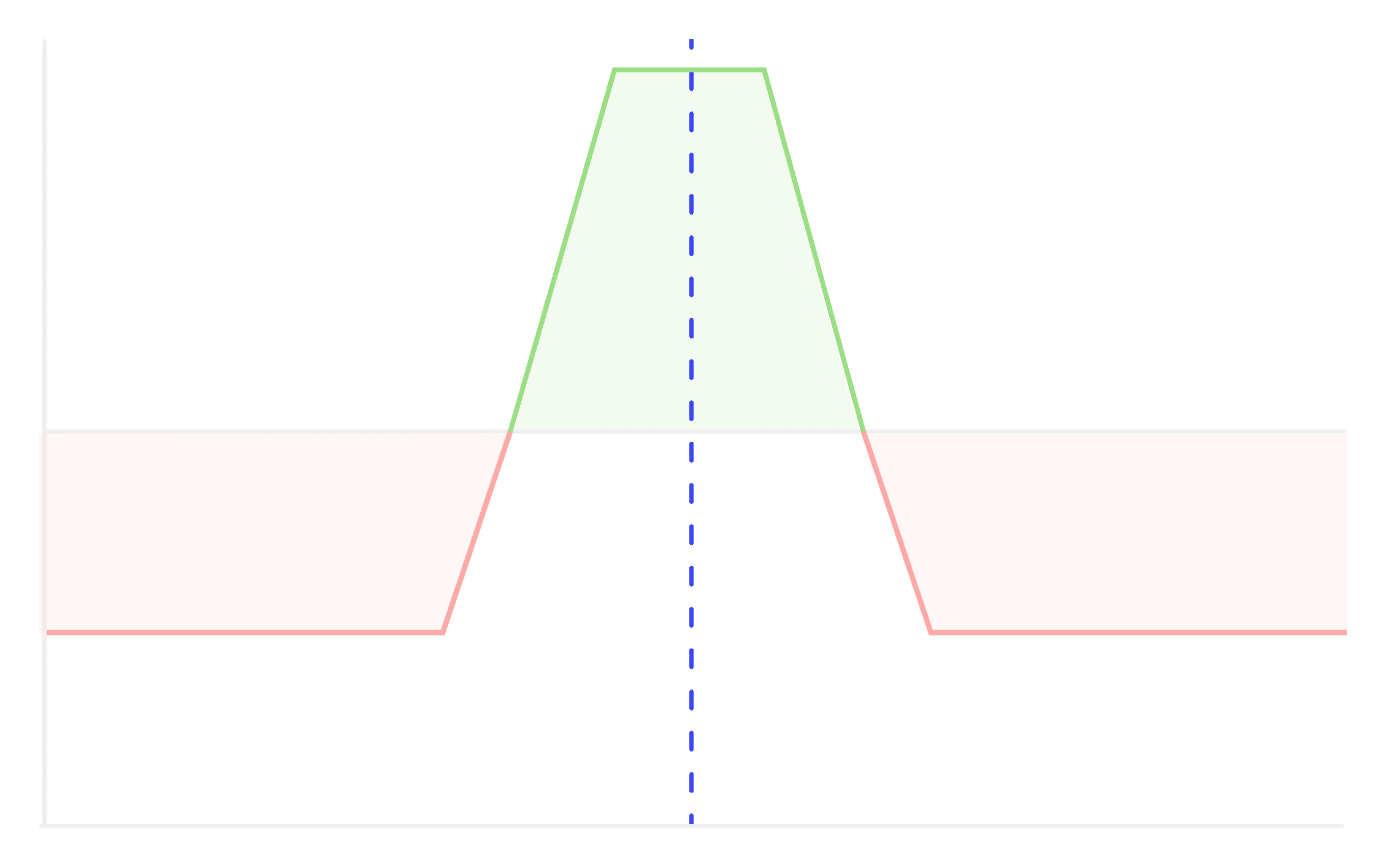

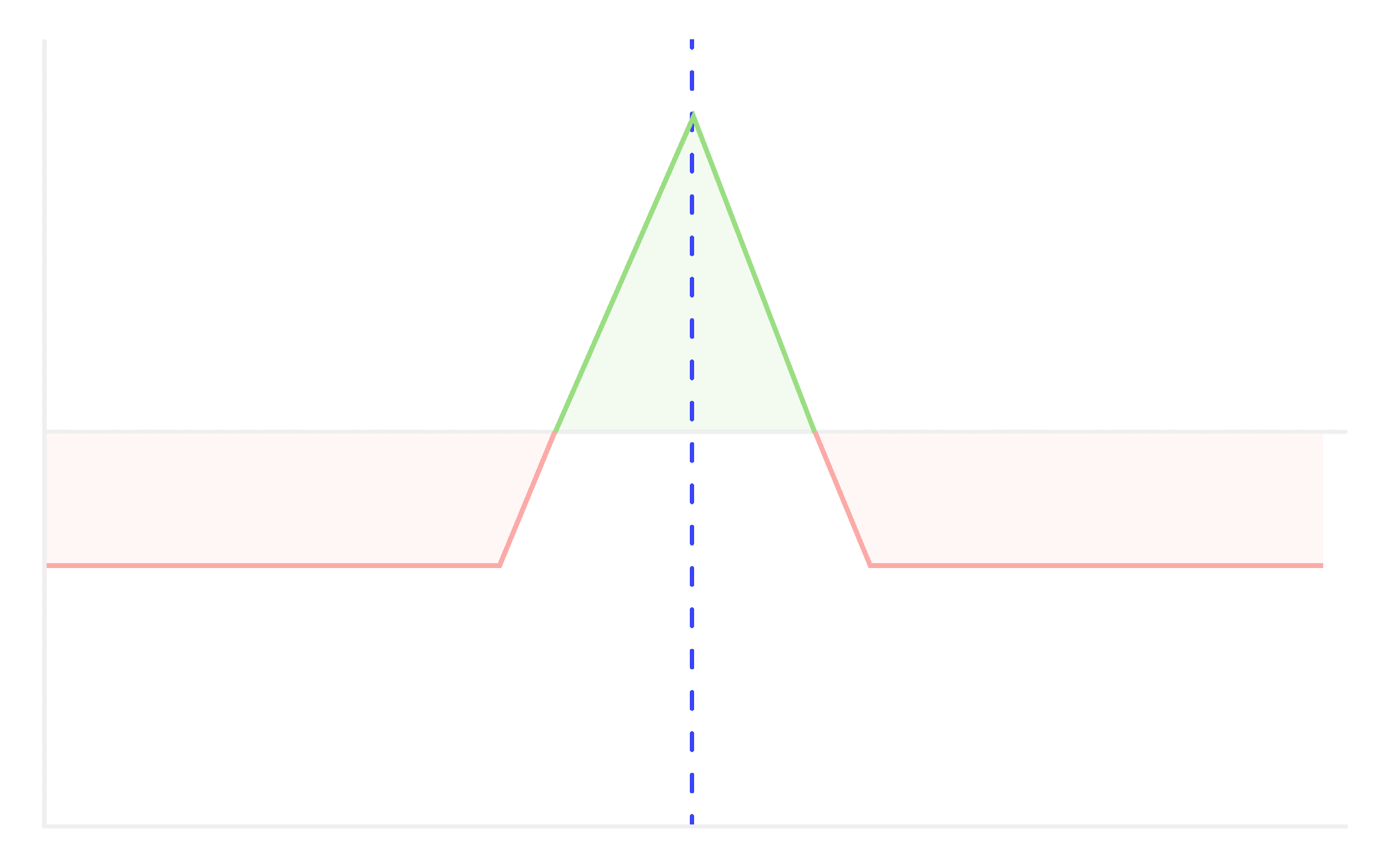

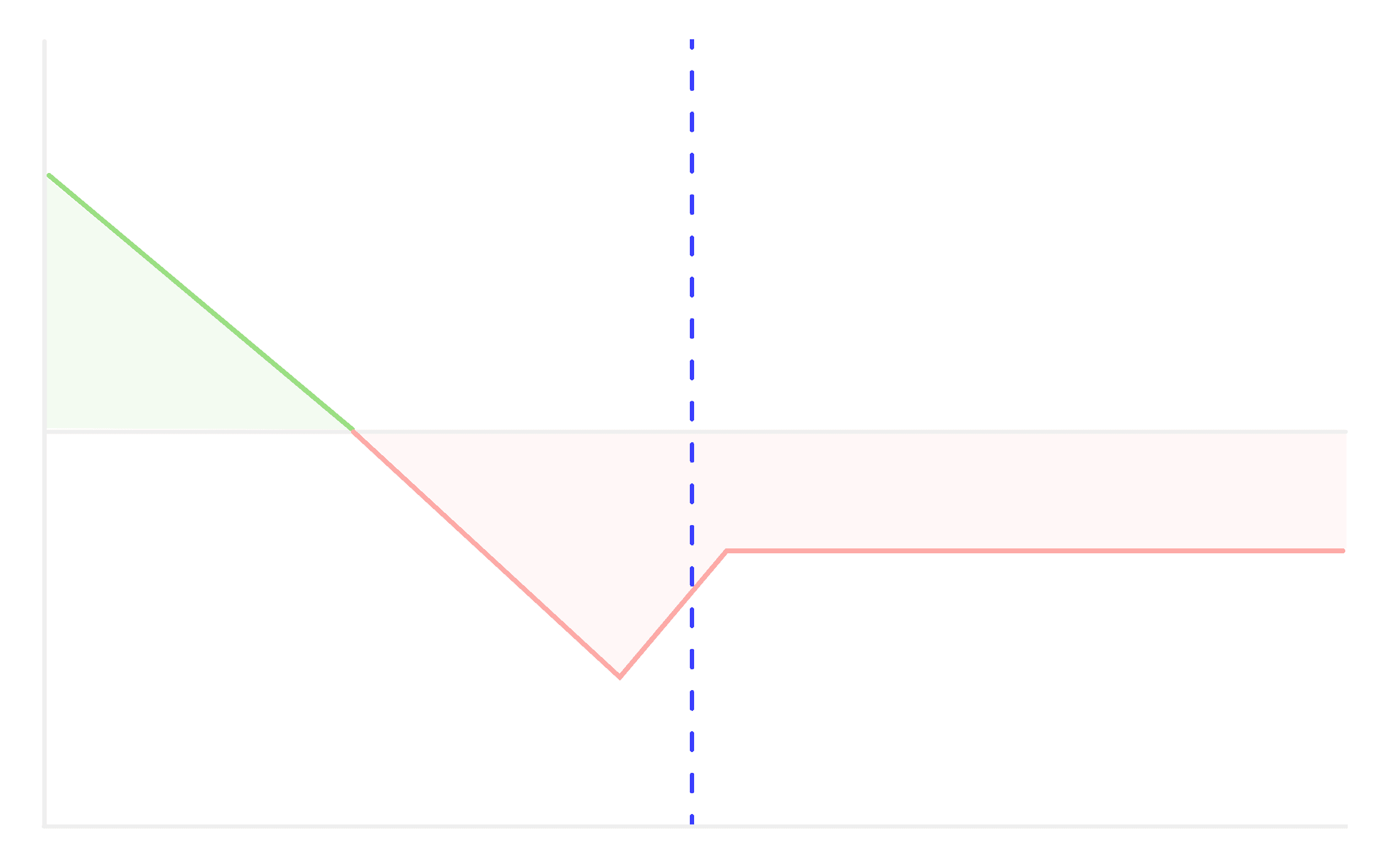

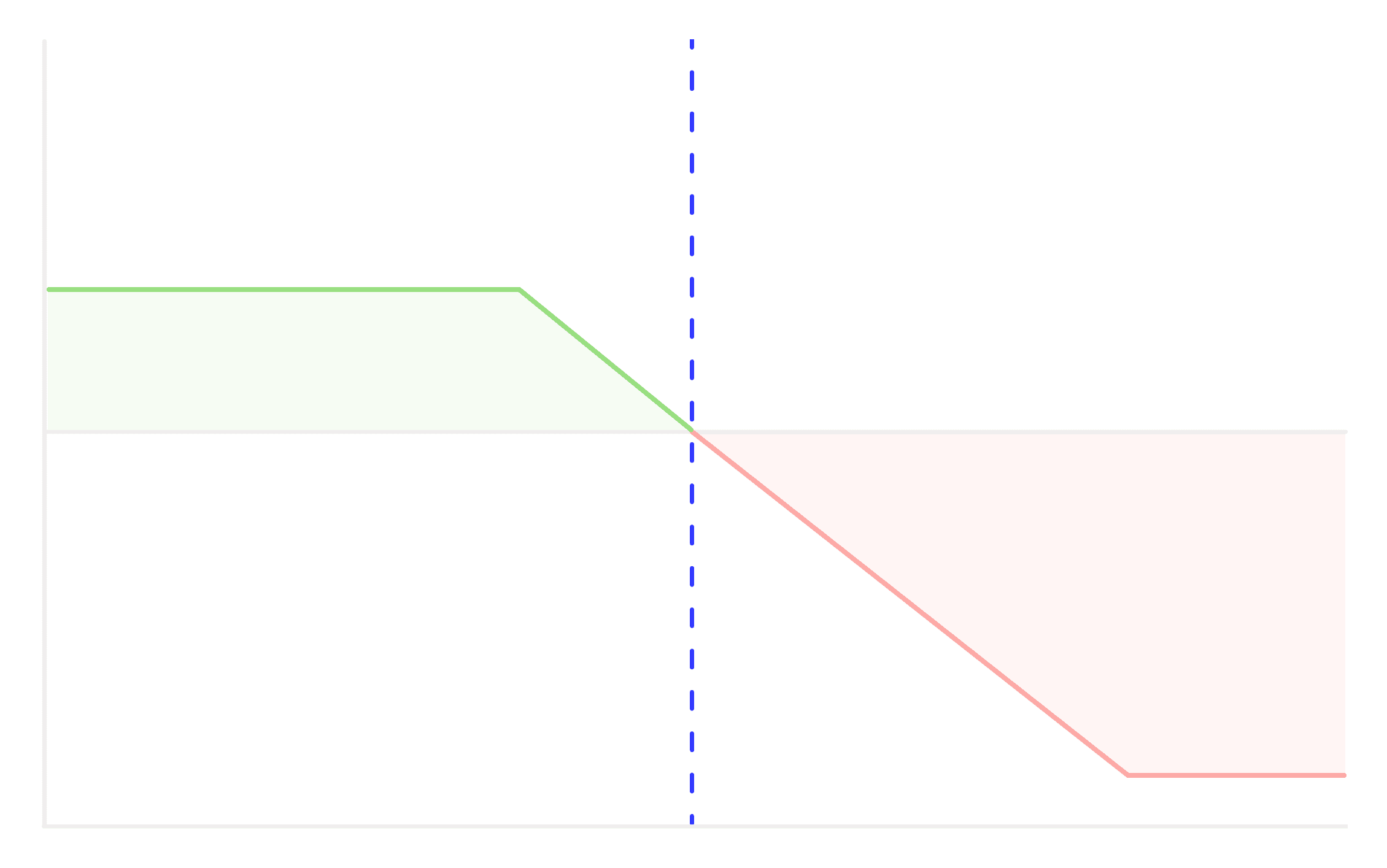

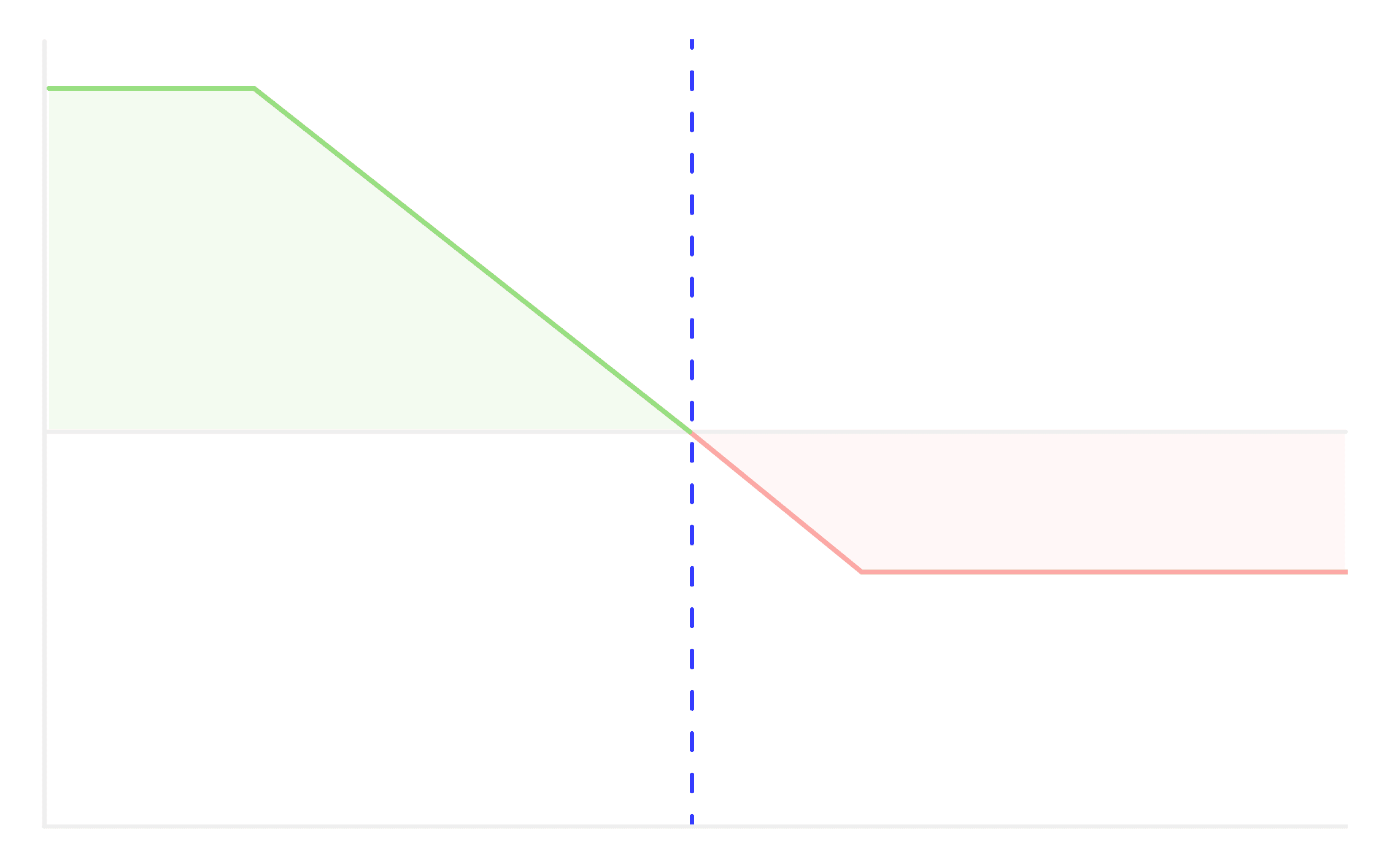

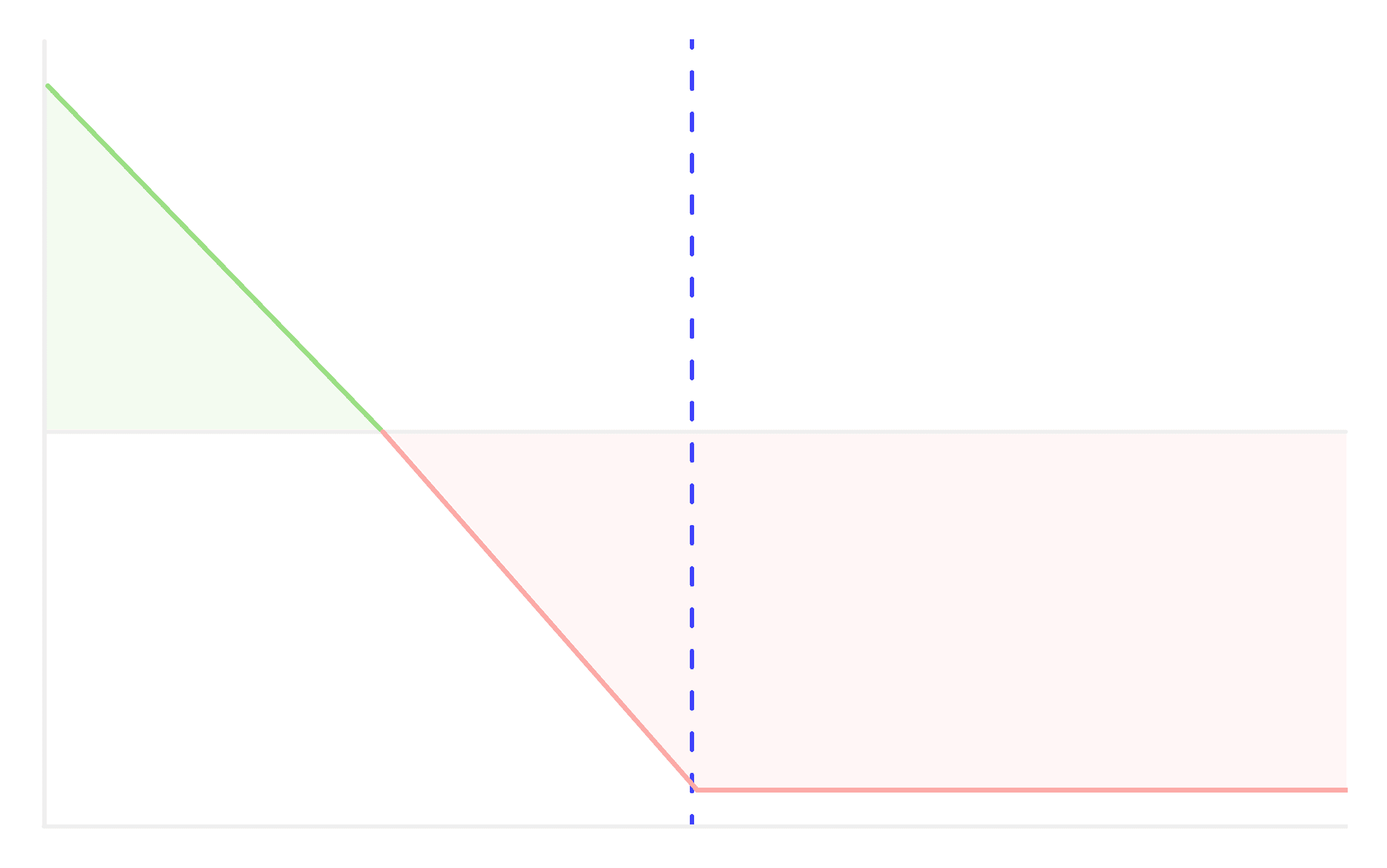

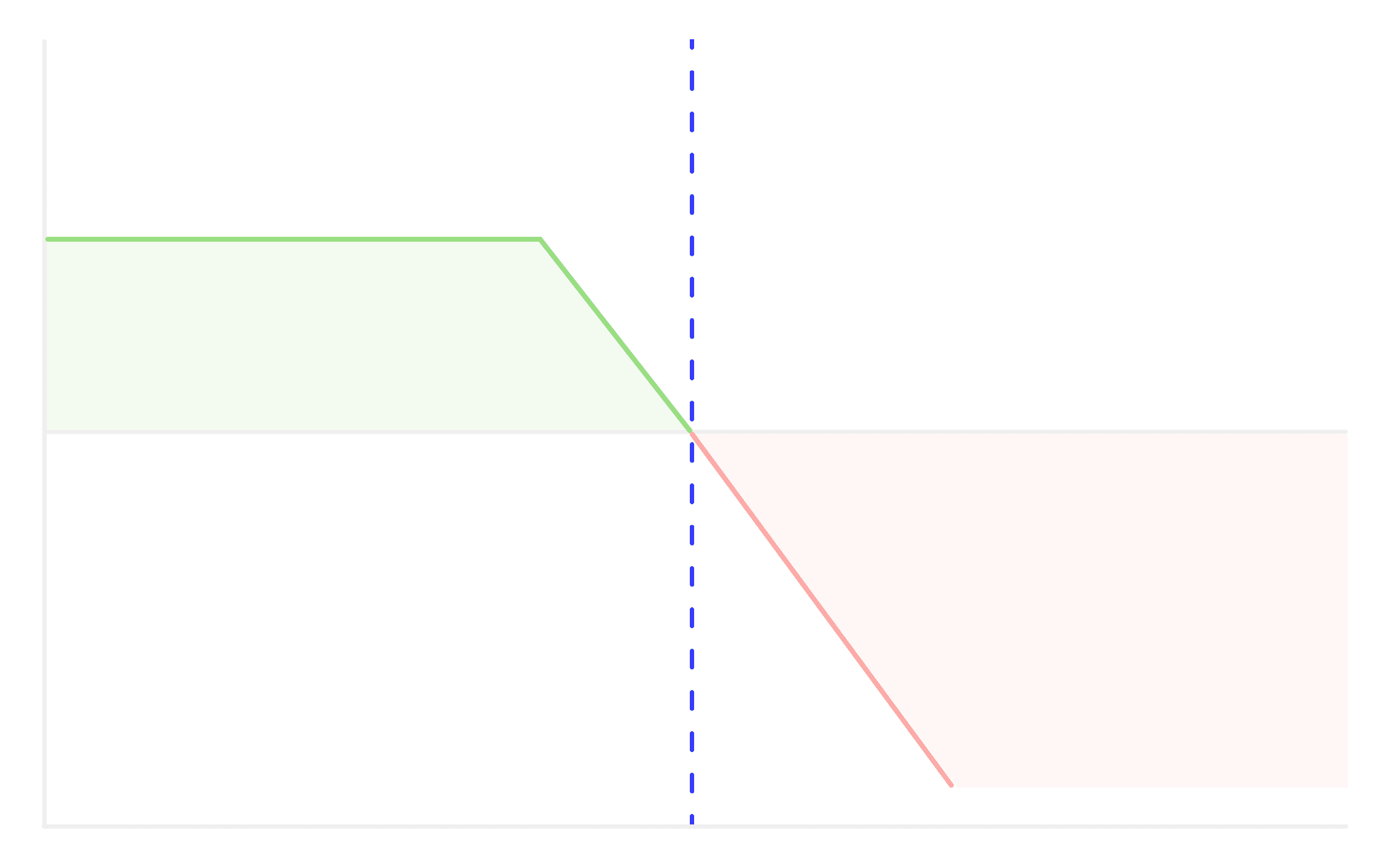

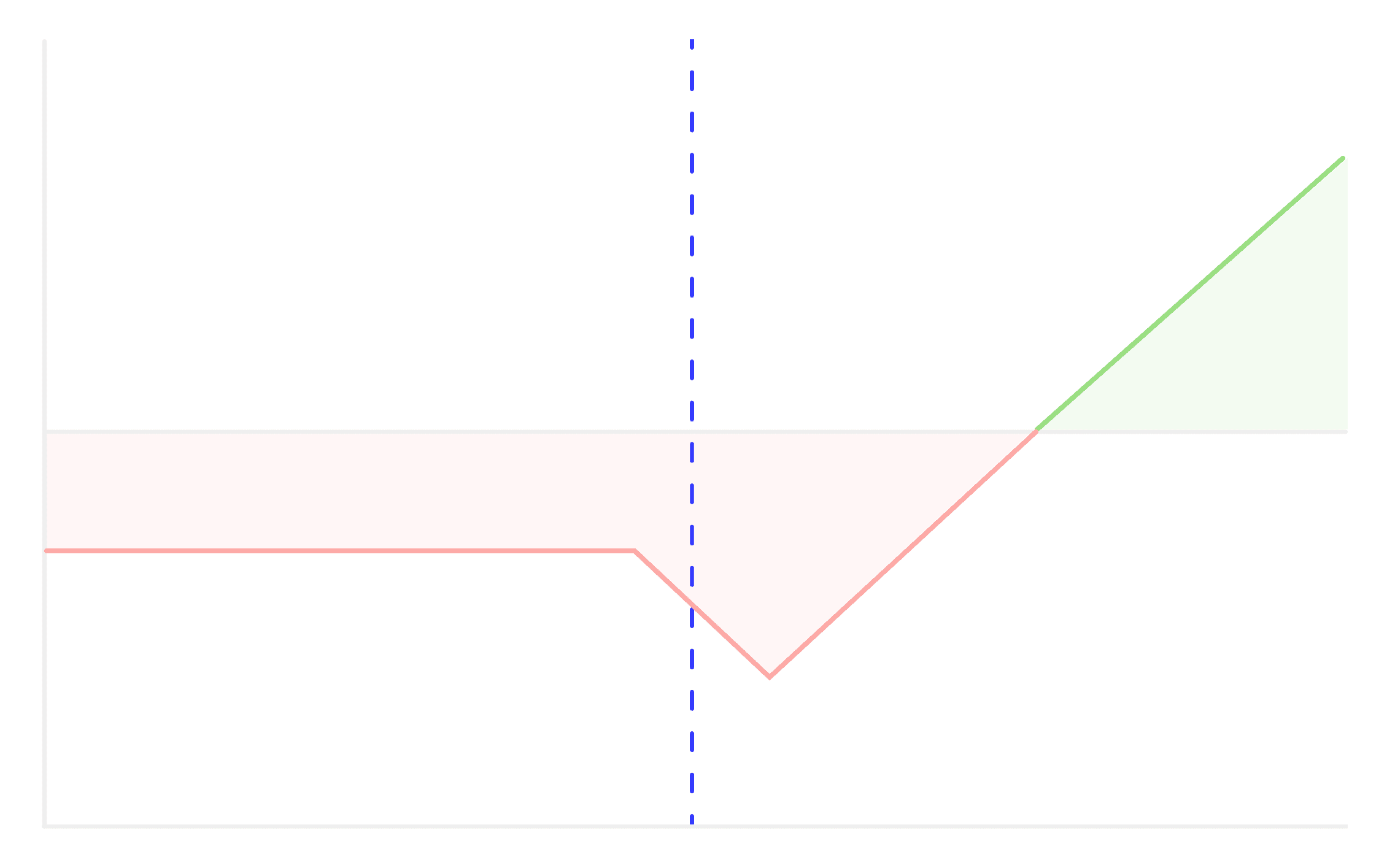

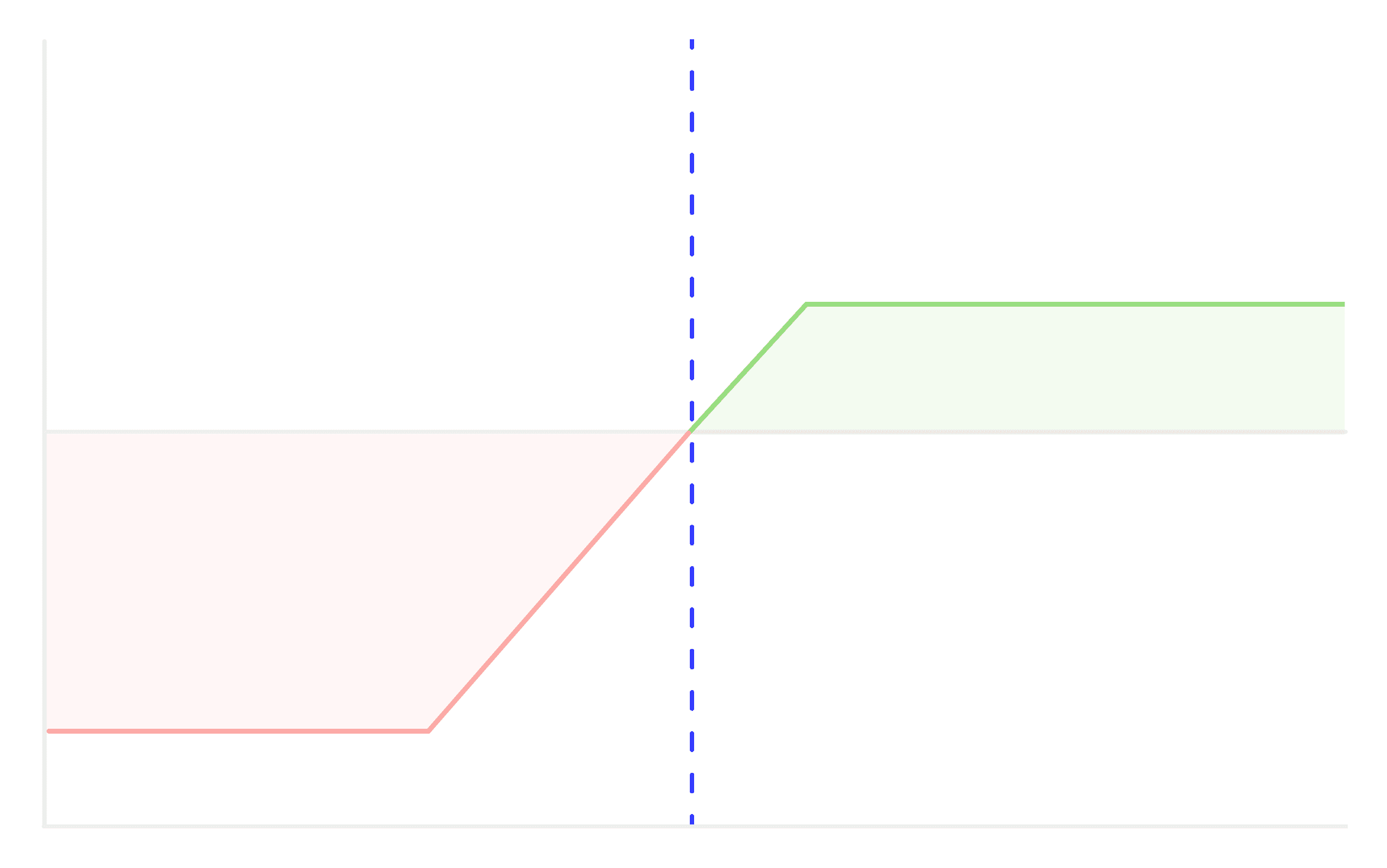

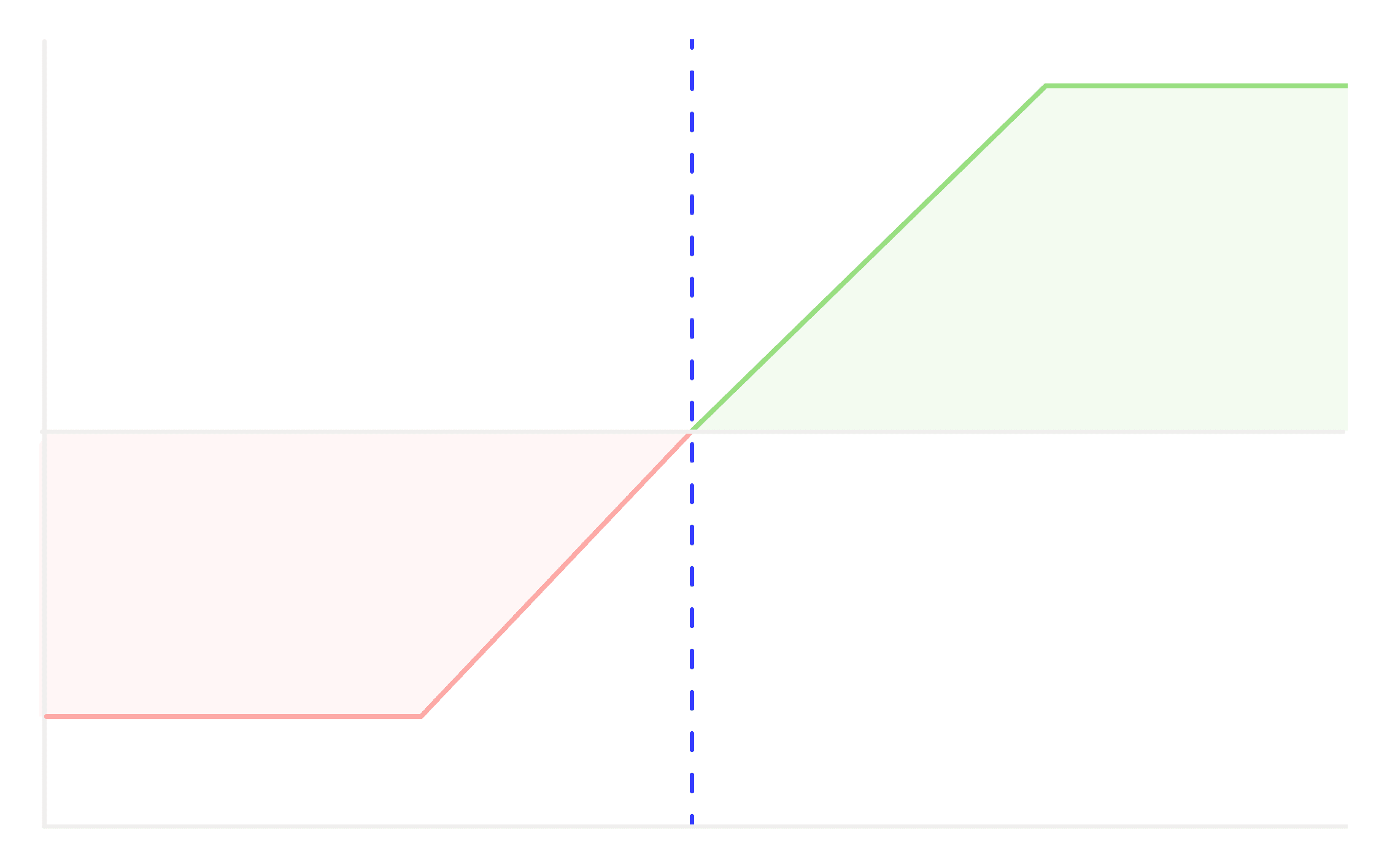

Short Put

Short Put strategy is employed in a bullish or neutral market outlook, where the investor believes that the underlying asset's price will remain stable or rise.

The selling of naked put options is an options trading strategy where an investor sells put options on a particular underlying asset without holding a corresponding short position in the underlying asset. This strategy is employed in a bullish or neutral market outlook, where the investor believes that the underlying asset's price will remain stable or rise.

How It Works:

- Select an Underlying Asset: The trader selects a specific underlying asset, such as a stock, ETF, or index, on which they are willing to sell put options.

- Sell Put Options: The investor then sells (writes) put options with a specific strike price and expiration date. By doing this, they receive a premium from the buyer of the put option.

- Obligation to Buy: When you sell a naked put option, you are essentially taking on the obligation to buy the underlying asset at the strike price if the option buyer decides to exercise the option. This means you should be comfortable with the idea of owning the asset at that strike price. In the Indian market, all the options that are In The Money (ITM) at the expiry would be physically settled by delivery of the stocks. All OTM and Index Options are cash-settled.

Key Points:

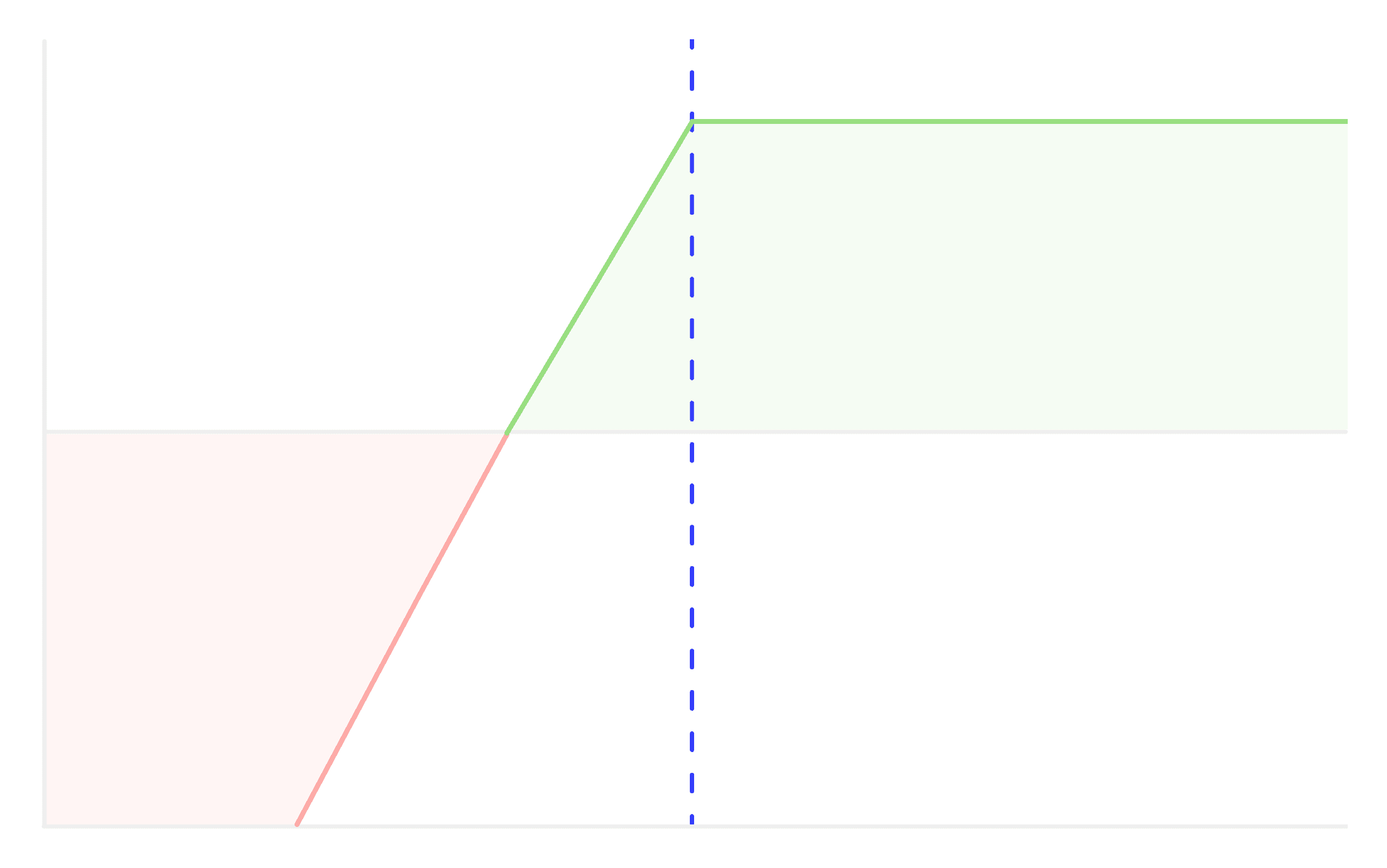

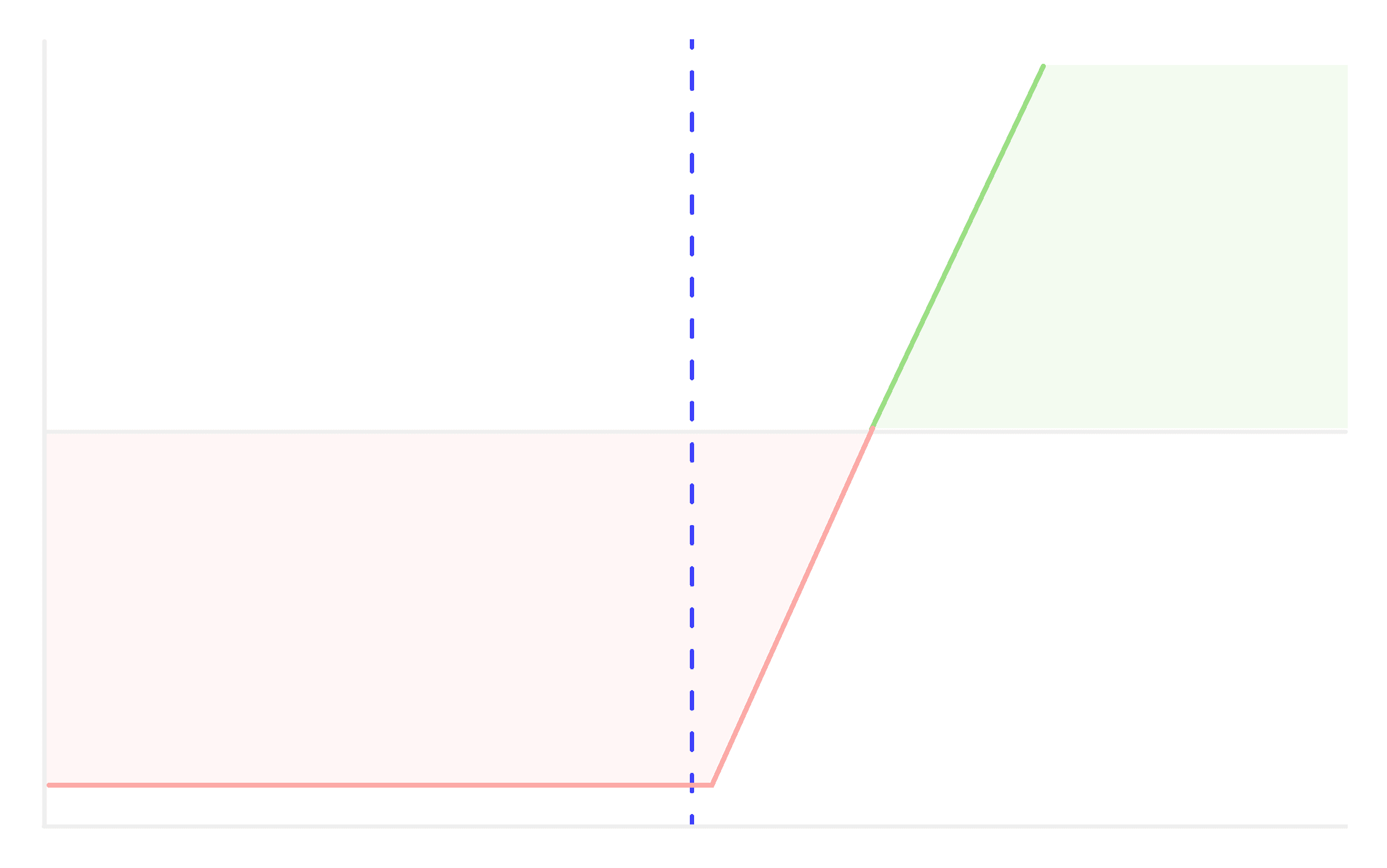

- Profit Mechanism: The seller of a naked put option profits when the price of the underlying asset remains above the strike price, allowing the put option to expire worthless. In this case, the seller keeps the premium received.

- Limited Profit: The profit potential is limited to the premium received from selling the put option. The maximum profit occurs when the put option expires worthless, and the seller doesn't have to buy the underlying asset.

- Limited Risk: While the profit potential is limited, the risk in this strategy is theoretically unlimited. If the price of the underlying asset falls significantly, the seller may be required to buy the asset at the higher strike price, potentially resulting in a loss.

- Margin Requirements: Brokers often require a margin deposit to cover potential losses in case the put option is exercised. These margin requirements can tie up capital.

- Suitable Market Conditions: Selling naked puts is generally considered in a stable or bullish market where the investor is comfortable owning the underlying asset at the strike price.

- Risk Management: Traders often set stop-loss orders or have a plan to buy the underlying asset if the price approaches the strike price to limit potential losses.

Selling naked puts can be a strategy to generate income through option premiums, but it requires a solid understanding of options, careful stock selection, and risk management. It's important to weigh the potential profit against the risk and be prepared for the possibility of buying the underlying asset if the market moves against your position. Consider consulting with a financial advisor or options expert before implementing this strategy.

Other Strategies

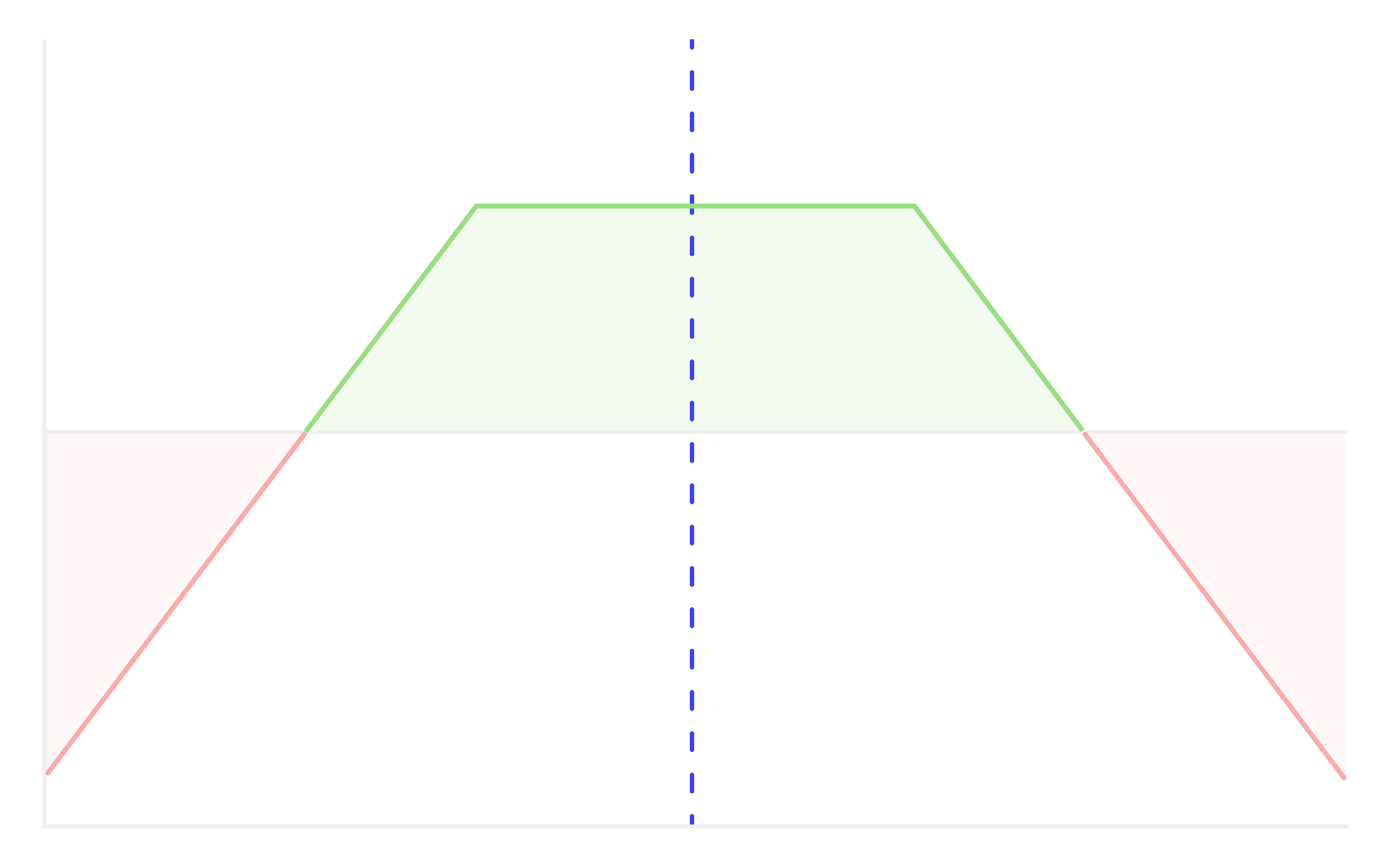

Iron Condor

A strategy designed to profit from low volatility in the underlying asset, combining a bullish put credit spread and a bearish call credit spread to it.

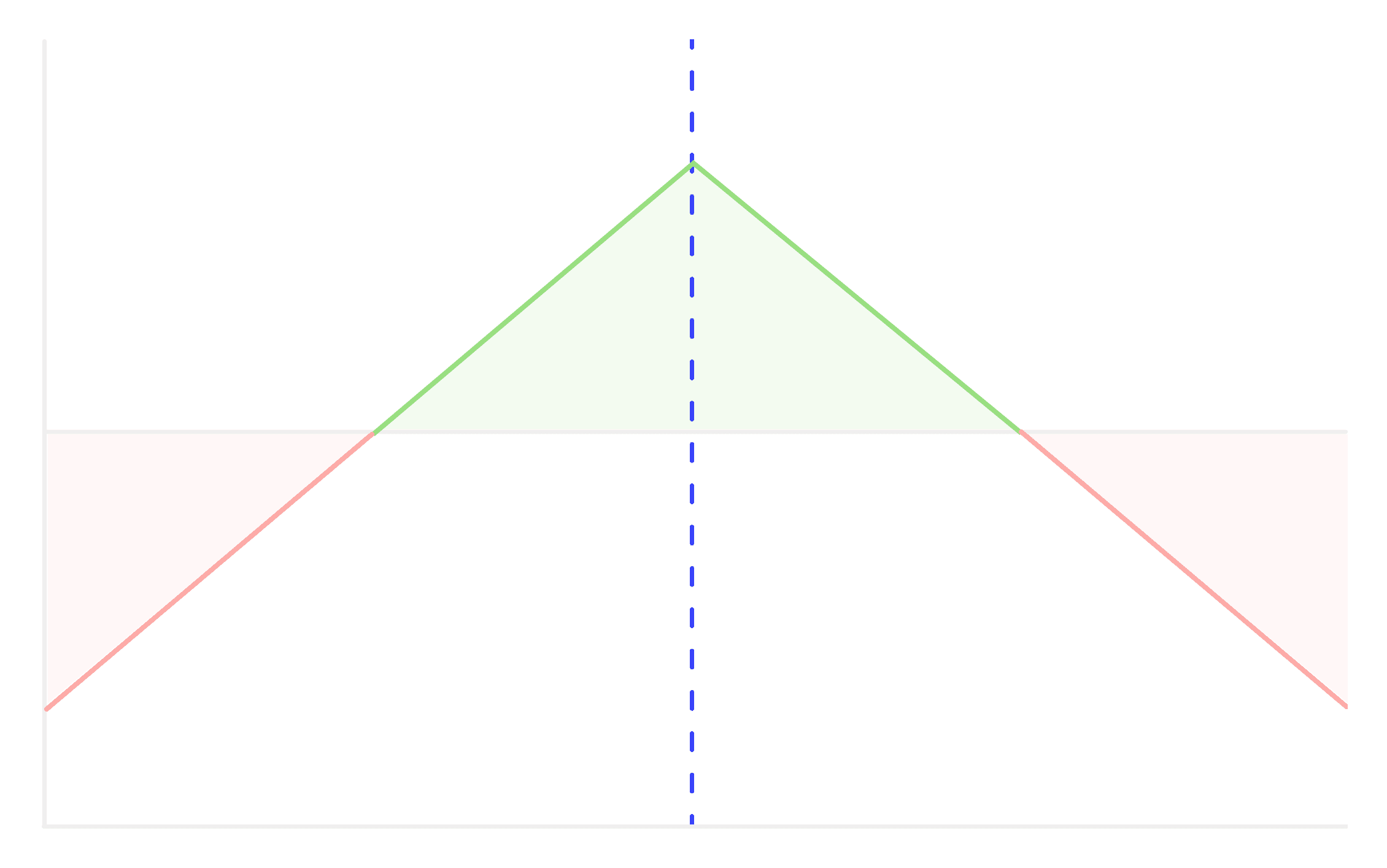

Iron Butterfly

This is a strategy which profits from low volatility in the price of the underlying asset while minimizing risk.

Short Strangle

A short strangle is a non directional trading strategy where an investor sells an (OTM) call option and put option on the same underlying asset simultaneously.

Short Straddle

A Short straddle is considered neutral or non-directional because it profits from minimal price movement in the underlying asset.

Put Ratio Backspread

The Put Ratio Backspread strategy involves selling and buying put options in a specific ratio.

Bear Call Spread

A Bear Call Spread is an options trading strategy that's used when a trader believes the price of an underlying asset will go down, but not significantly.

Bear Put Spread

A Bear Put Spread is a type of vertical spread strategy used in options trading.

Long Put

Long Put option is the most basic & simplest strategy. It is recommended or implemented when we expect the underlying asset to show significant downside move.

Short Call

Short Call strategy is employed in a bearish or neutral market outlook, where the underlying asset's price is expected to remain stable or fall.

Call Ratio Backspread

The Call Ratio Backspread strategy involves selling and buying call options in a specific ratio.

Bull Put Spread

A Bull Put Spread is a type of vertical spread strategy used in options trading

Bull Call Spread

A Bull Call Spread is an options trading strategy that's used when a trader believes the price of an underlying asset will go up, but not significantly.

Short Put

Short Put strategy is employed in a bullish or neutral market outlook, where the investor believes that the underlying asset's price will remain stable or rise.

Long Call

Long Call option' is the most basic & simplest strategy. It is recommended or implemented when we expect the underlying asset to show significant upside move.

Don't let emotions take over your trades, take control now and become a tactical trader with 1lyOptions