Iron Butterfly

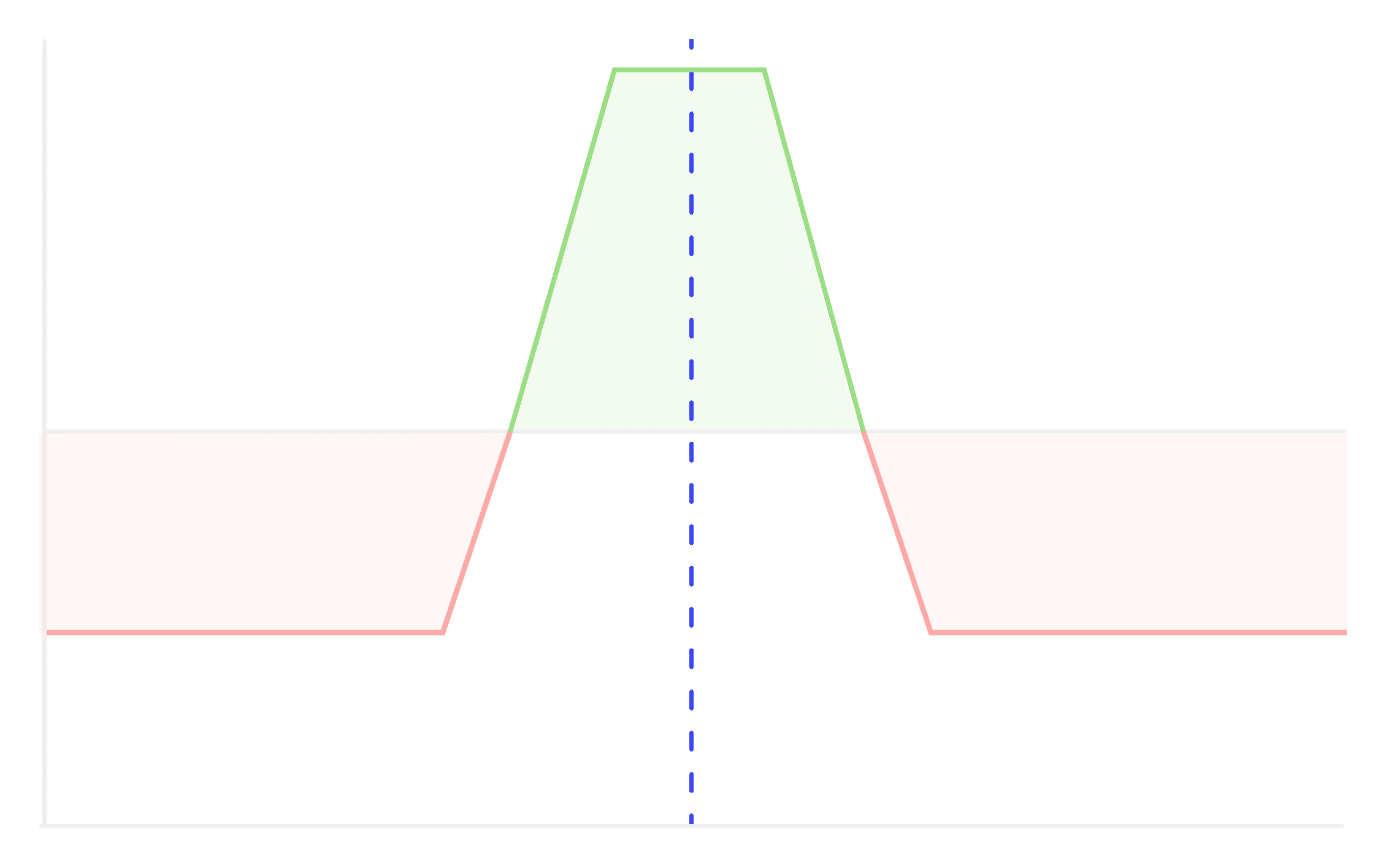

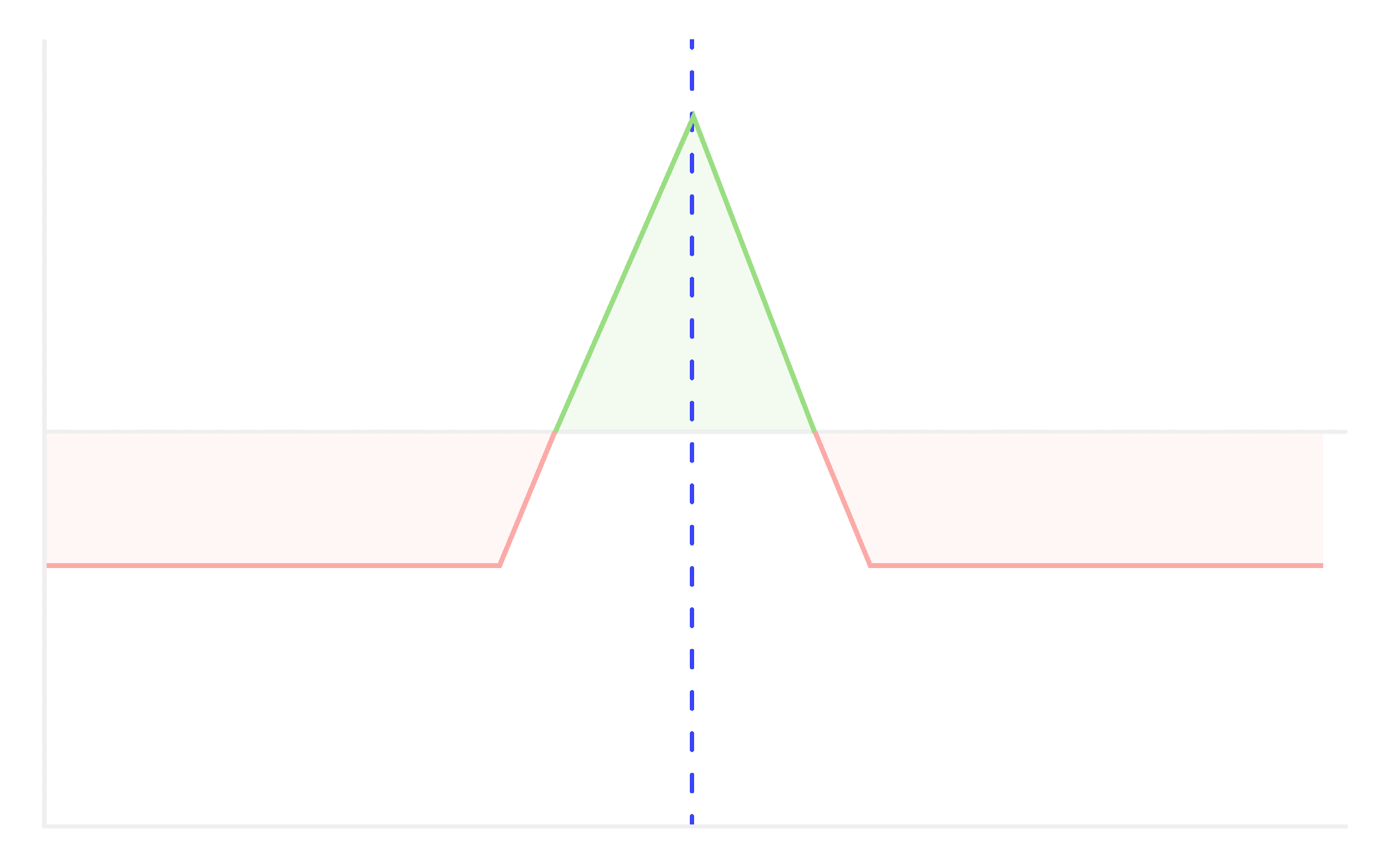

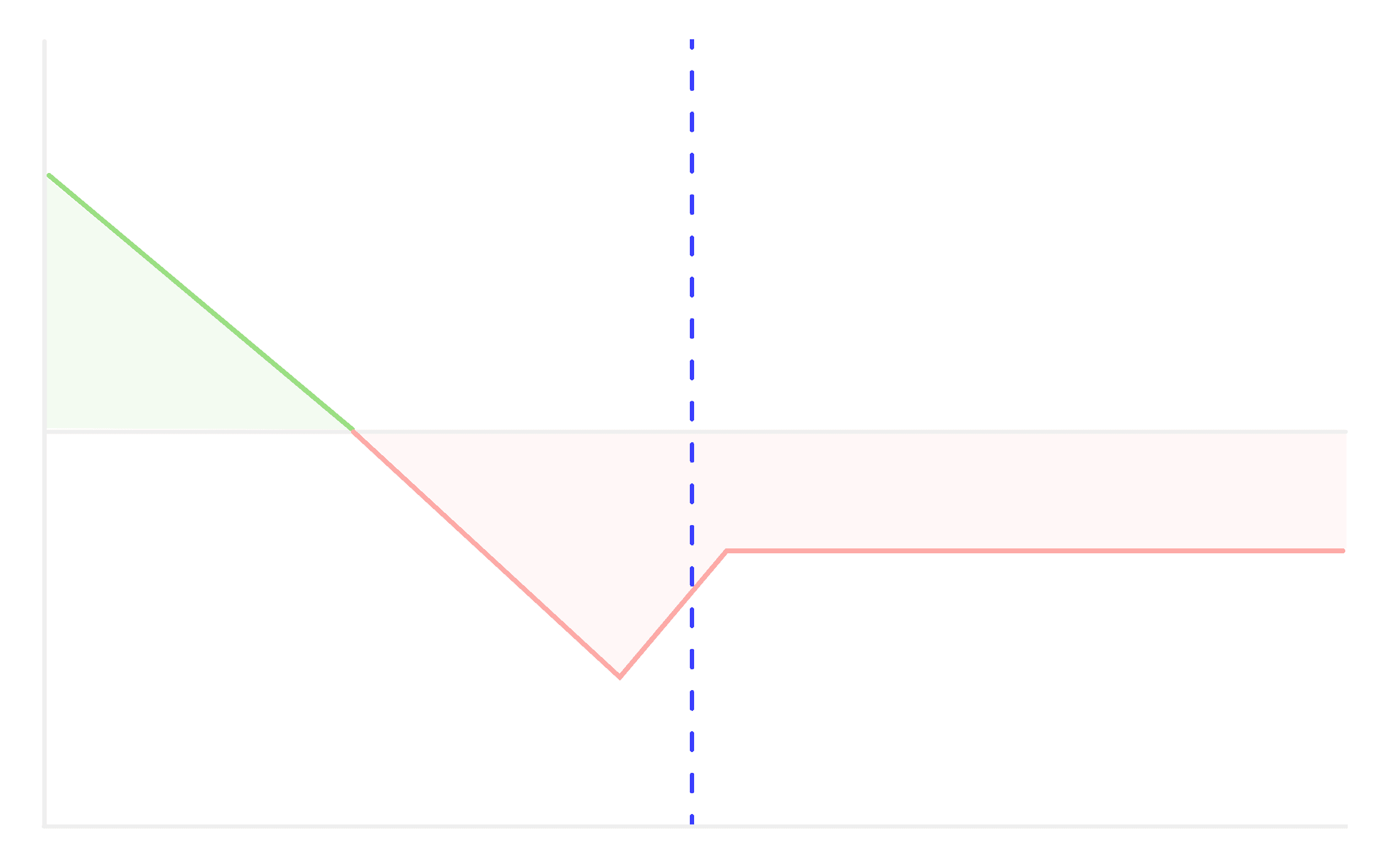

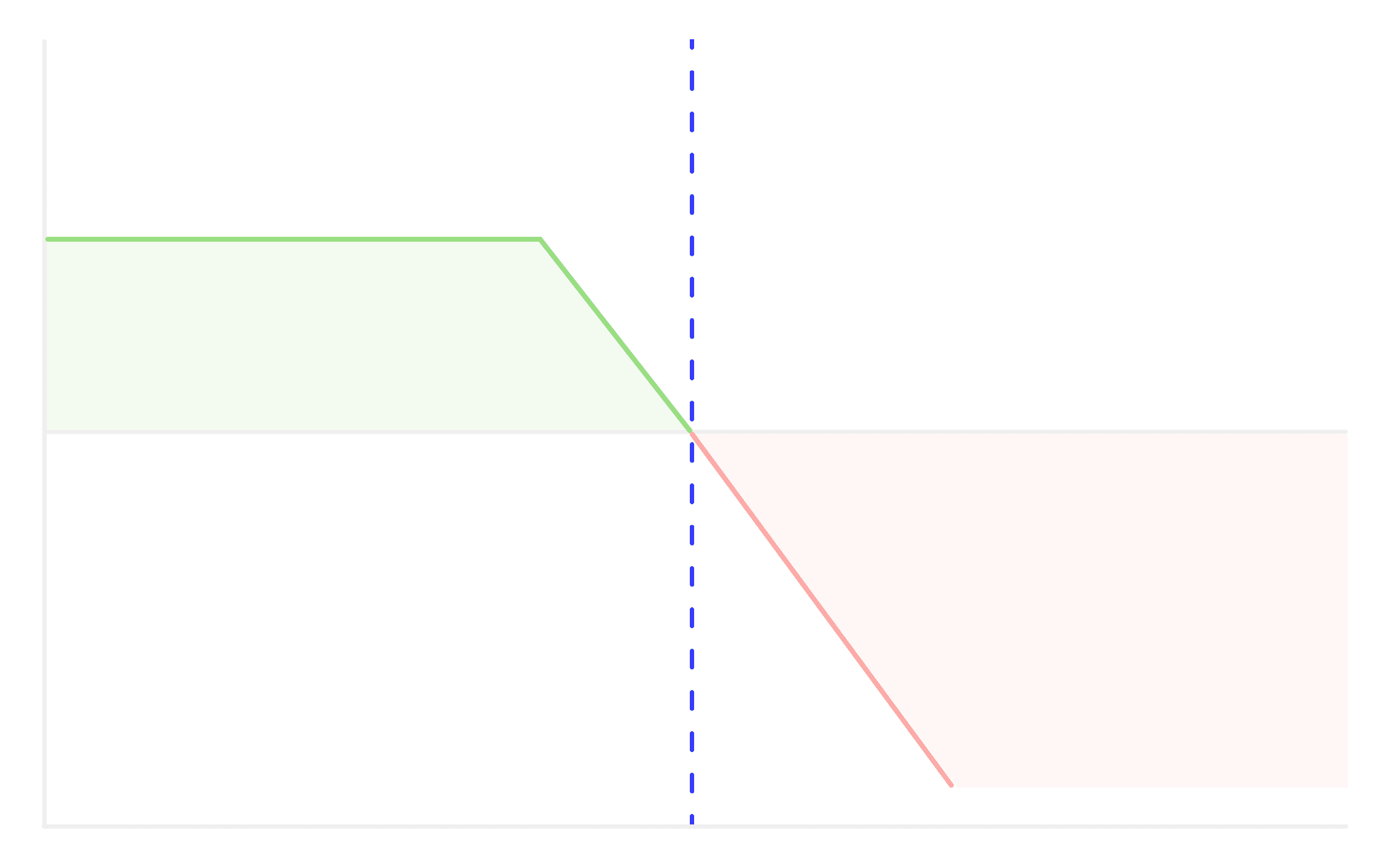

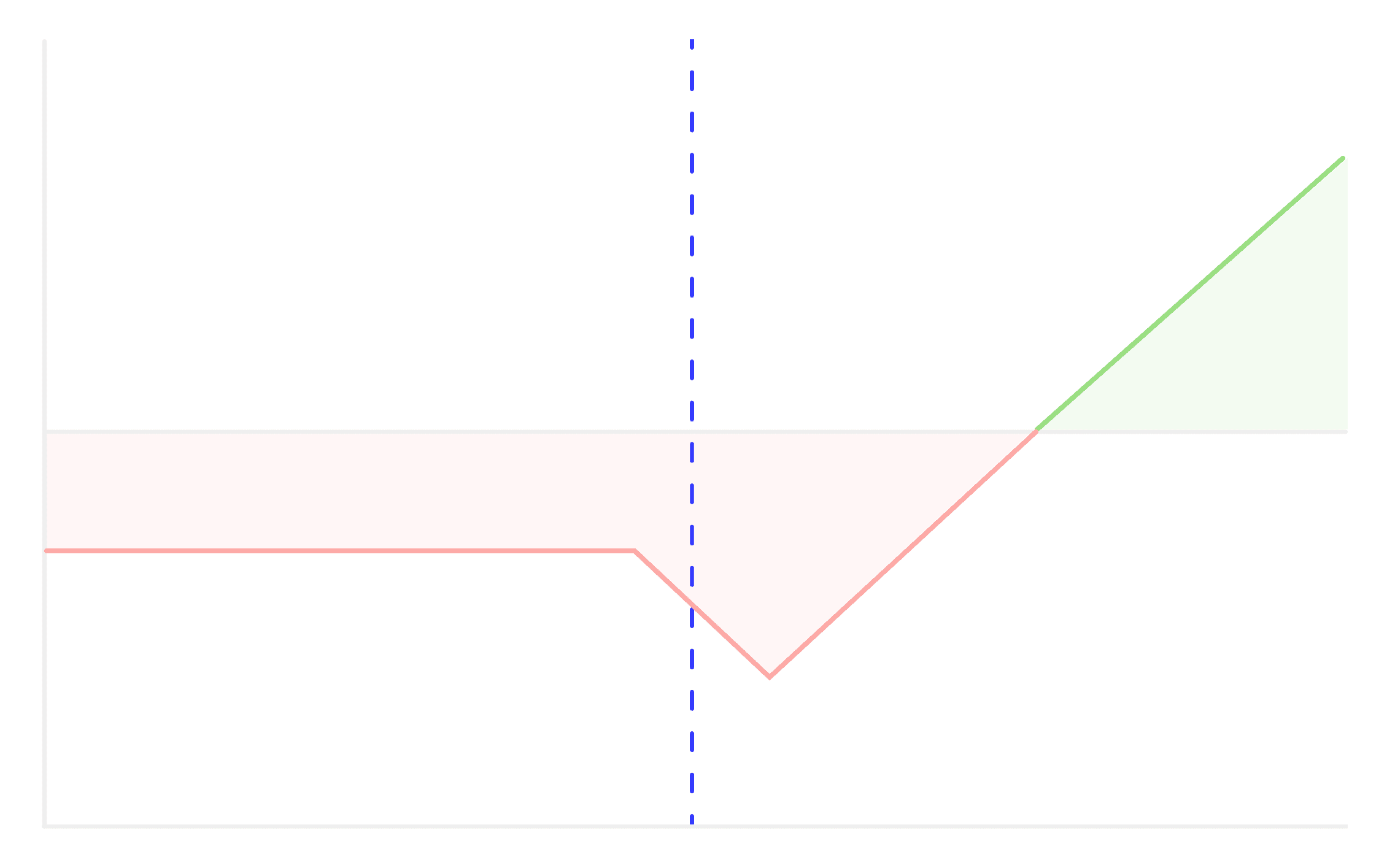

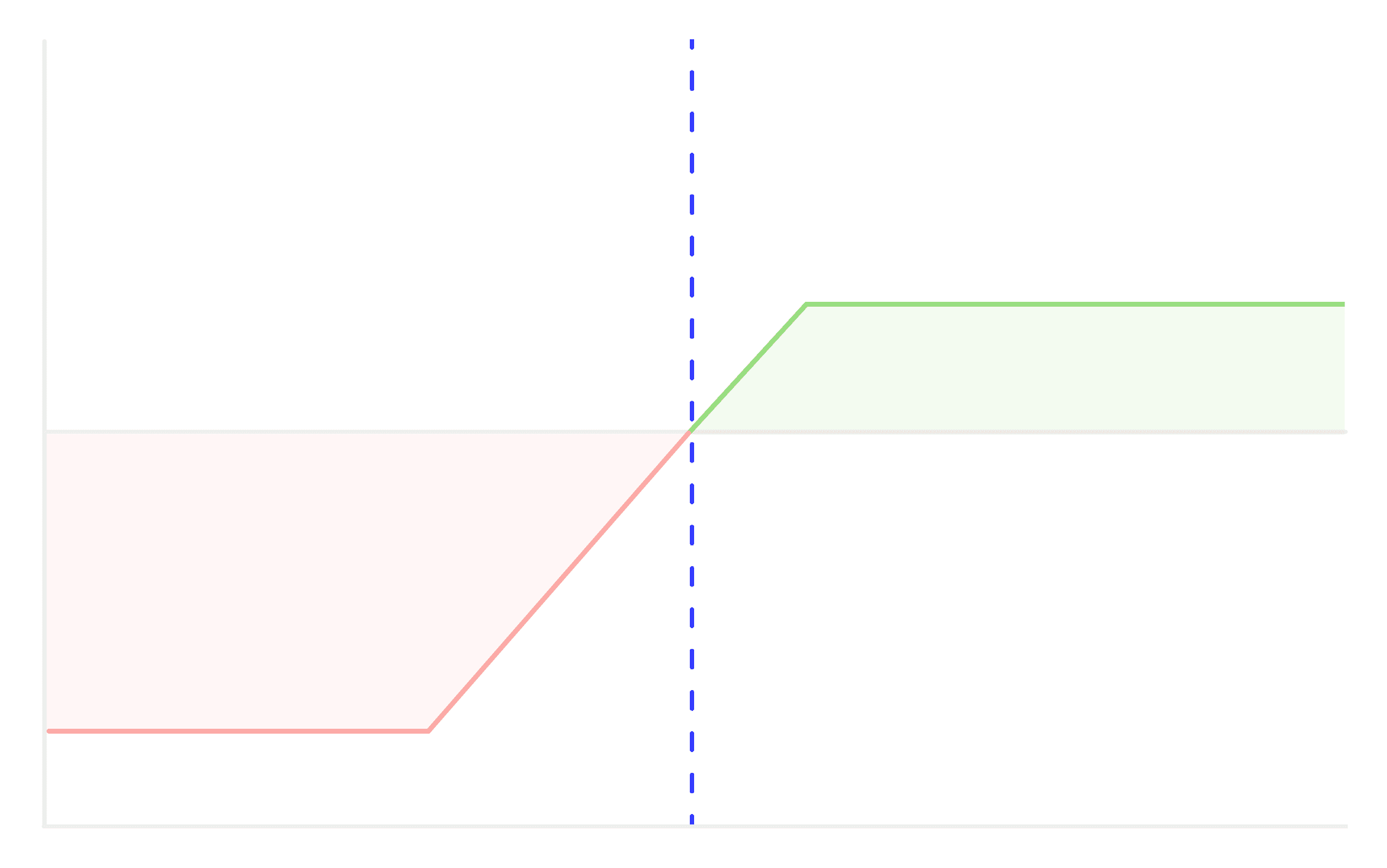

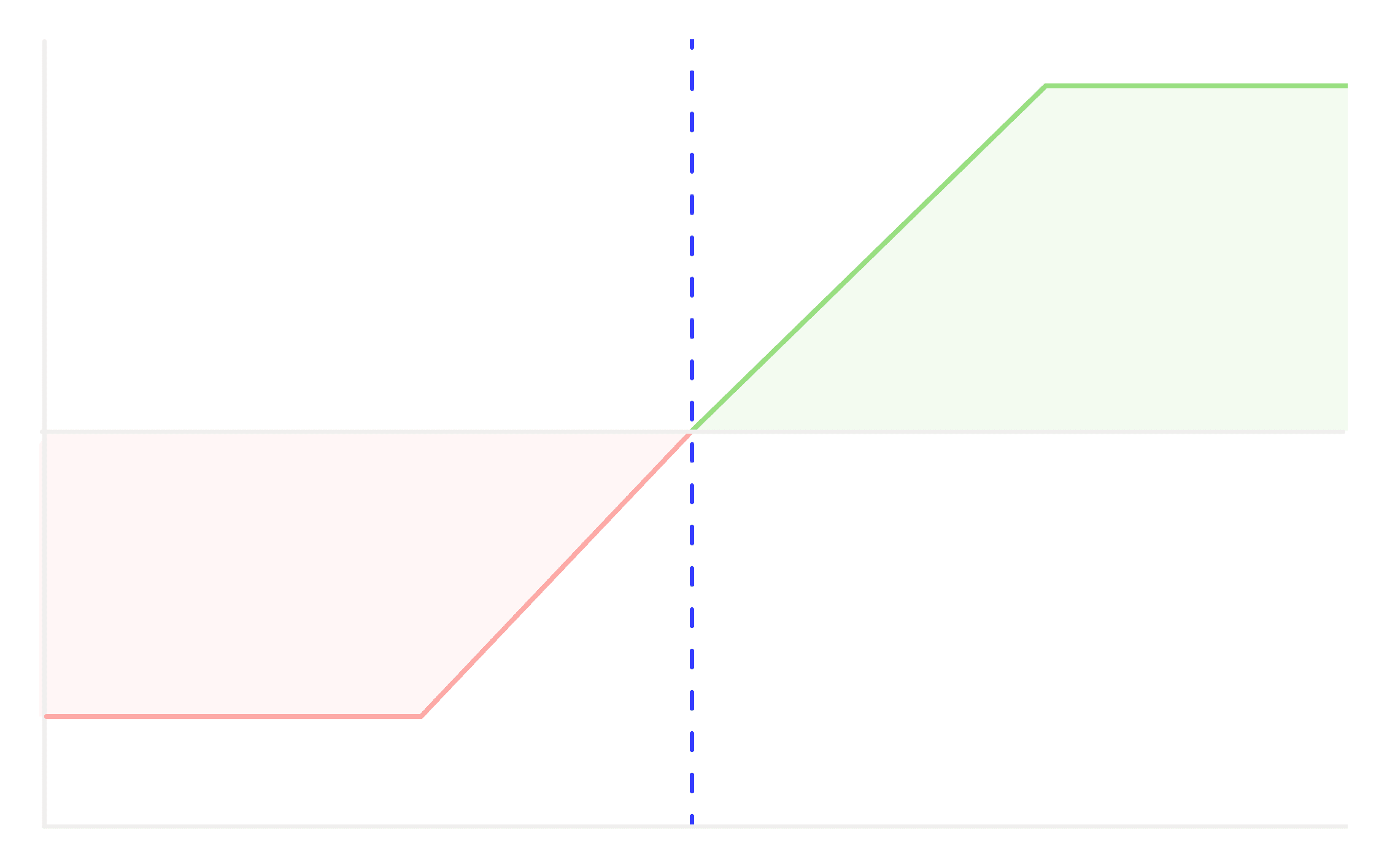

This is a strategy which profits from low volatility in the price of the underlying asset while minimizing risk.

An iron butterfly is an options trading strategy that combines elements of both a short straddle and a long strangle. It is used when an options trader expects very low volatility in the price of the underlying asset but still wants to profit from small price movements. This strategy is designed to generate income from the time decay of options while minimizing risk.

Here's how to construct an iron butterfly:

Assumptions:

- Current Nifty Index Level: ₹20,000

- Expiration Date: One month from today

Constructing the Iron Butterfly:

- Determine the Strike Prices:

- For an iron butterfly, you will typically choose strike prices that are equidistant from the current index level. In this case, we'll choose the following strike prices:

- Sell an at-the-money (ATM) Nifty call option with a strike price of ₹20,000.

- Sell an ATM Nifty put option with a strike price of ₹20,000.

- Buy an out-of-the-money (OTM) Nifty call option with a higher strike price (e.g., ₹20,400).

- Buy an OTM Nifty put option with a lower strike price (e.g., ₹19,600).

- For an iron butterfly, you will typically choose strike prices that are equidistant from the current index level. In this case, we'll choose the following strike prices:

- Same Expiration Date:

- Ensure that all four options (two short and two long) have the same expiration date, typically one month from the trade date.

- Premium Calculation:

- Calculate the net premium you pay or receive for this iron butterfly position by subtracting the premiums of the long call and put options from the total premiums received from selling the ATM call and put options.

- Net Premium Earned = (₹20000 Call sold) + (₹19600 Put Sold) = ₹64.5 - ₹69.85= ₹134.35

- Net Premium Paid = (₹20000 Put sold) + (₹19600 Put Bought) = ₹2.9 + ₹6.7 = ₹9.6

- Total Net Premium = ₹124.75

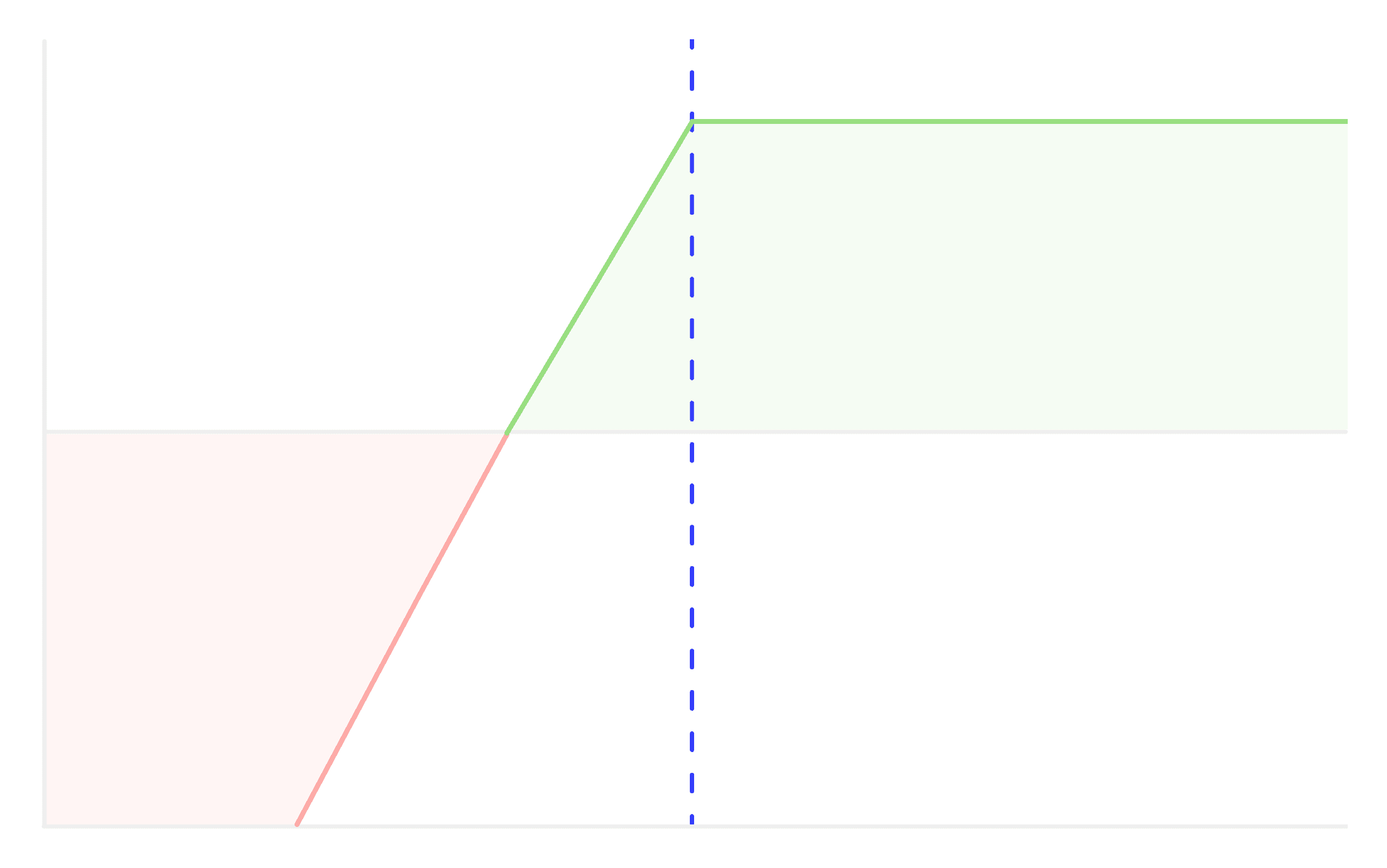

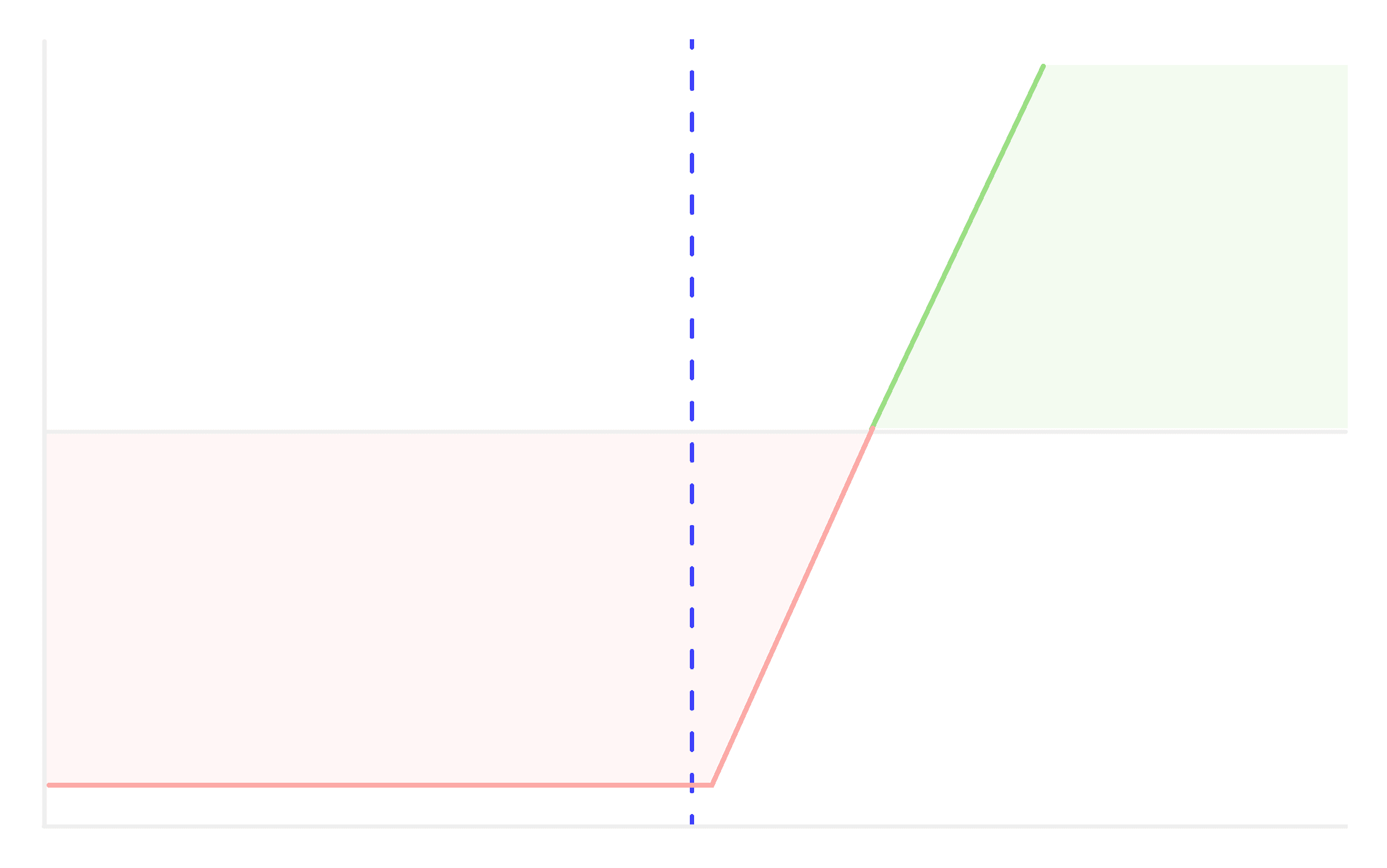

- Risk and Reward:

- The maximum profit occurs if the Nifty index settles exactly at the ATM strike price of ₹20,000 at expiration. Your profit is the net premium received. (₹ 124.75)

- The maximum loss is limited and occurs if the Nifty makes a significant move away from the ATM strike in either direction. The loss is capped at the net premium paid.

- Breakeven Points:

- The upper breakeven point is the ATM call strike (₹20,000) plus the net premium. = ₹20000 + 124.75 = ₹20124.75

- The lower breakeven point is the ATM put strike (₹20,000) minus the net premium. = ₹20000 - 124.75 = ₹19875.25

Please note that options prices and market conditions change continuously, so it's important to analyze the specific options available and their premiums at the time of your trade. Always practice proper risk management and consider consulting with a financial advisor or options expert before implementing complex options strategies.

Other Strategies

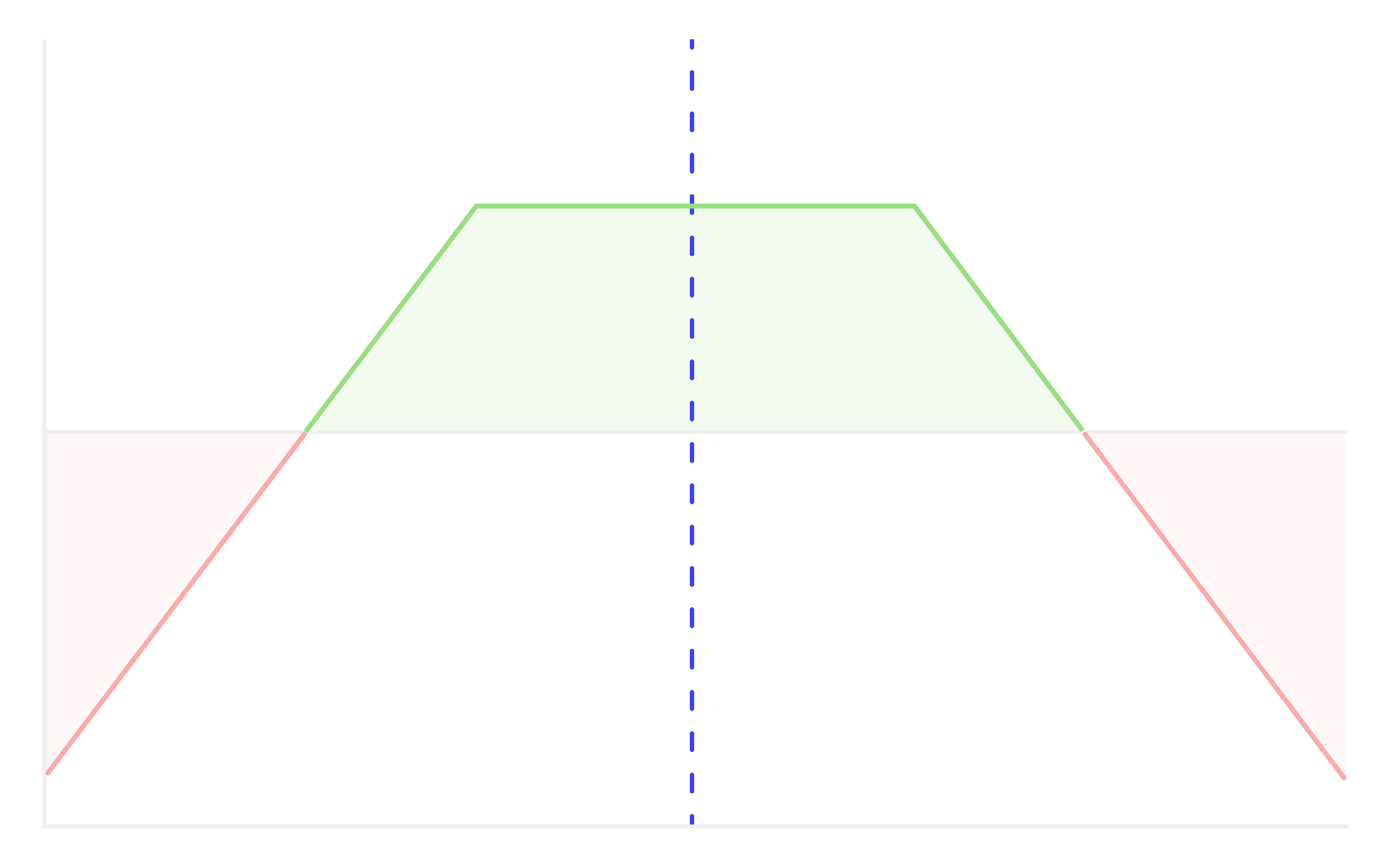

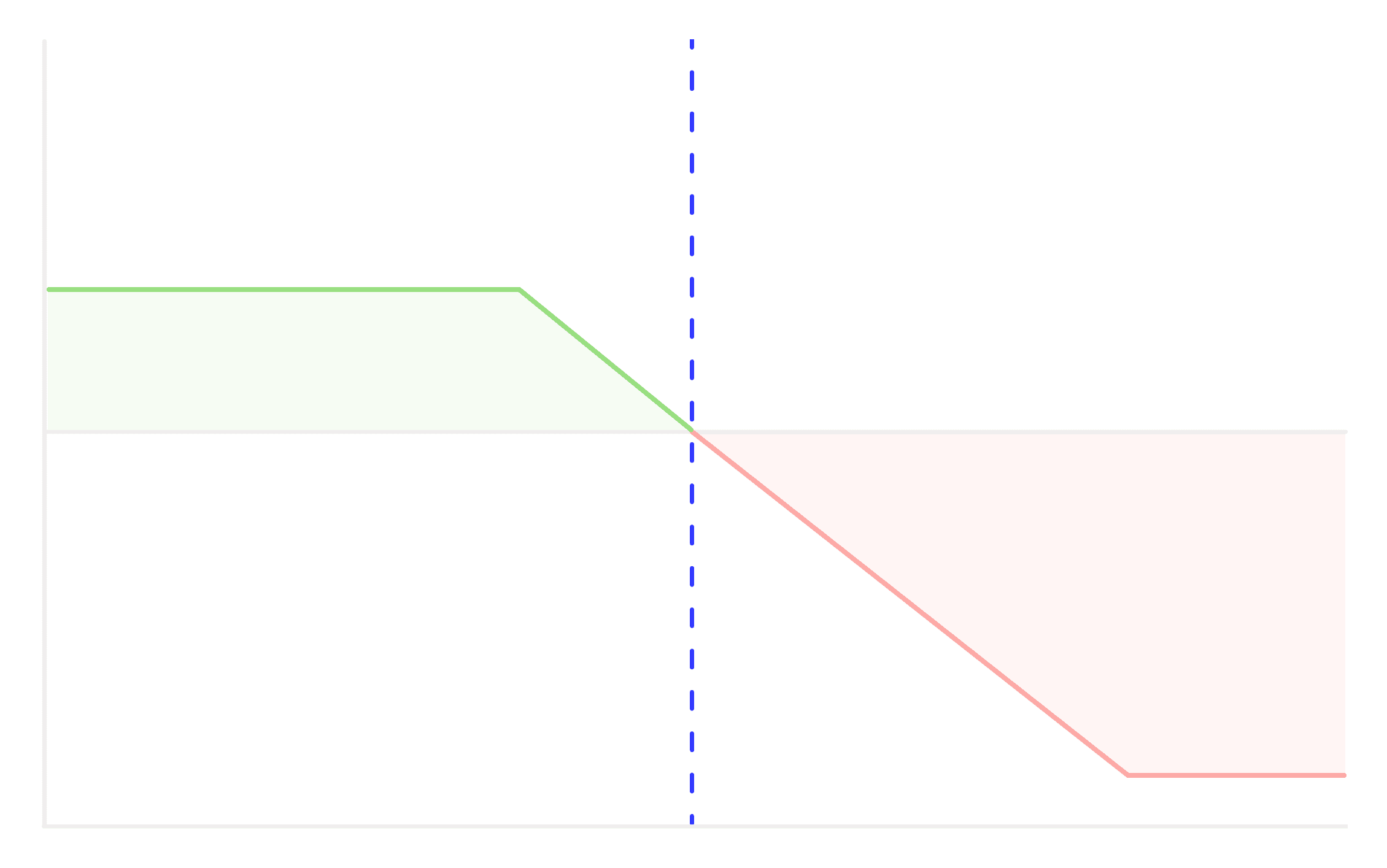

Iron Condor

A strategy designed to profit from low volatility in the underlying asset, combining a bullish put credit spread and a bearish call credit spread to it.

Iron Butterfly

This is a strategy which profits from low volatility in the price of the underlying asset while minimizing risk.

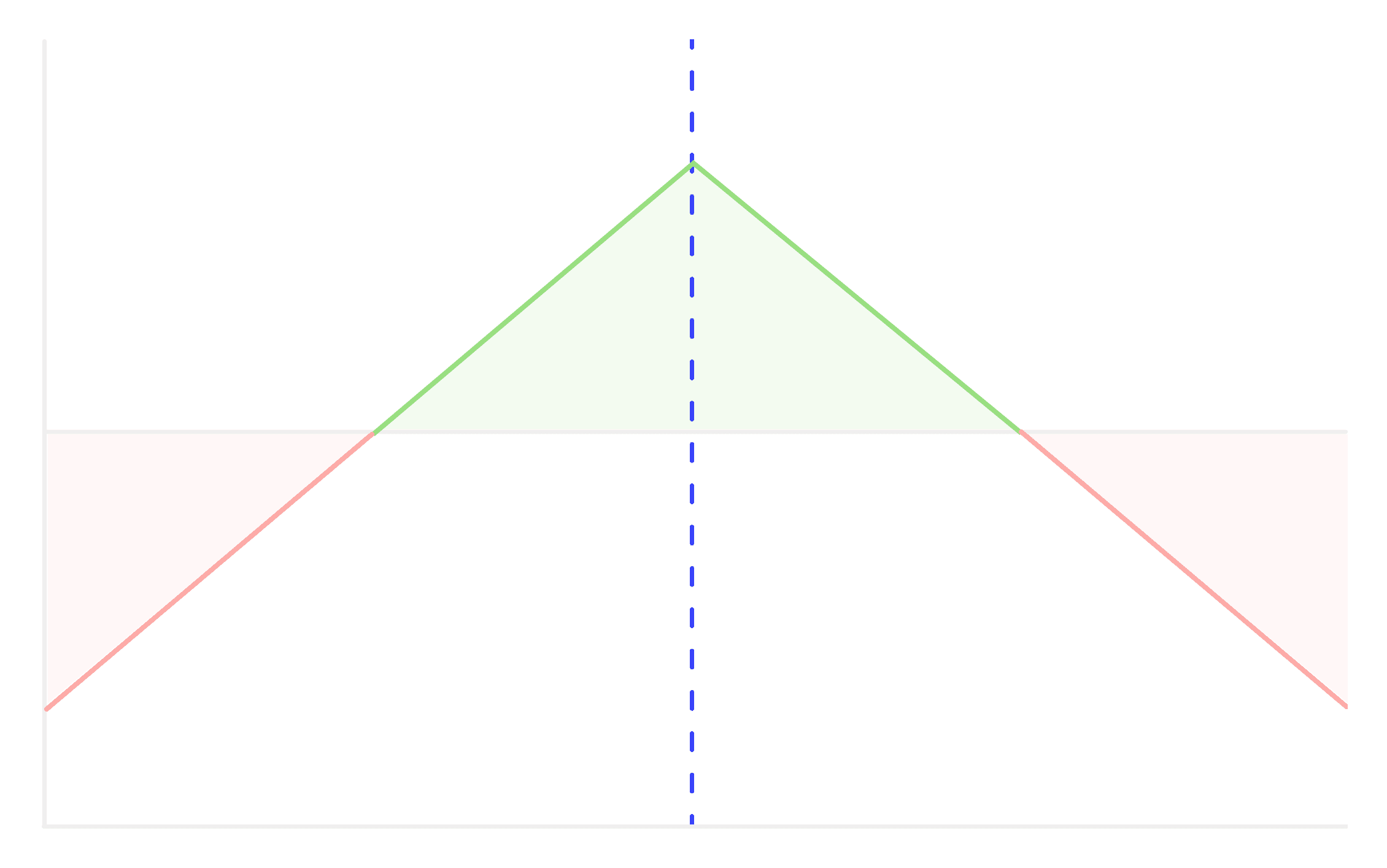

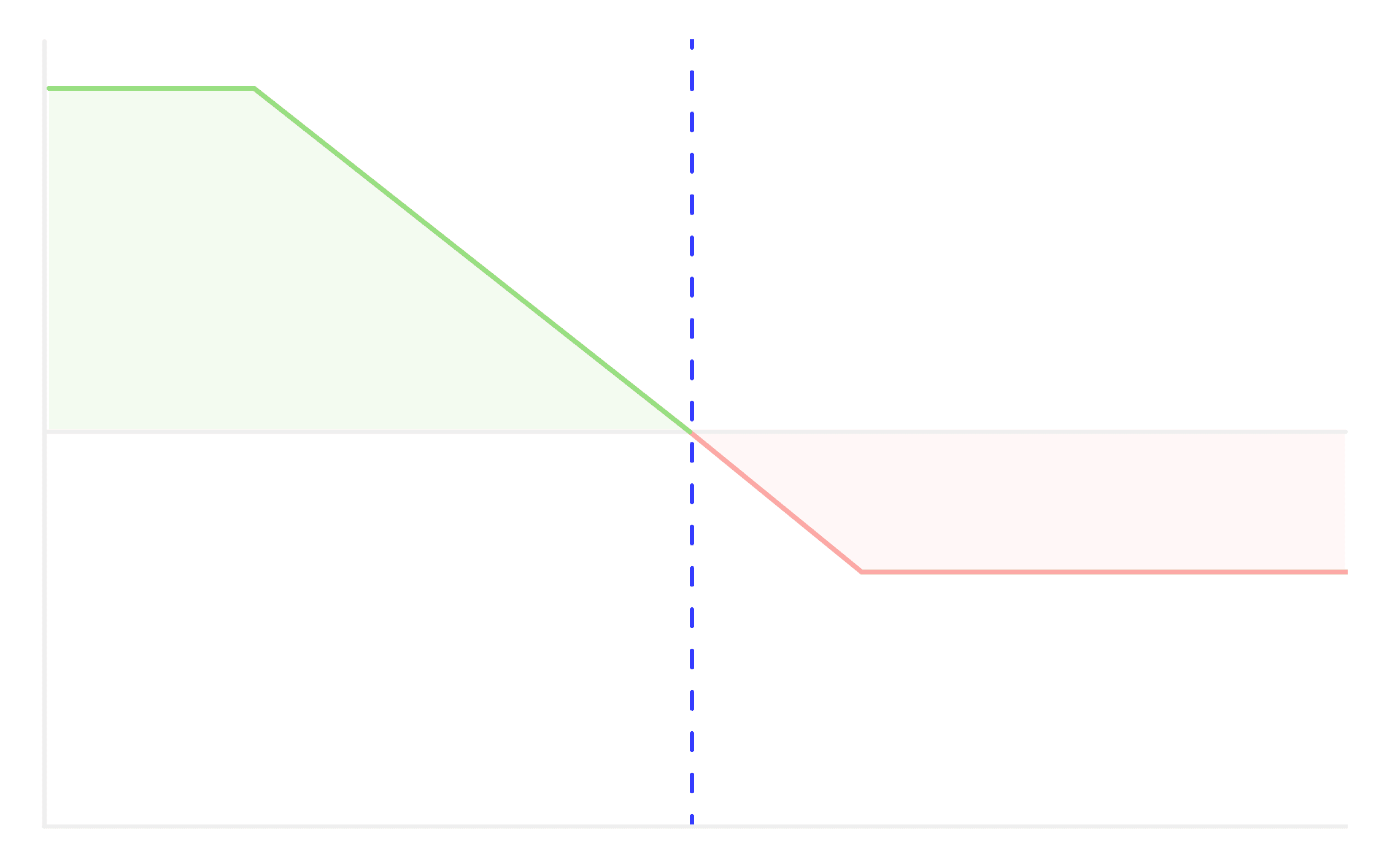

Short Strangle

A short strangle is a non directional trading strategy where an investor sells an (OTM) call option and put option on the same underlying asset simultaneously.

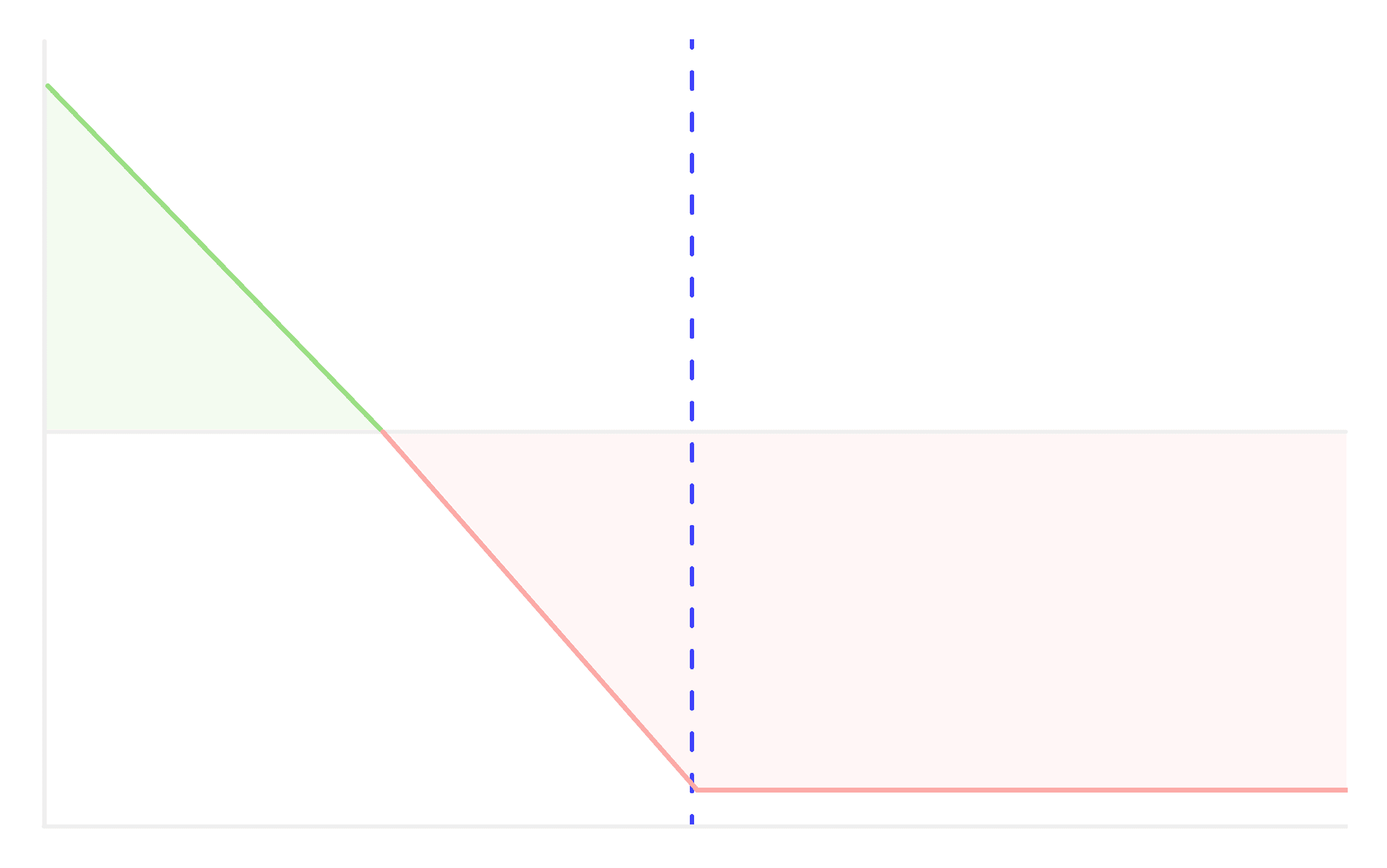

Short Straddle

A Short straddle is considered neutral or non-directional because it profits from minimal price movement in the underlying asset.

Put Ratio Backspread

The Put Ratio Backspread strategy involves selling and buying put options in a specific ratio.

Bear Call Spread

A Bear Call Spread is an options trading strategy that's used when a trader believes the price of an underlying asset will go down, but not significantly.

Bear Put Spread

A Bear Put Spread is a type of vertical spread strategy used in options trading.

Long Put

Long Put option is the most basic & simplest strategy. It is recommended or implemented when we expect the underlying asset to show significant downside move.

Short Call

Short Call strategy is employed in a bearish or neutral market outlook, where the underlying asset's price is expected to remain stable or fall.

Call Ratio Backspread

The Call Ratio Backspread strategy involves selling and buying call options in a specific ratio.

Bull Put Spread

A Bull Put Spread is a type of vertical spread strategy used in options trading

Bull Call Spread

A Bull Call Spread is an options trading strategy that's used when a trader believes the price of an underlying asset will go up, but not significantly.

Short Put

Short Put strategy is employed in a bullish or neutral market outlook, where the investor believes that the underlying asset's price will remain stable or rise.

Long Call

Long Call option' is the most basic & simplest strategy. It is recommended or implemented when we expect the underlying asset to show significant upside move.

Don't let emotions take over your trades, take control now and become a tactical trader with 1lyOptions