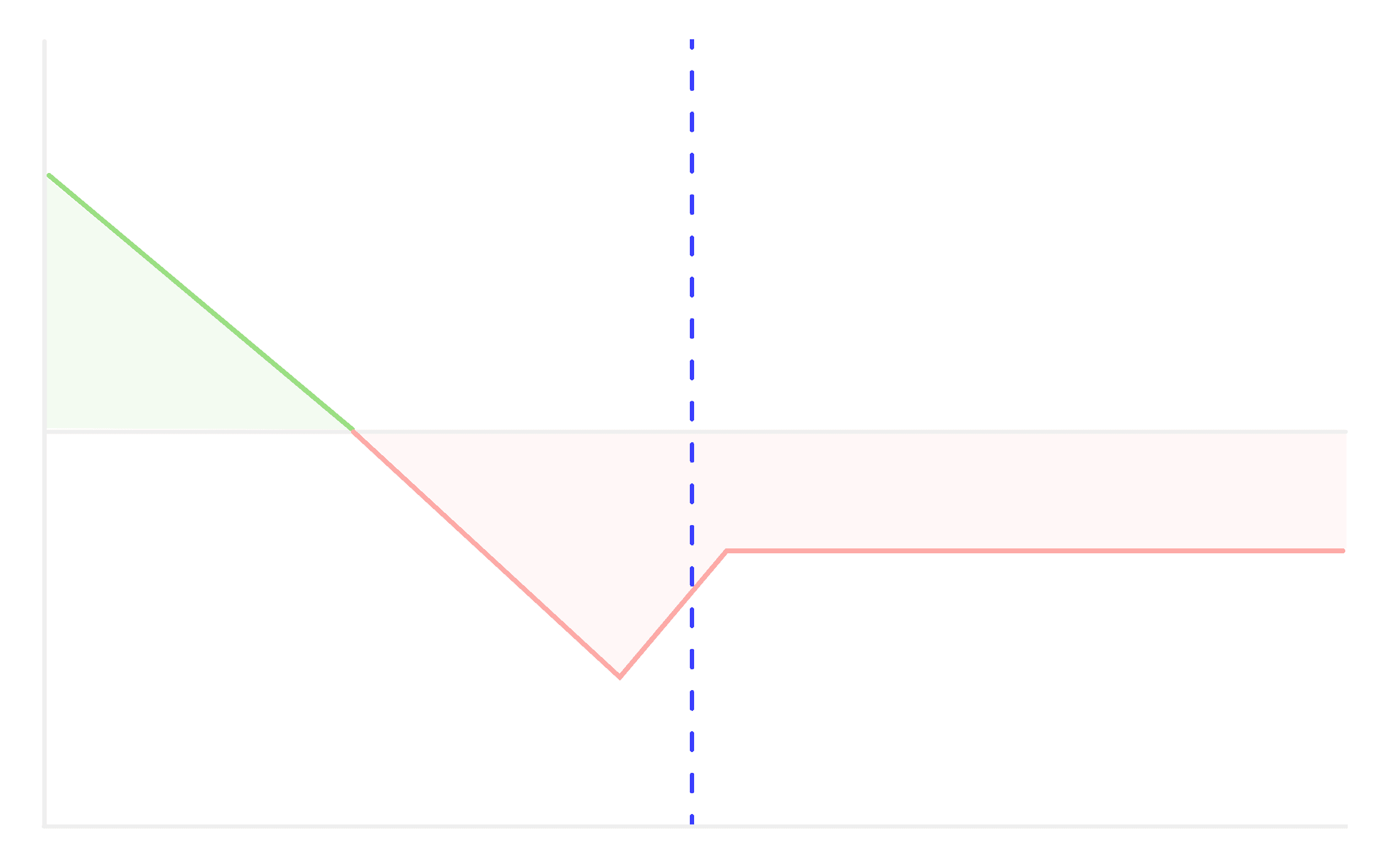

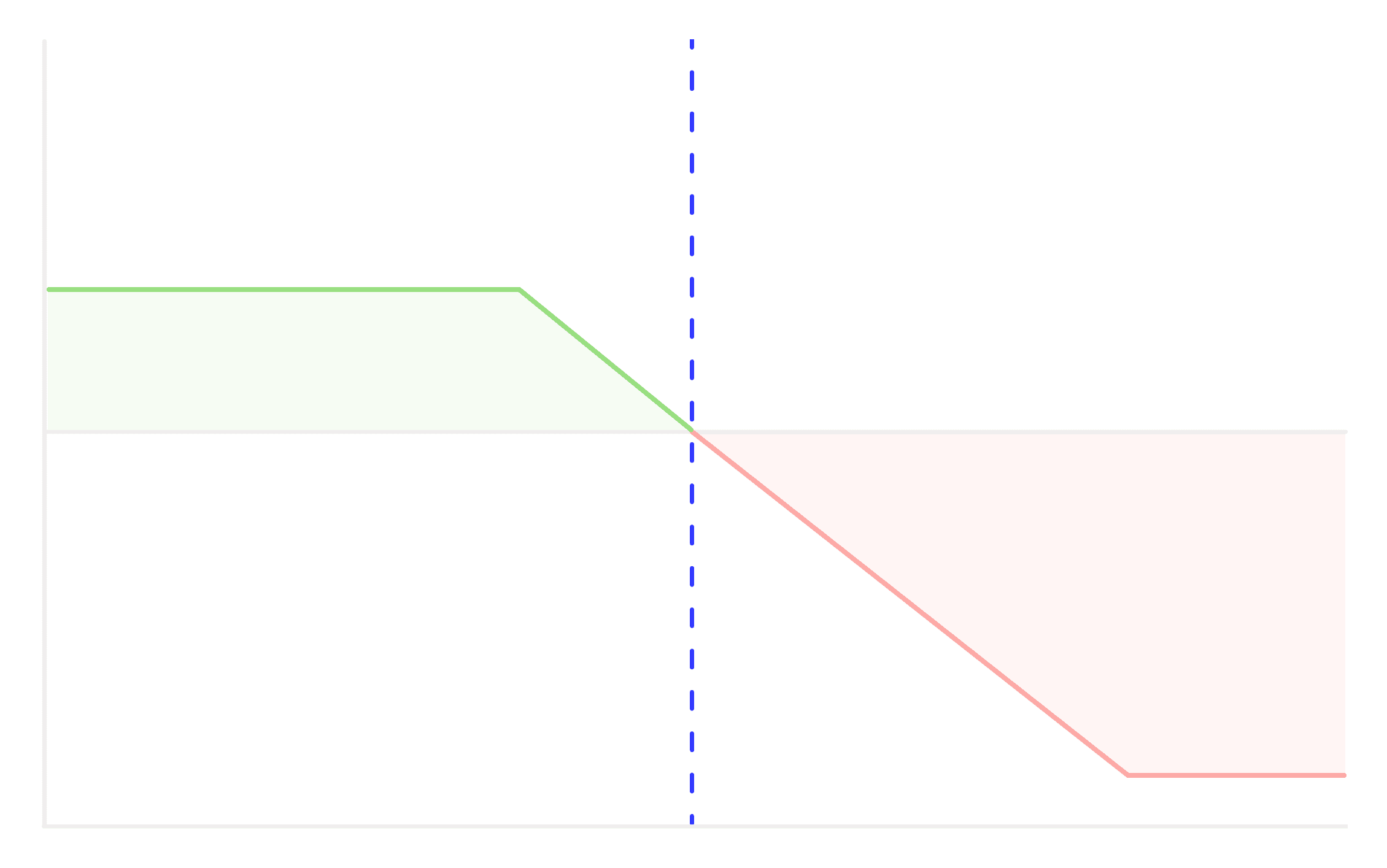

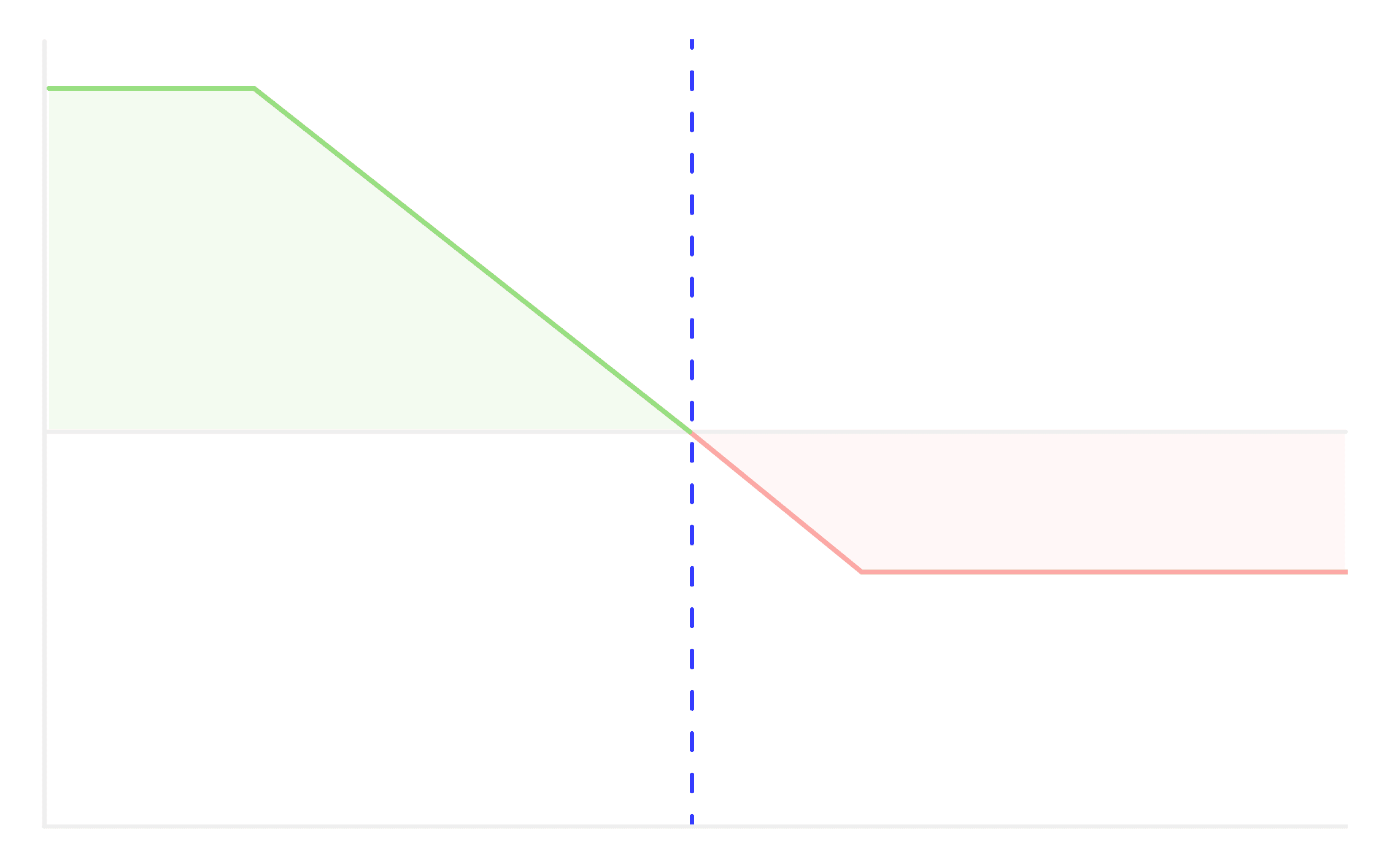

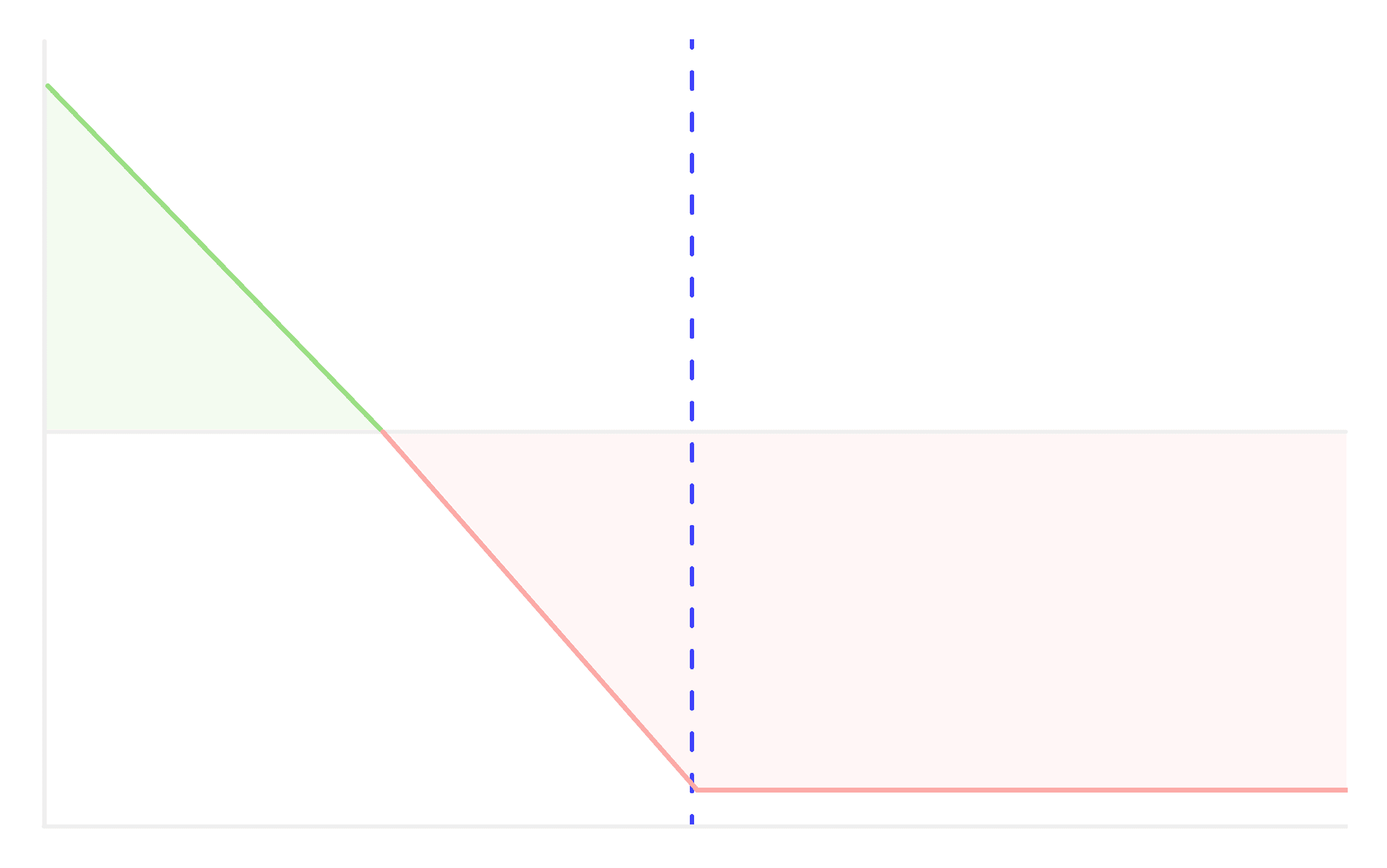

Long Call

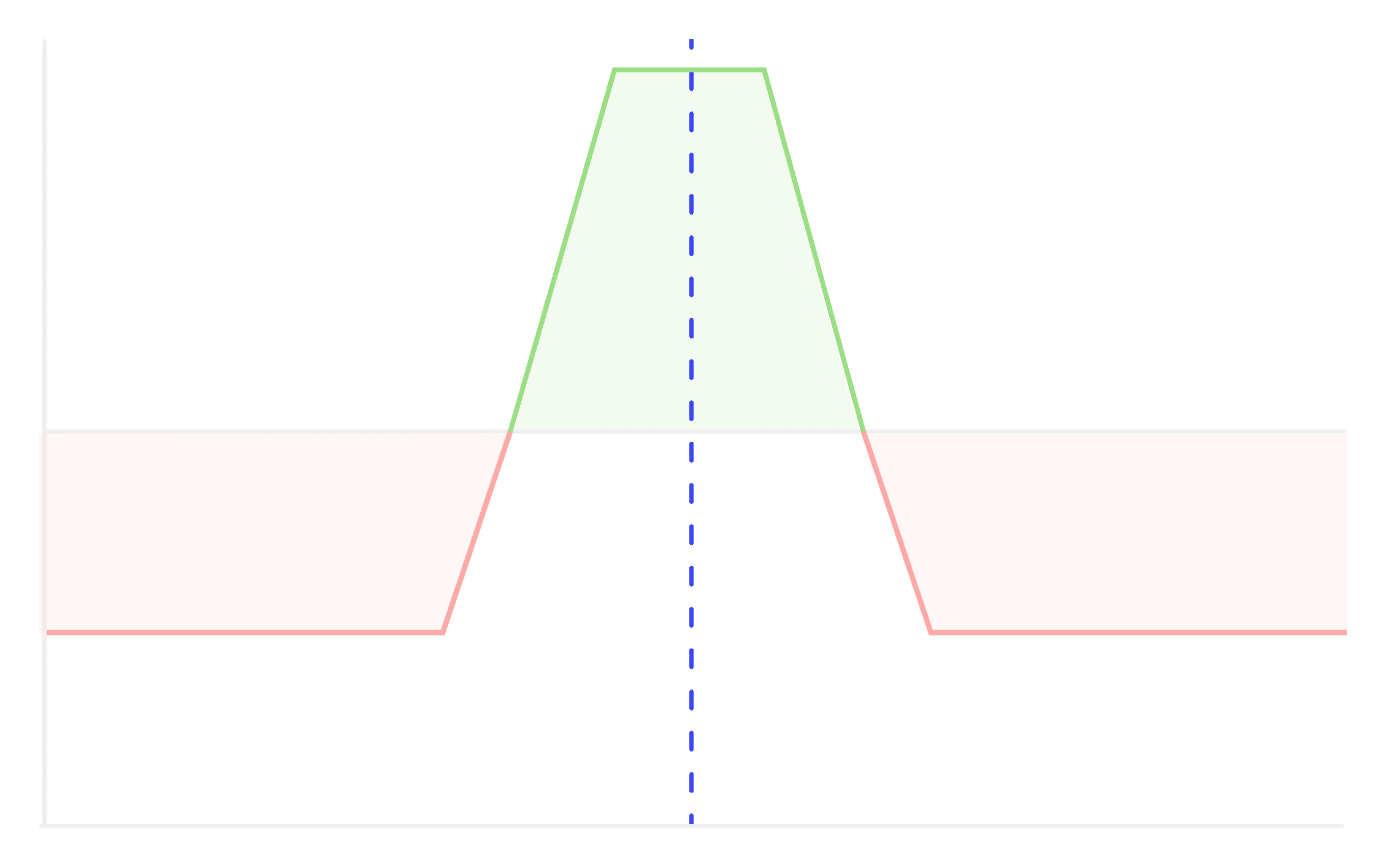

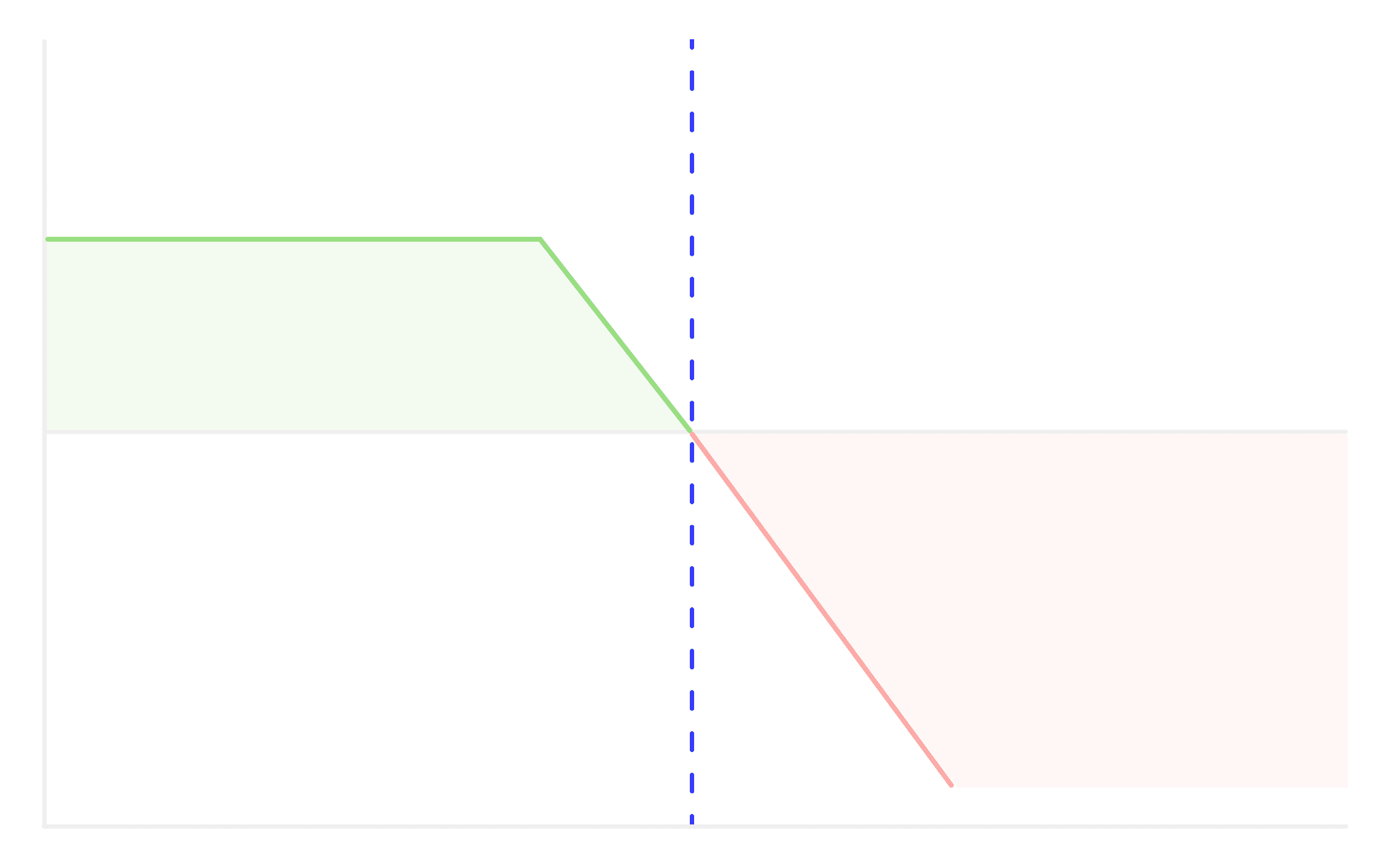

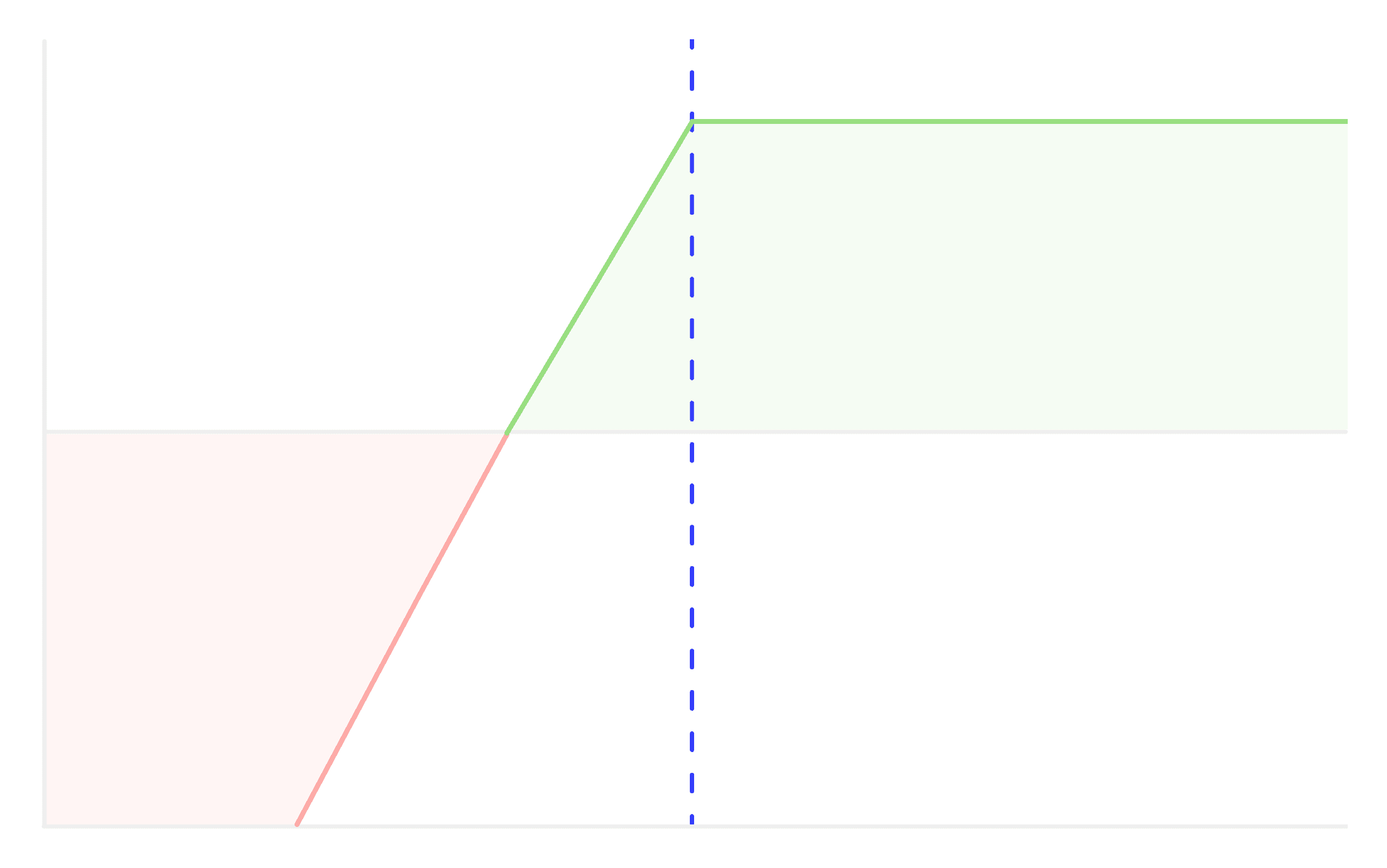

Long Call option' is the most basic & simplest strategy. It is recommended or implemented when we expect the underlying asset to show significant upside move.

A long call option is a popular bullish options strategy that gives the holder the right, but not the obligation, to buy an underlying asset at a predetermined strike price before the option's expiration date. This strategy is employed when you anticipate that the price of the underlying asset will rise, allowing you to profit from the potential price increase.

How It Works:

- Buy a Call Option: As the investor, you purchase a call option with a specified strike price and expiration date.

- Pay the Premium: To acquire this right, you pay a premium to the option seller.

- Profit Potential: If the price of the underlying asset rises above the strike price plus the premium paid, you can profit from the price difference. Your potential profit is theoretically unlimited.

Example: Let's say you believe that Nifty, currently trading at ₹19,996, will rise in value. You buy a call option with a strike price of ₹20,000 for a premium of ₹365 per share, and the option has an expiration date of 2 months. If the price of Nifty Index rises to ₹20,500 at the option expiry, you can exercise your call option at the strike price of ₹20,000. Your profit would be ₹20,500 (current stock price) - ₹20,000 (strike price) - ₹365 (premium paid) = ₹135 per share. Nifty has lot size of 50, hence your total profit would be ₹6,750.

Key Points:

- Long call options offer the potential for significant profit if the underlying asset's price rises.

- Your risk is limited to the premium paid for the call option. If the asset's price does not rise above the strike price, you may lose the premium.

- You are not obligated to exercise the option; you can let it expire if it's not profitable.

- Timing is crucial, as the option has an expiration date. If the price does not rise sufficiently before expiration, the option may expire worthless.

In summary, a long call option is a bullish strategy that allows you to benefit from anticipated price increases in the underlying asset. It provides potential for profit while limiting your risk to the premium paid for the option. However, like all options strategies, it's essential to thoroughly understand the mechanics and risks involved before implementing it in your trading or investment portfolio.

Other Strategies

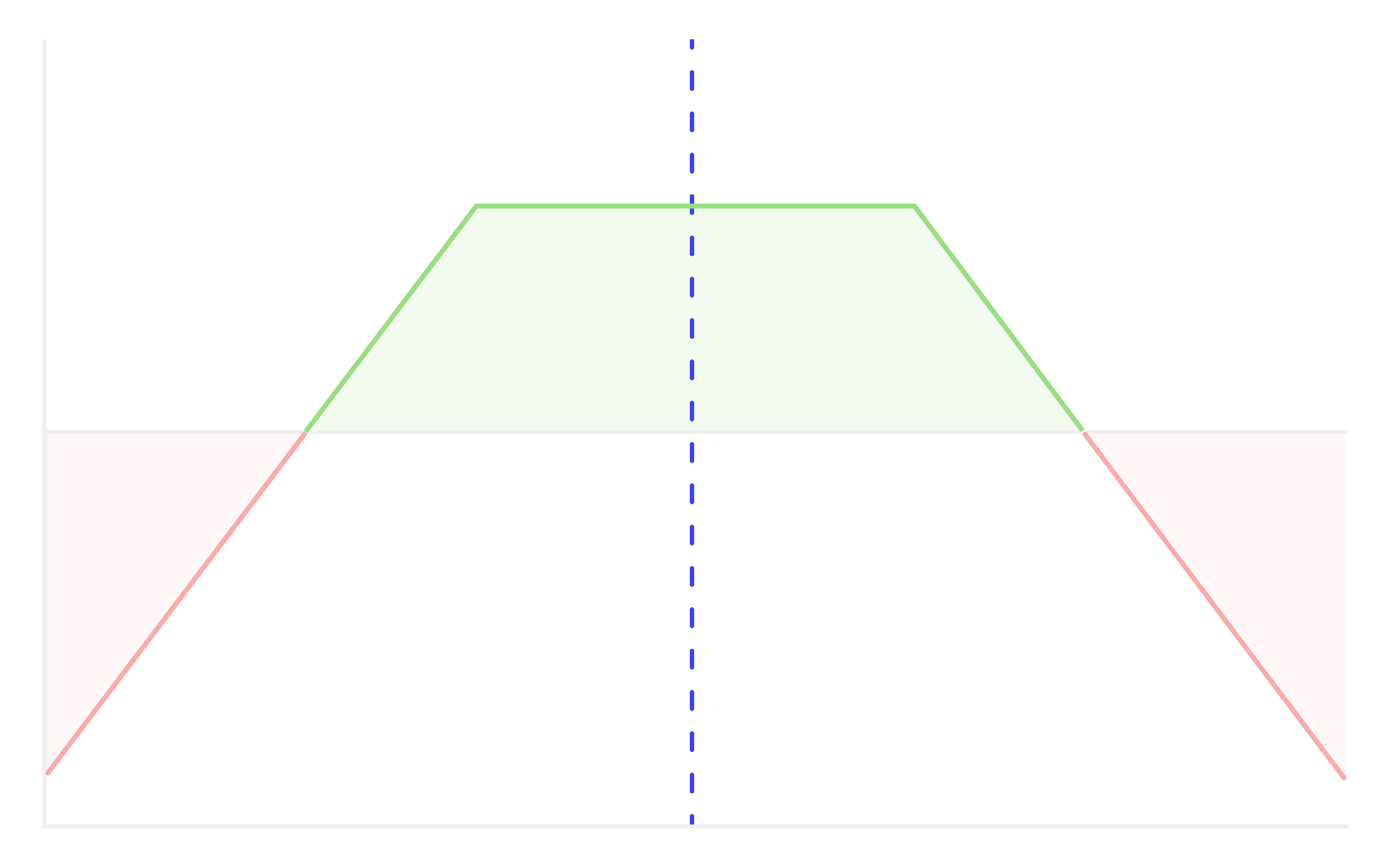

Iron Condor

A strategy designed to profit from low volatility in the underlying asset, combining a bullish put credit spread and a bearish call credit spread to it.

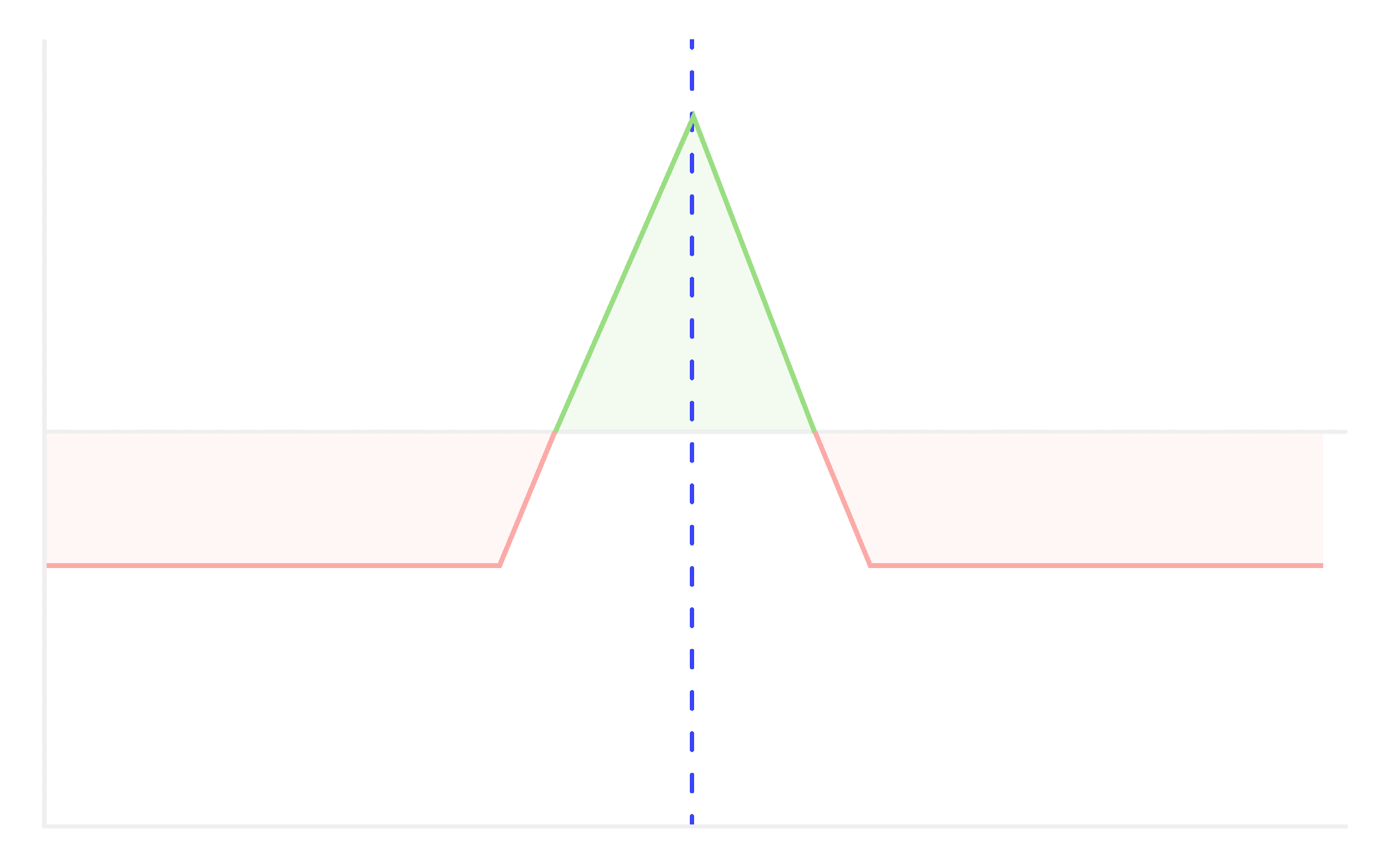

Iron Butterfly

This is a strategy which profits from low volatility in the price of the underlying asset while minimizing risk.

Short Strangle

A short strangle is a non directional trading strategy where an investor sells an (OTM) call option and put option on the same underlying asset simultaneously.

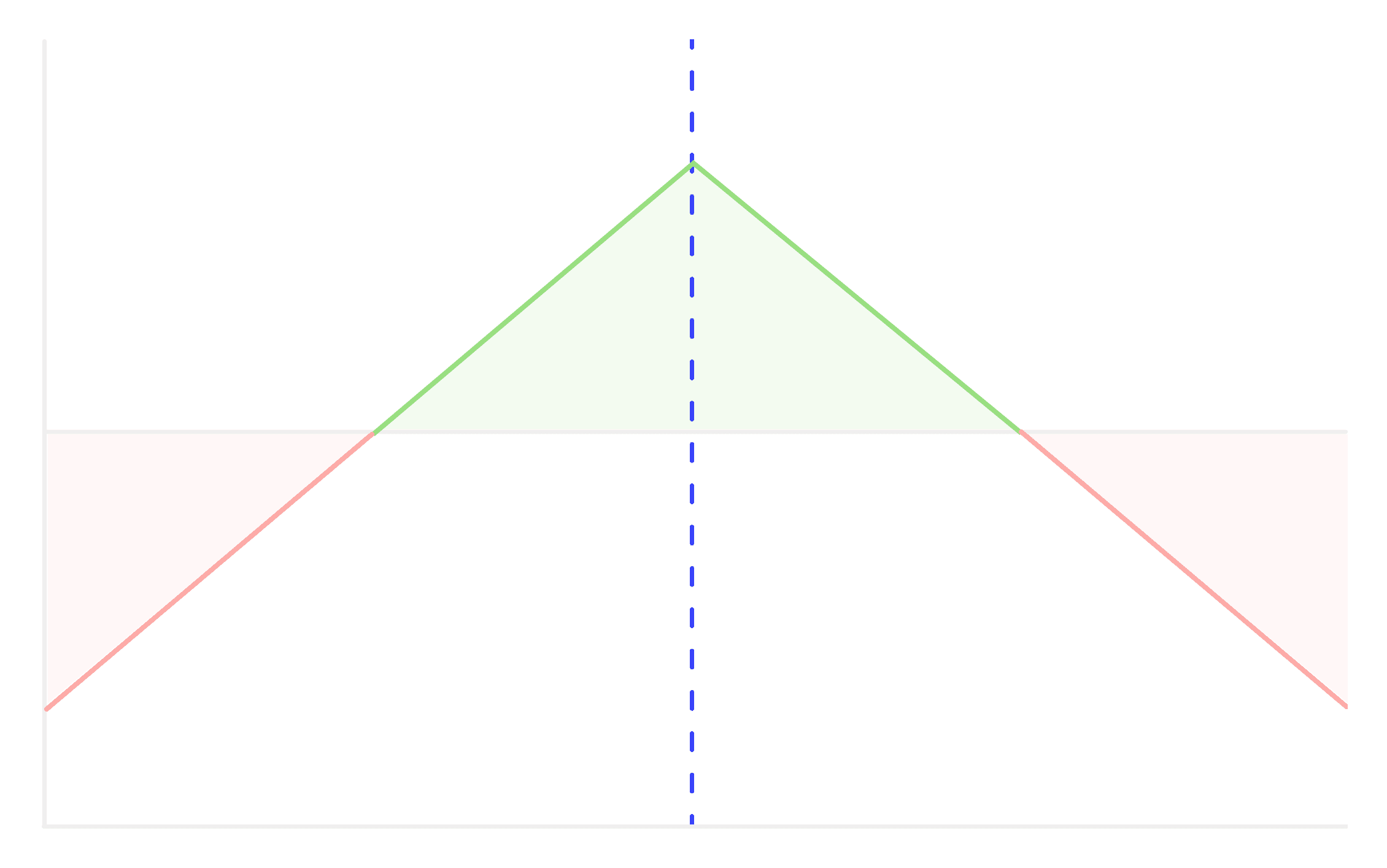

Short Straddle

A Short straddle is considered neutral or non-directional because it profits from minimal price movement in the underlying asset.

Put Ratio Backspread

The Put Ratio Backspread strategy involves selling and buying put options in a specific ratio.

Bear Call Spread

A Bear Call Spread is an options trading strategy that's used when a trader believes the price of an underlying asset will go down, but not significantly.

Bear Put Spread

A Bear Put Spread is a type of vertical spread strategy used in options trading.

Long Put

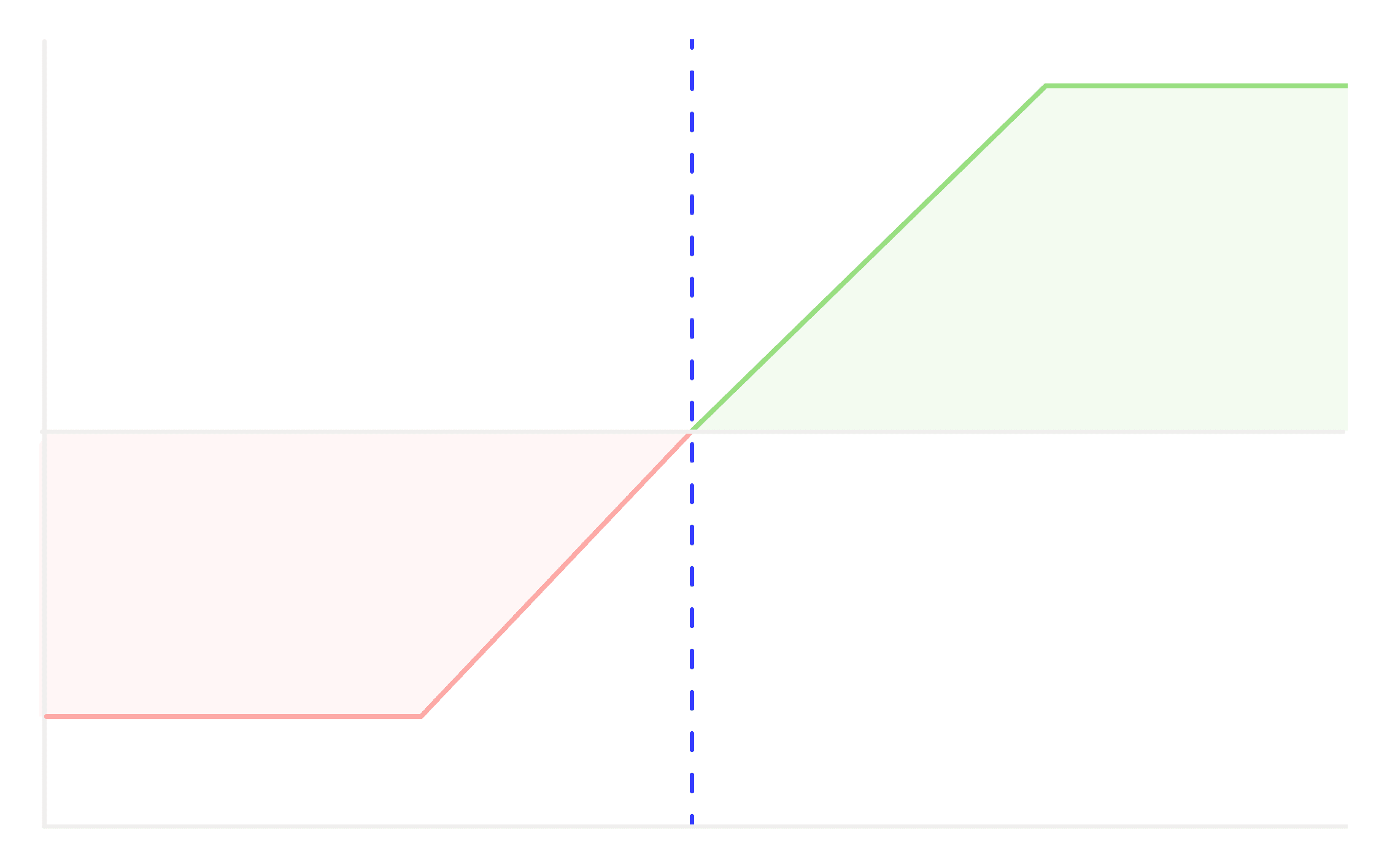

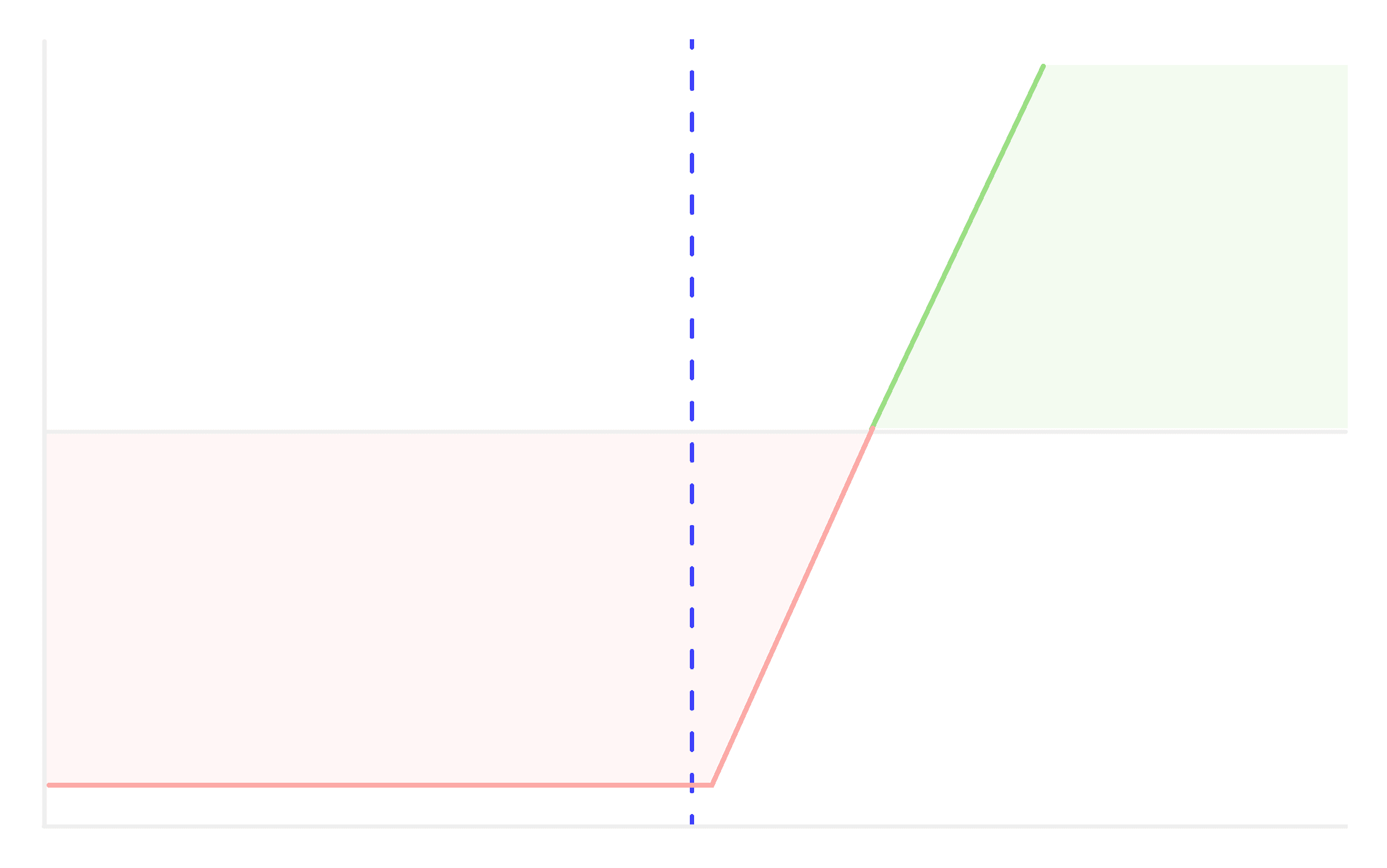

Long Put option is the most basic & simplest strategy. It is recommended or implemented when we expect the underlying asset to show significant downside move.

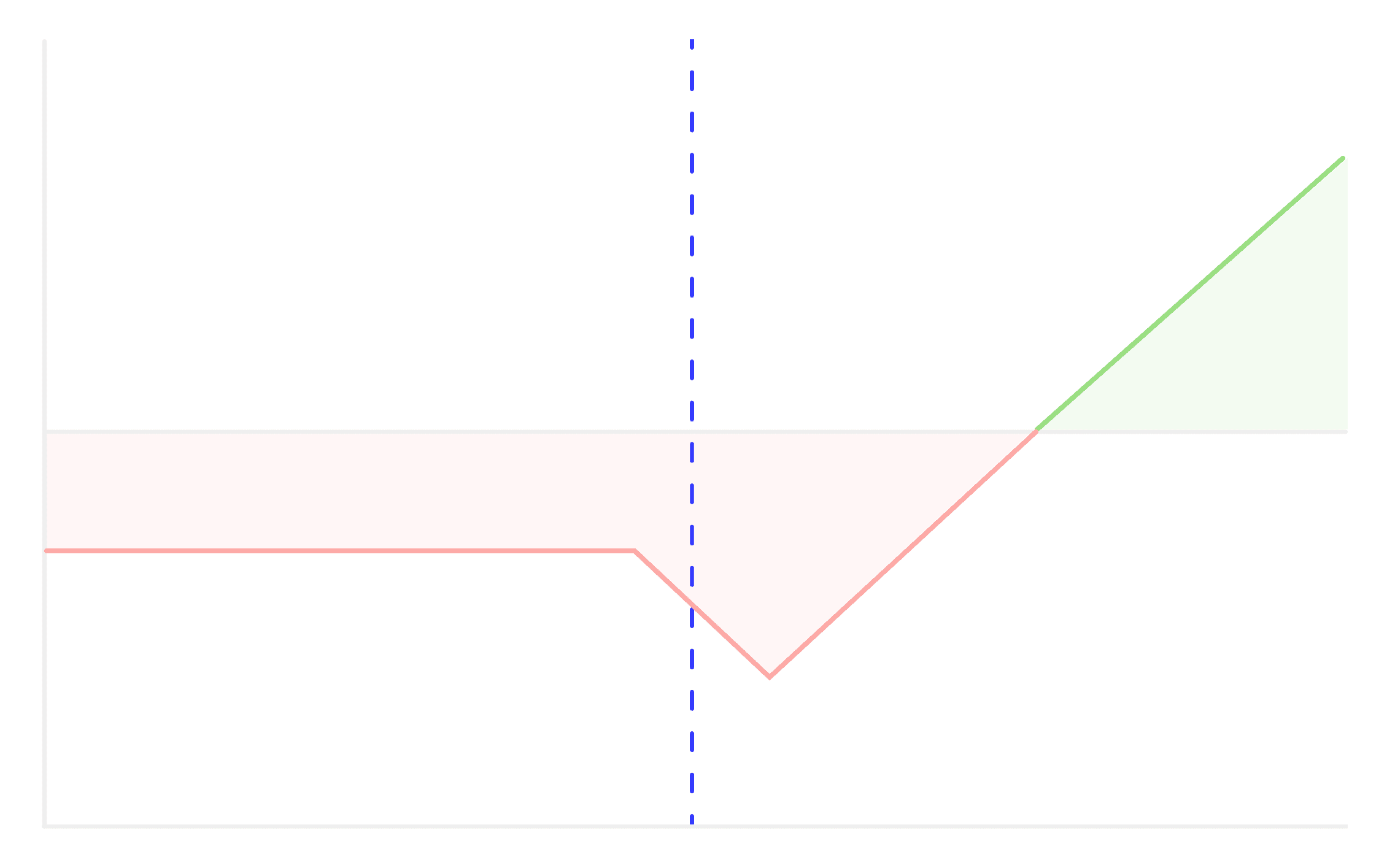

Short Call

Short Call strategy is employed in a bearish or neutral market outlook, where the underlying asset's price is expected to remain stable or fall.

Call Ratio Backspread

The Call Ratio Backspread strategy involves selling and buying call options in a specific ratio.

Bull Put Spread

A Bull Put Spread is a type of vertical spread strategy used in options trading

Bull Call Spread

A Bull Call Spread is an options trading strategy that's used when a trader believes the price of an underlying asset will go up, but not significantly.

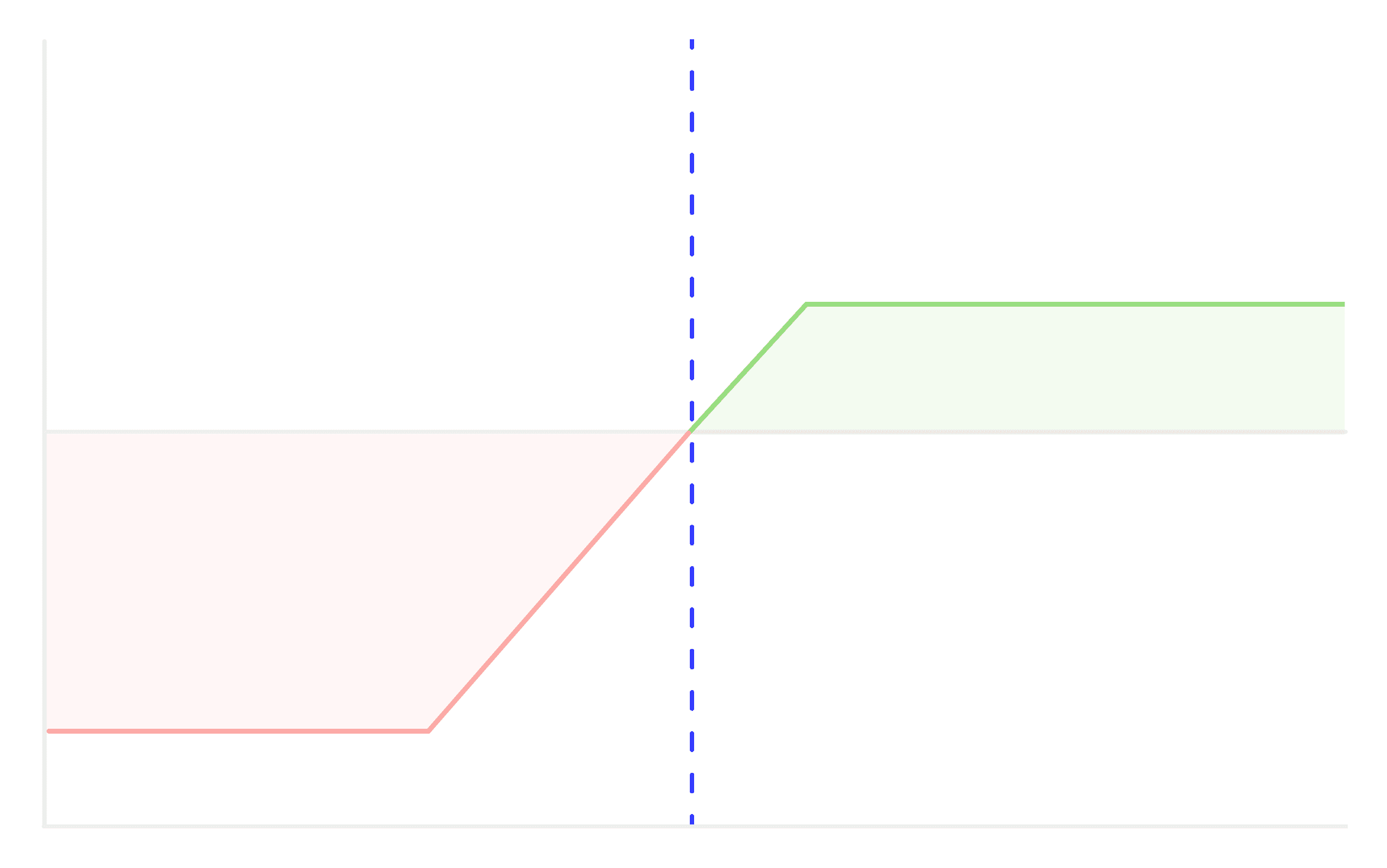

Short Put

Short Put strategy is employed in a bullish or neutral market outlook, where the investor believes that the underlying asset's price will remain stable or rise.

Long Call

Long Call option' is the most basic & simplest strategy. It is recommended or implemented when we expect the underlying asset to show significant upside move.

Don't let emotions take over your trades, take control now and become a tactical trader with 1lyOptions