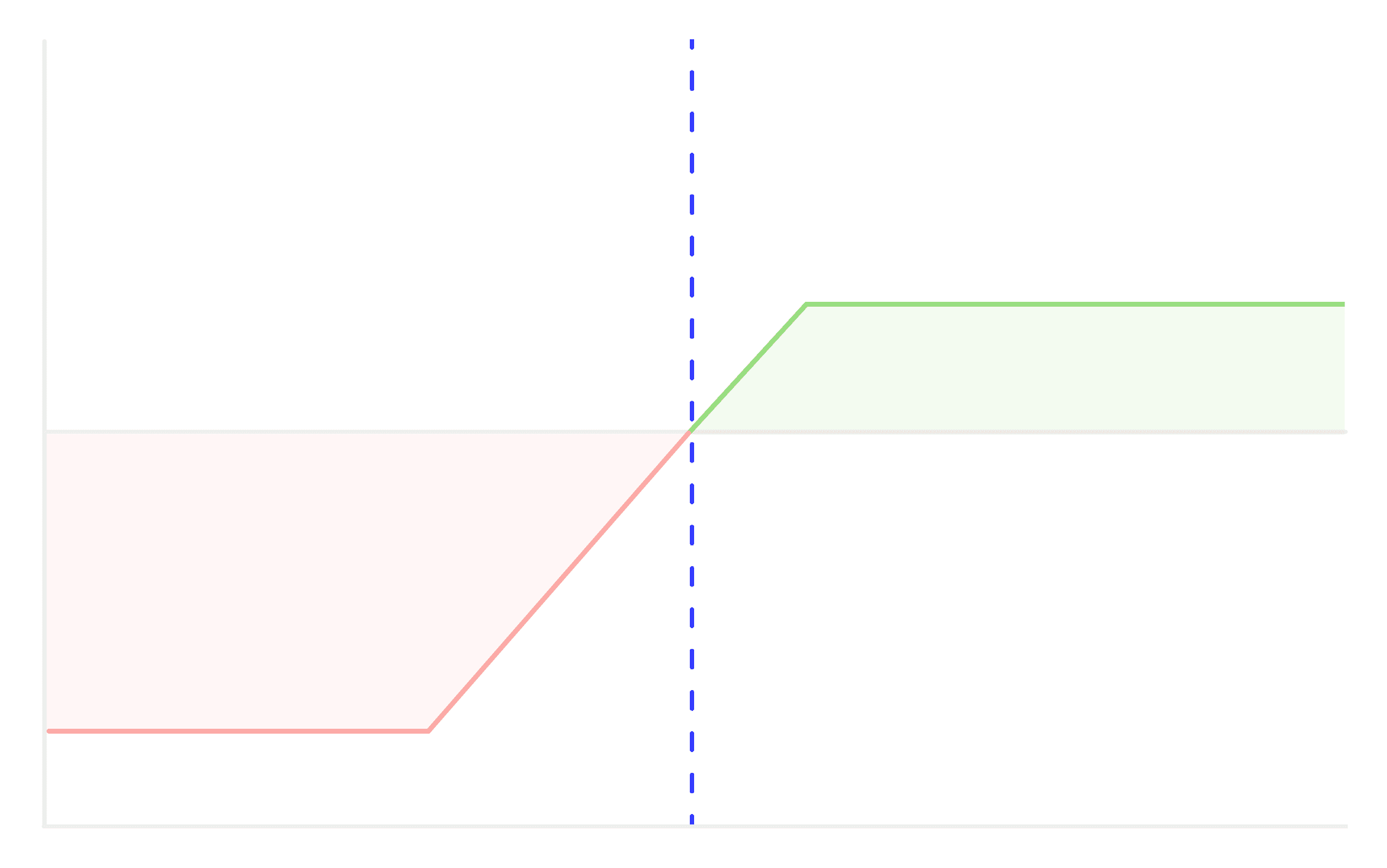

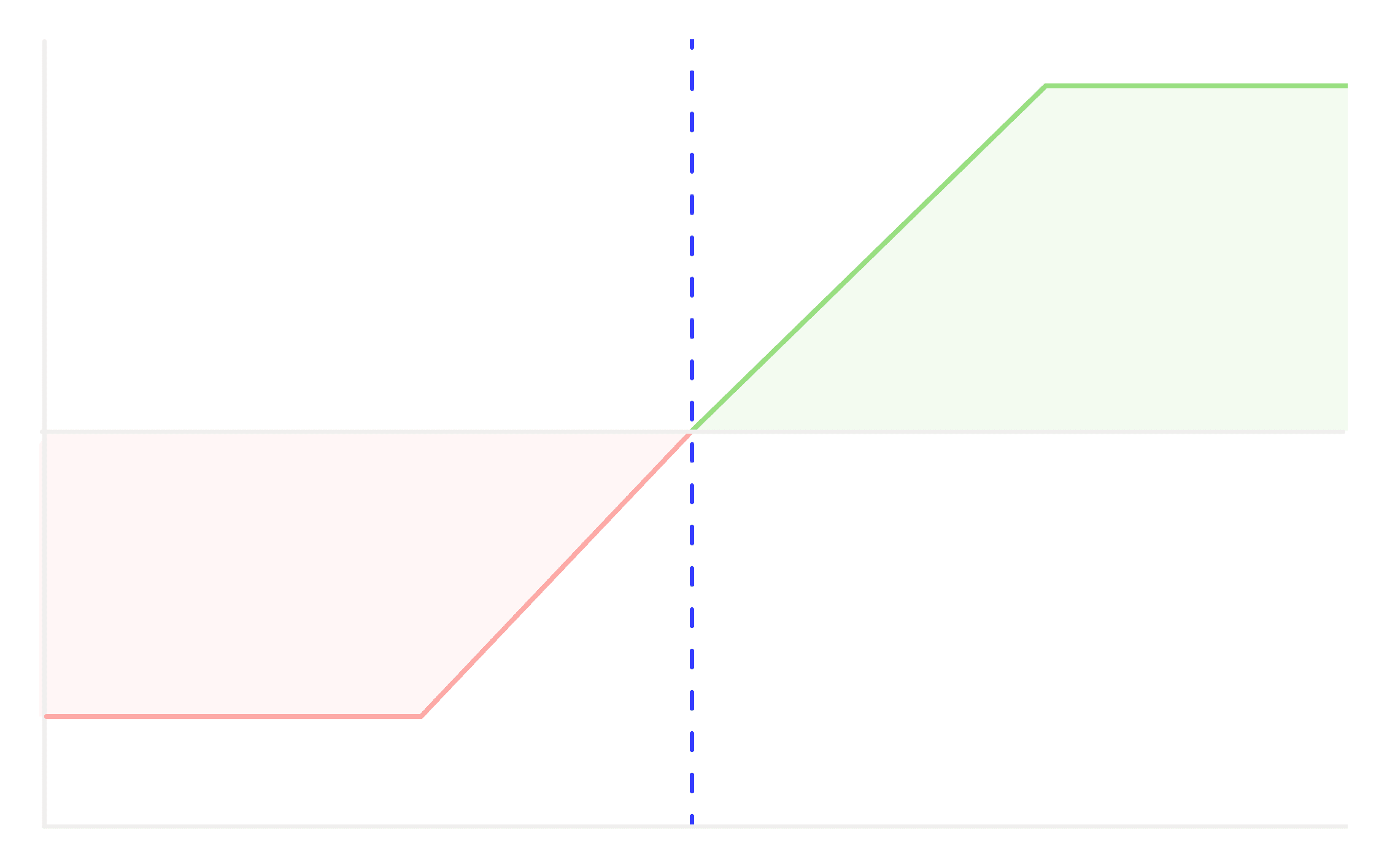

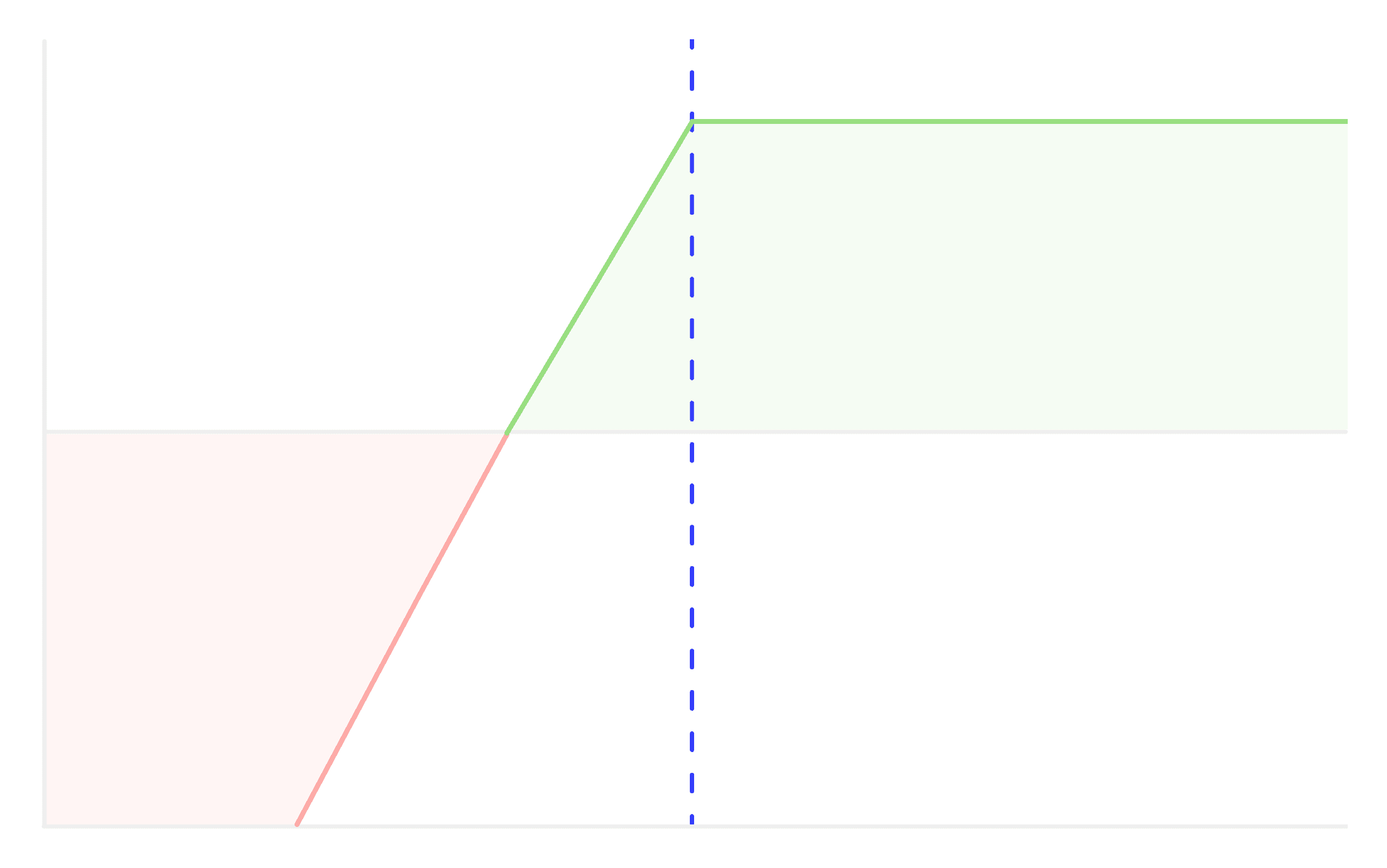

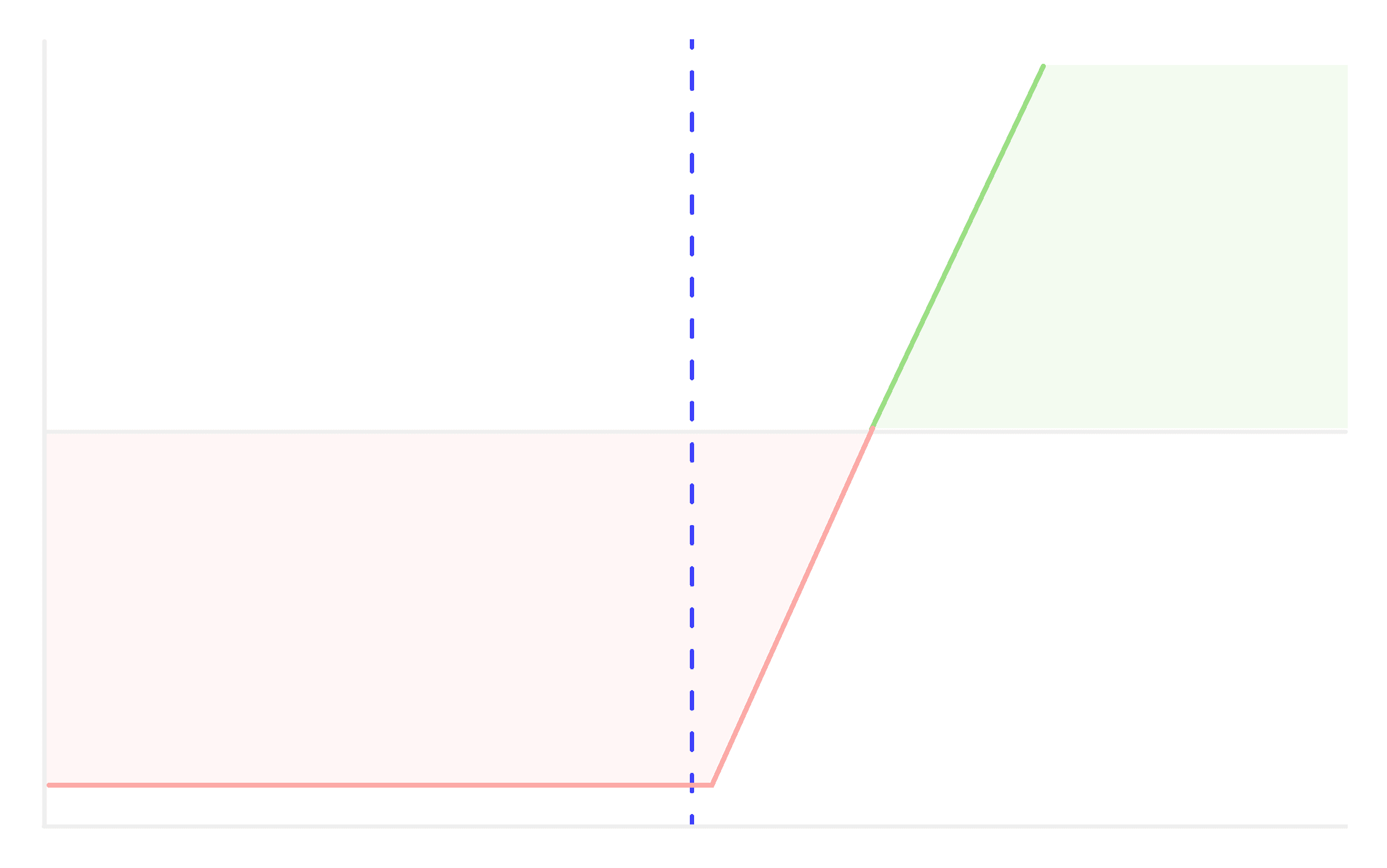

Potential Profit and Loss:

- Maximum Profit: The difference between the strike prices minus the net premium paid. This profit is realized if the stock closes upon expiration at or above the higher strike price.

- Maximum Loss: Limited to the net premium paid to establish the spread. The loss is incurred if the stock closes upon expiration at or below the lower strike price.

Benefits:

- Reduced Cost: By selling the higher strike call, the trader offsets some of the costs of the lower strike call. This reduces the net outlay and thus the maximum potential loss.

- Defined Risk: Unlike a simple long call position where the potential loss can be significant if the stock goes down, the Bull Call Spread has a clearly defined maximum loss.

Drawbacks:

- Capped Profit: The profit is limited to the difference between the strike prices minus the net premium paid.

- Requires Movement: The stock must move above the lower strike price for the strategy to be profitable.

Example:

Let's assume a trader believes Nifty, currently trading at ₹19,996, will rise, but not beyond ₹20,500 within two months. The trader could:

- Buy a 20,000 call option for a premium of ₹365.

- Sell a 20,250 call option for a premium of ₹218.

The net outlay (or maximum loss) is ₹7,350(₹365 - ₹218) X 50 (lot size). If Nifty rises to ₹20250 or higher at expiration, the maximum profit of ₹103 per lot will be realized (₹250 difference between strikes - ₹147 net premium). Total profit would be ₹5,150 (₹103 X 50 (lot size)).

In conclusion, a Bull Call Spread is a popular strategy among options traders who have a moderately bullish outlook on a stock. It allows for profit from a moderate price increase while capping both potential profit and loss.

Other Strategies

Iron Condor

A strategy designed to profit from low volatility in the underlying asset, combining a bullish put credit spread and a bearish call credit spread to it.

Iron Butterfly

This is a strategy which profits from low volatility in the price of the underlying asset while minimizing risk.

Short Strangle

A short strangle is a non directional trading strategy where an investor sells an (OTM) call option and put option on the same underlying asset simultaneously.

Short Straddle

A Short straddle is considered neutral or non-directional because it profits from minimal price movement in the underlying asset.

Put Ratio Backspread

The Put Ratio Backspread strategy involves selling and buying put options in a specific ratio.

Bear Call Spread

A Bear Call Spread is an options trading strategy that's used when a trader believes the price of an underlying asset will go down, but not significantly.

Bear Put Spread

A Bear Put Spread is a type of vertical spread strategy used in options trading.

Long Put

Long Put option is the most basic & simplest strategy. It is recommended or implemented when we expect the underlying asset to show significant downside move.

Short Call

Short Call strategy is employed in a bearish or neutral market outlook, where the underlying asset's price is expected to remain stable or fall.

Call Ratio Backspread

The Call Ratio Backspread strategy involves selling and buying call options in a specific ratio.

Bull Put Spread

A Bull Put Spread is a type of vertical spread strategy used in options trading

Bull Call Spread

A Bull Call Spread is an options trading strategy that's used when a trader believes the price of an underlying asset will go up, but not significantly.

Short Put

Short Put strategy is employed in a bullish or neutral market outlook, where the investor believes that the underlying asset's price will remain stable or rise.

Long Call

Long Call option' is the most basic & simplest strategy. It is recommended or implemented when we expect the underlying asset to show significant upside move.

Don't let emotions take over your trades, take control now and become a tactical trader with 1lyOptions