Bull Put Spread

A Bull Put Spread is a type of vertical spread strategy used in options trading

A Bull Put Spread is a type of vertical spread strategy used in options trading, employed when the trader believes the price of an underlying asset will rise moderately. It involves selling a put option while simultaneously buying another put option with the same expiration date but a lower strike price.

How It Works:

- Sell a Put Option: The trader sells a put option with a specific strike price. This is known as the "higher strike price."

- Buy a Put Option: At the same time, the trader buys another put option with a lower strike price. This is known as the "lower strike price."

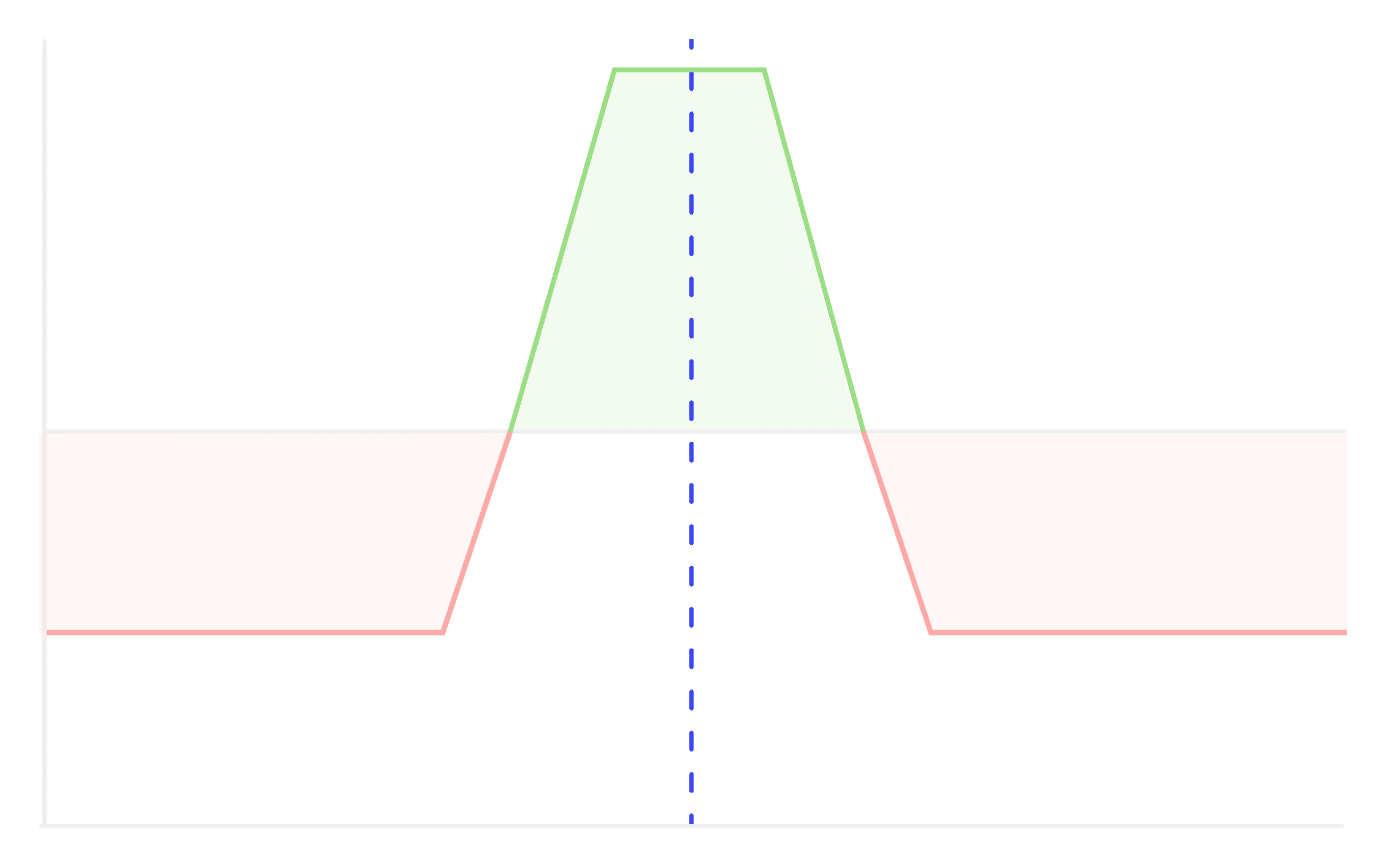

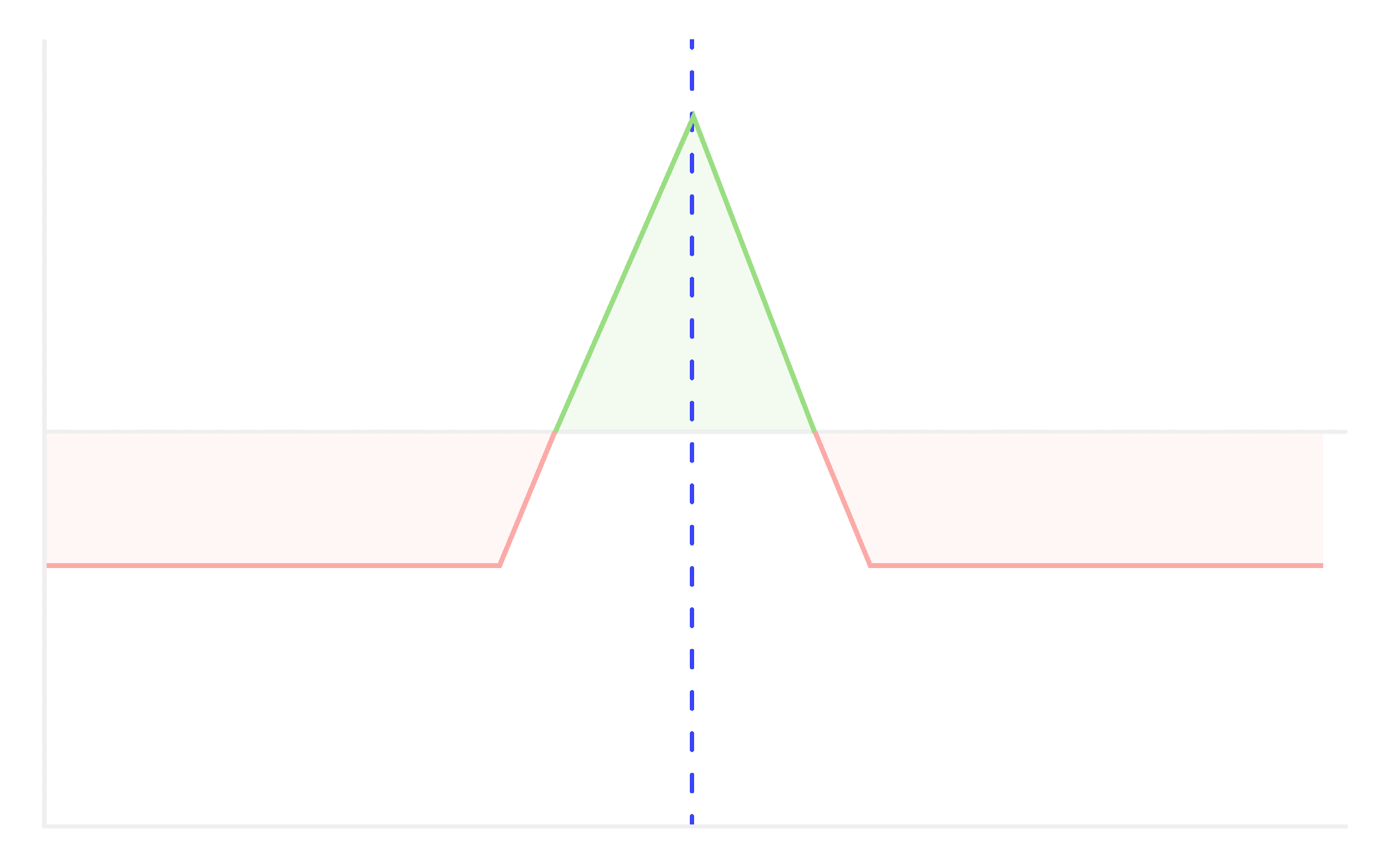

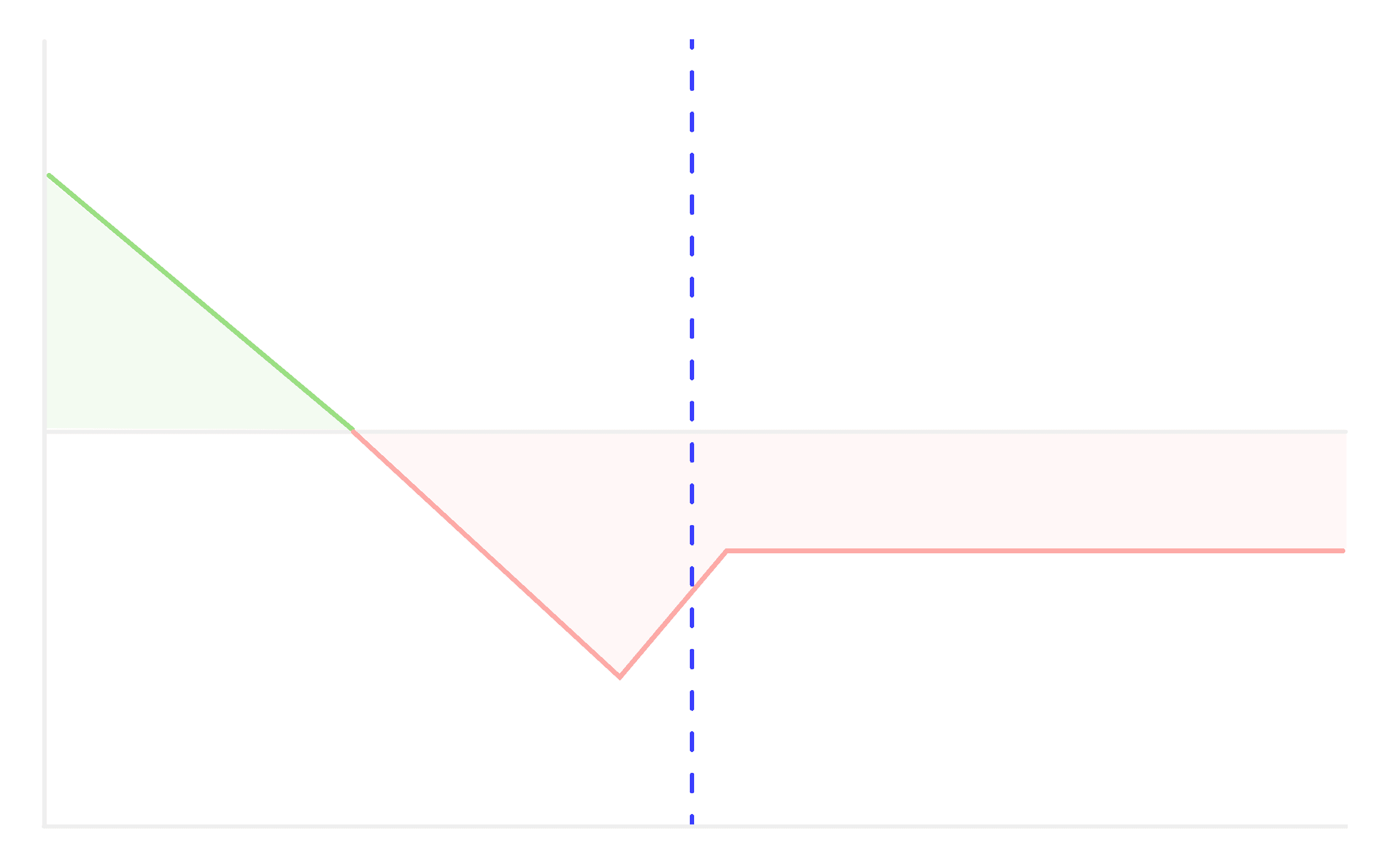

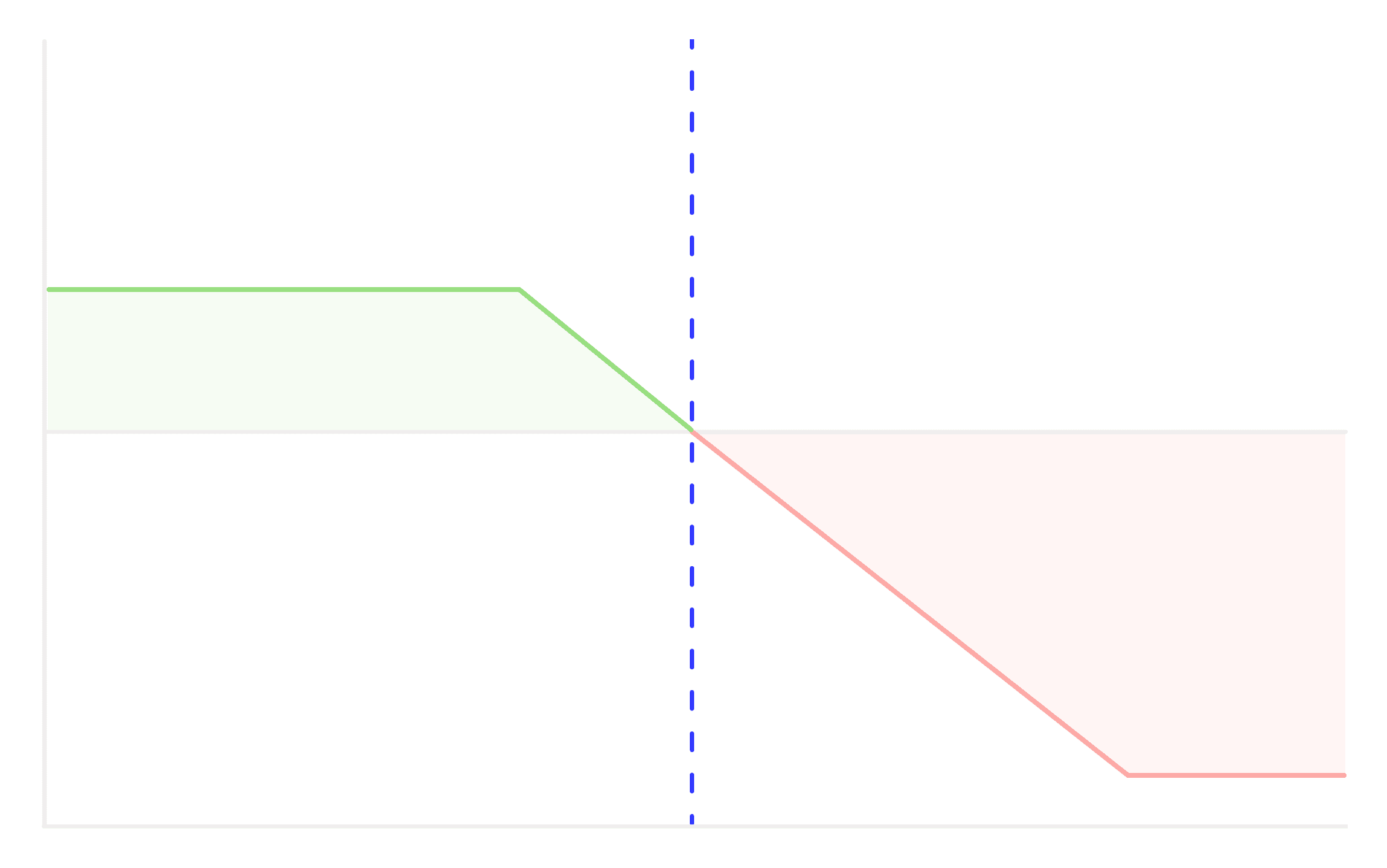

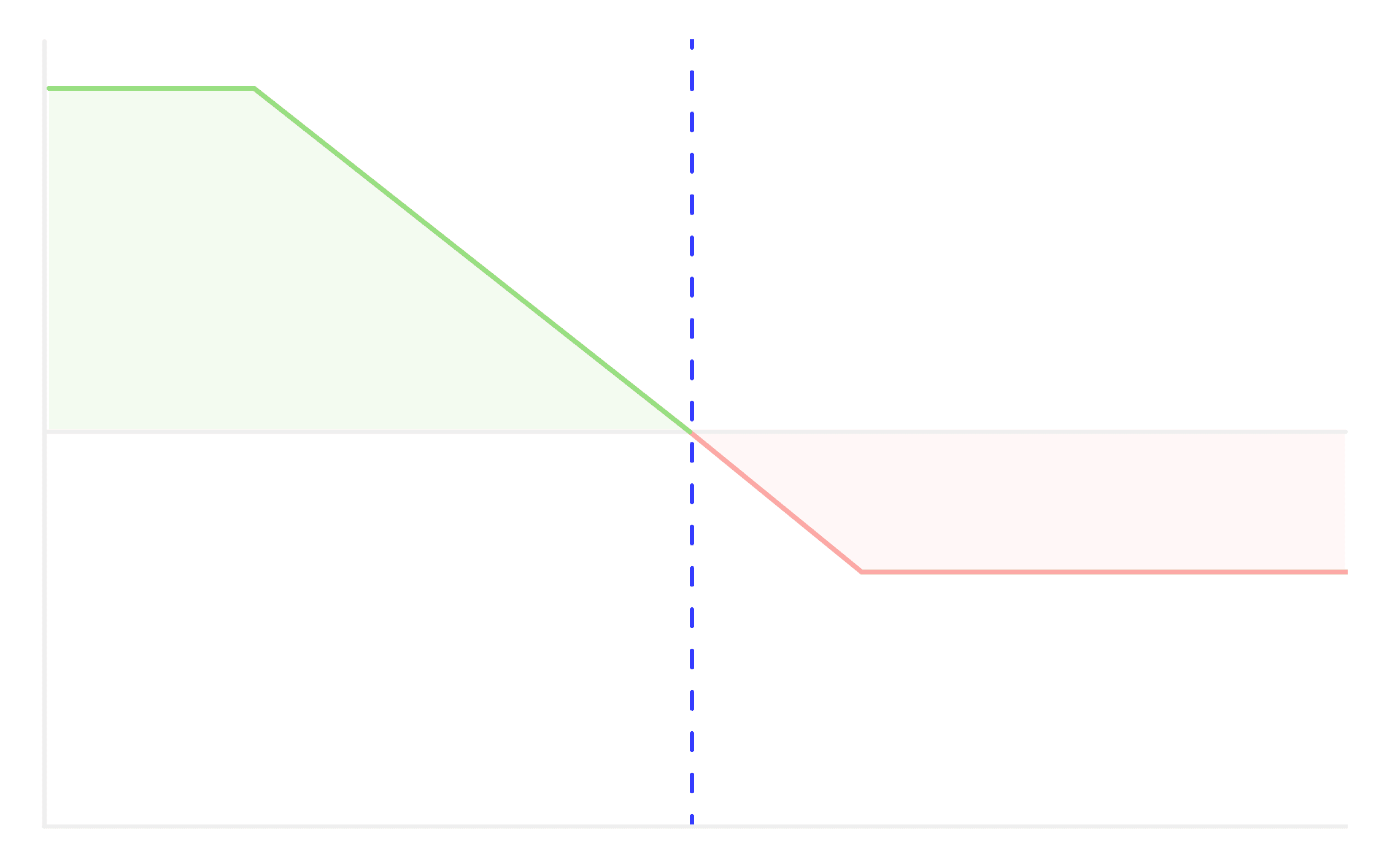

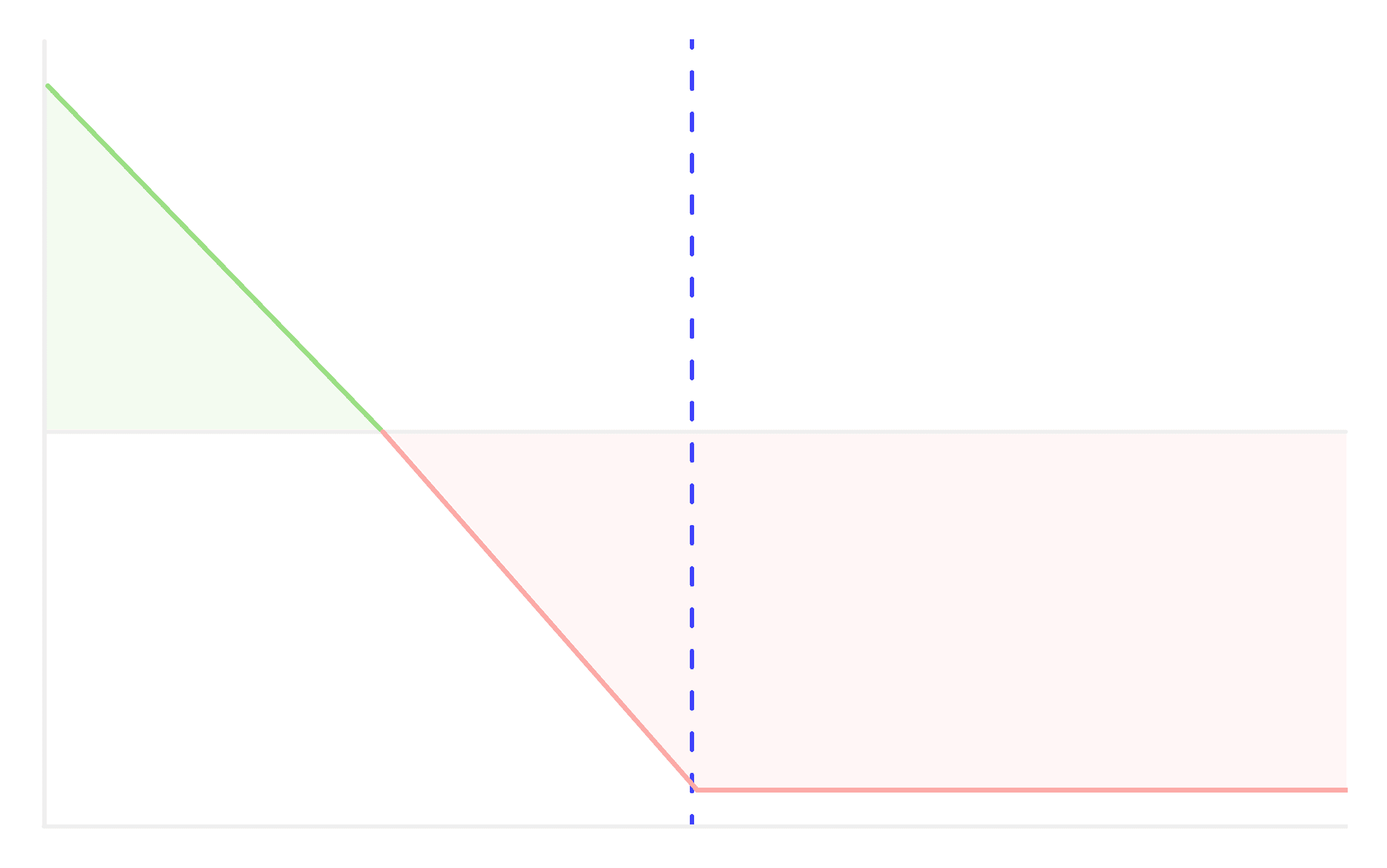

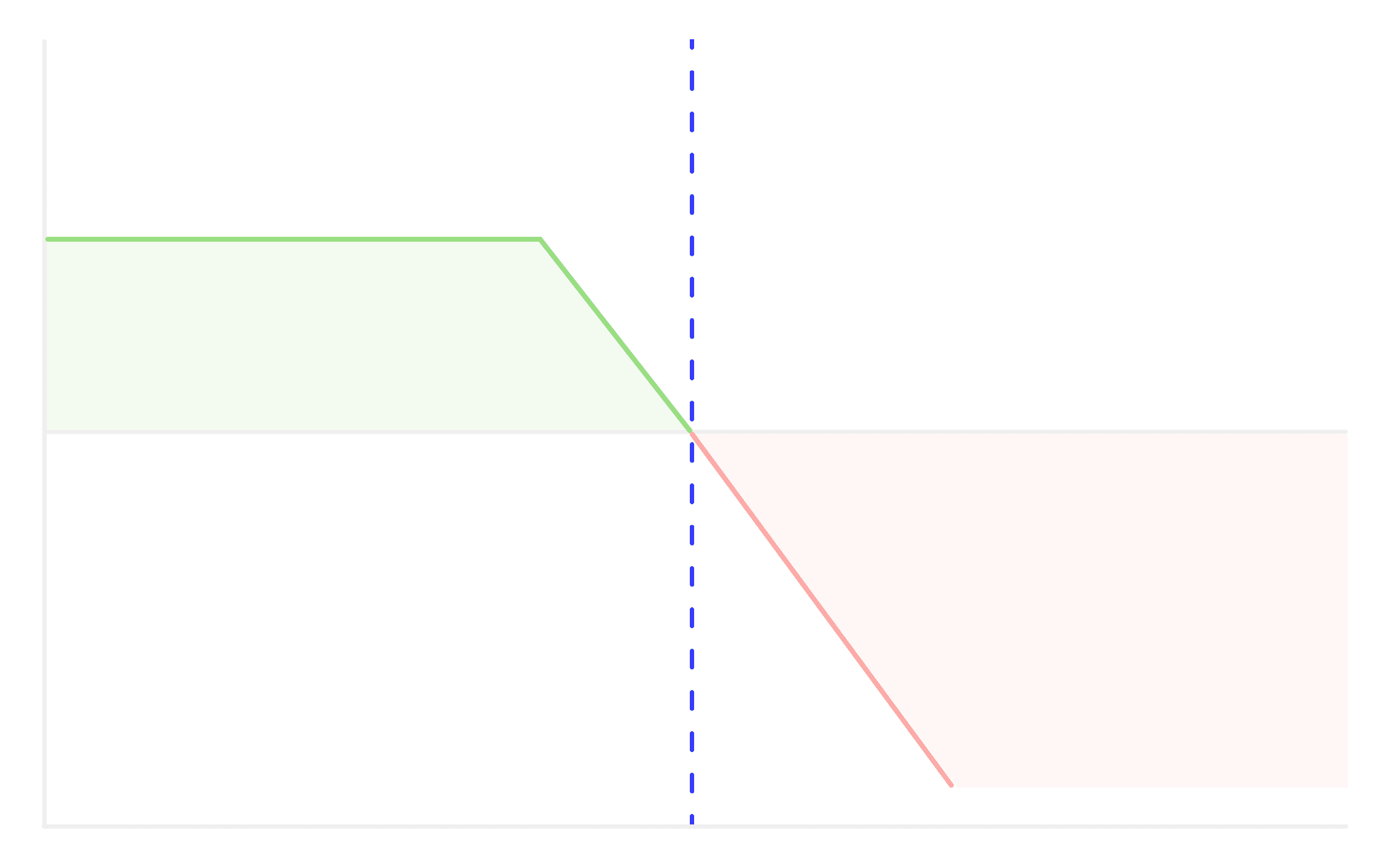

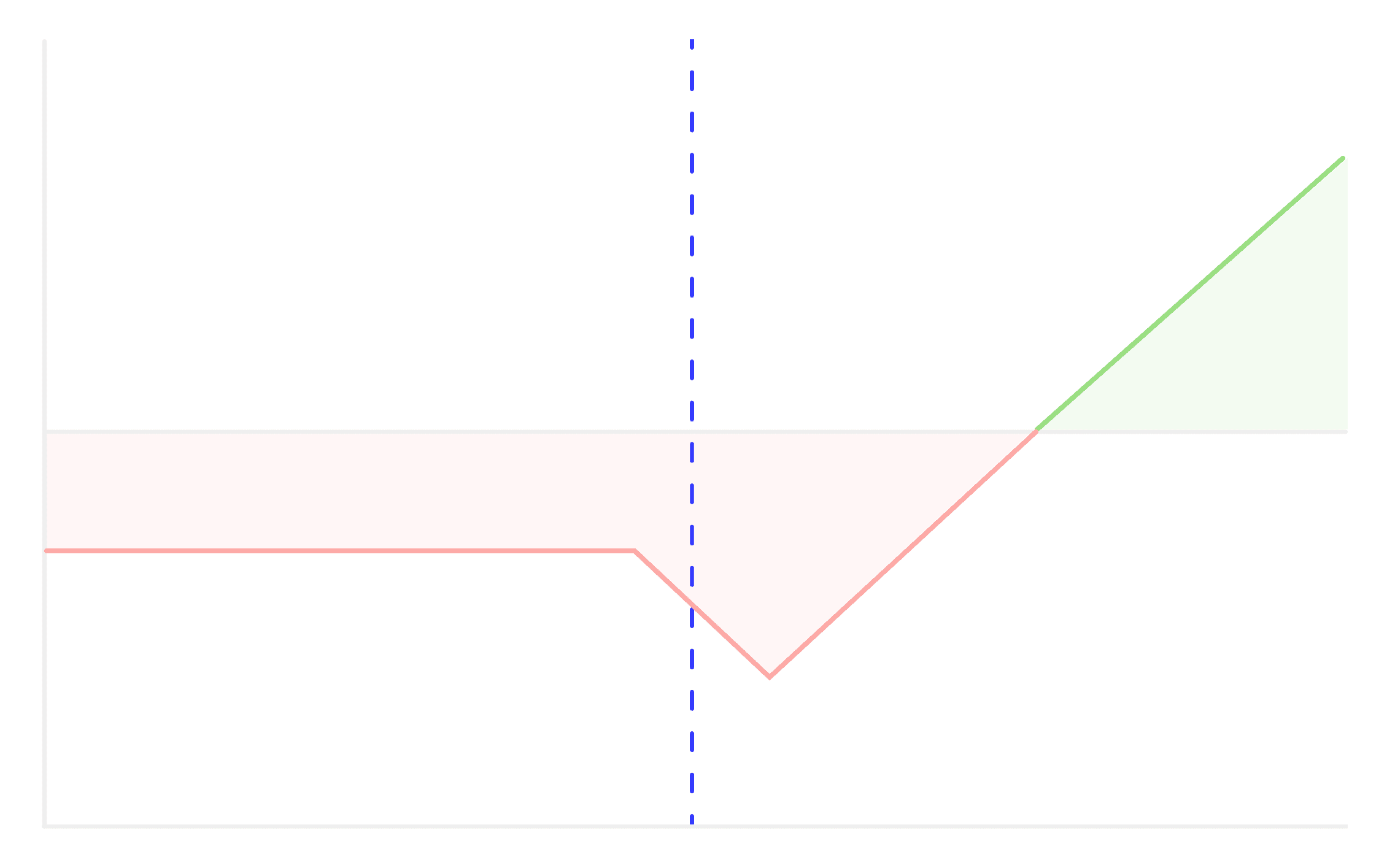

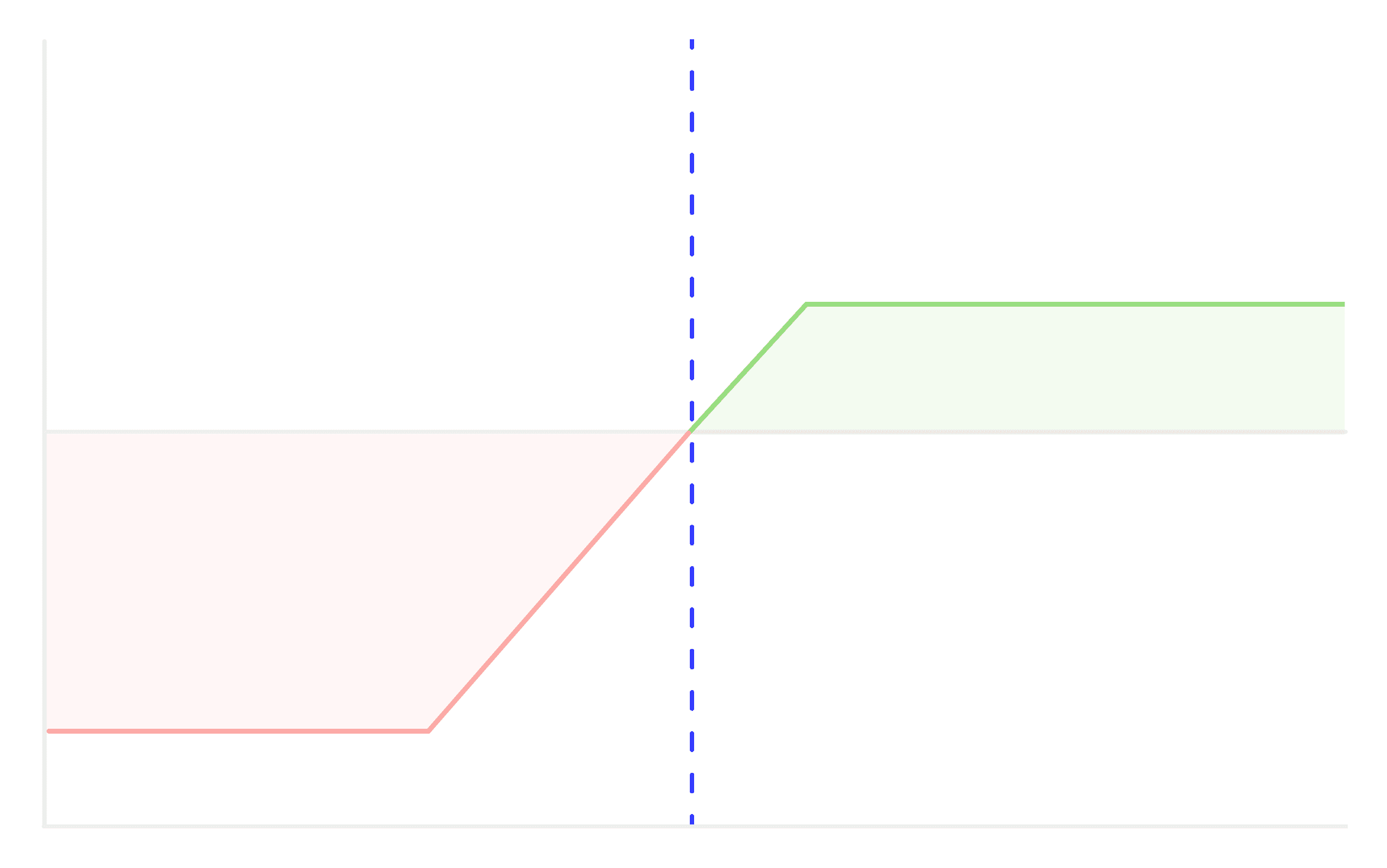

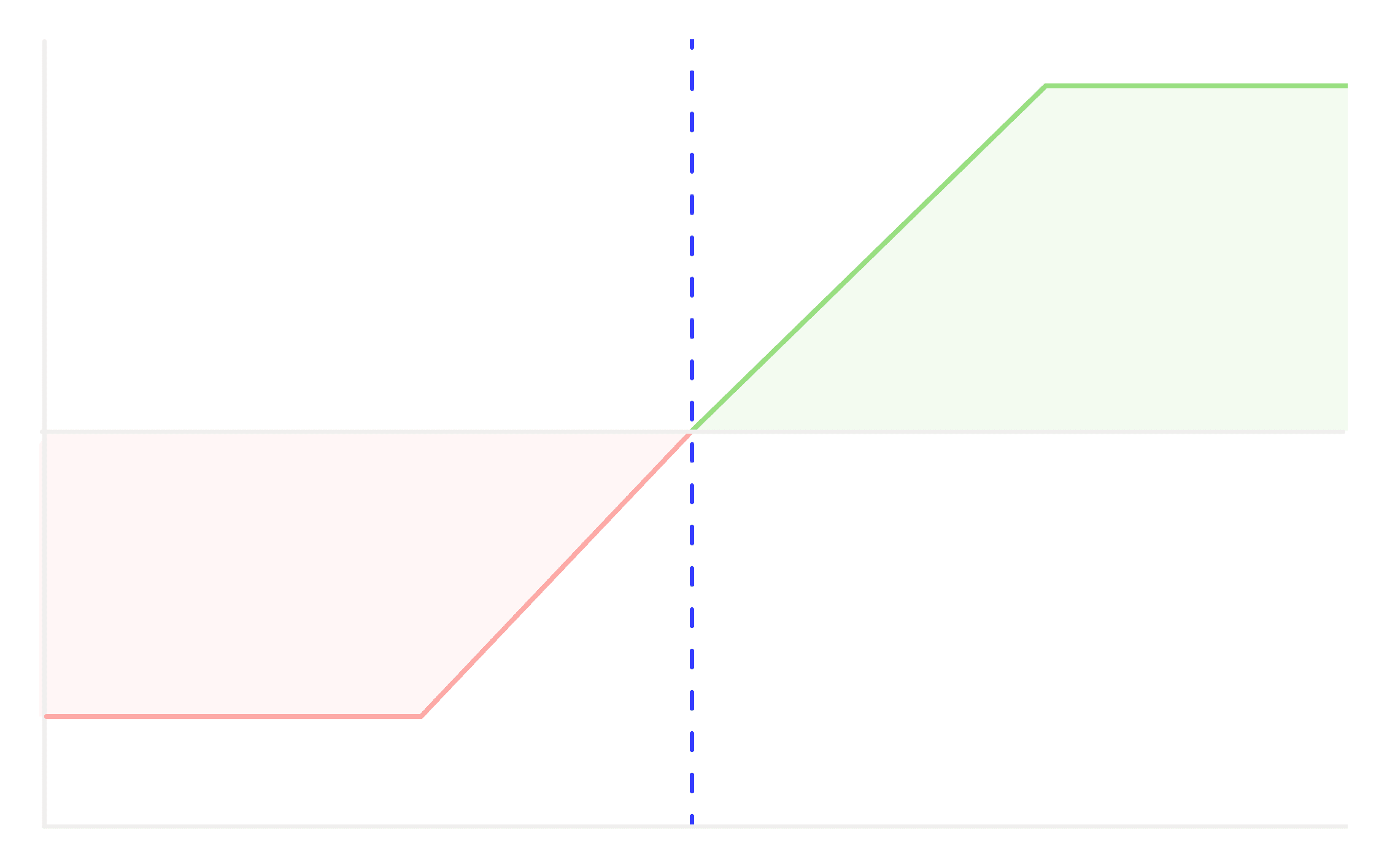

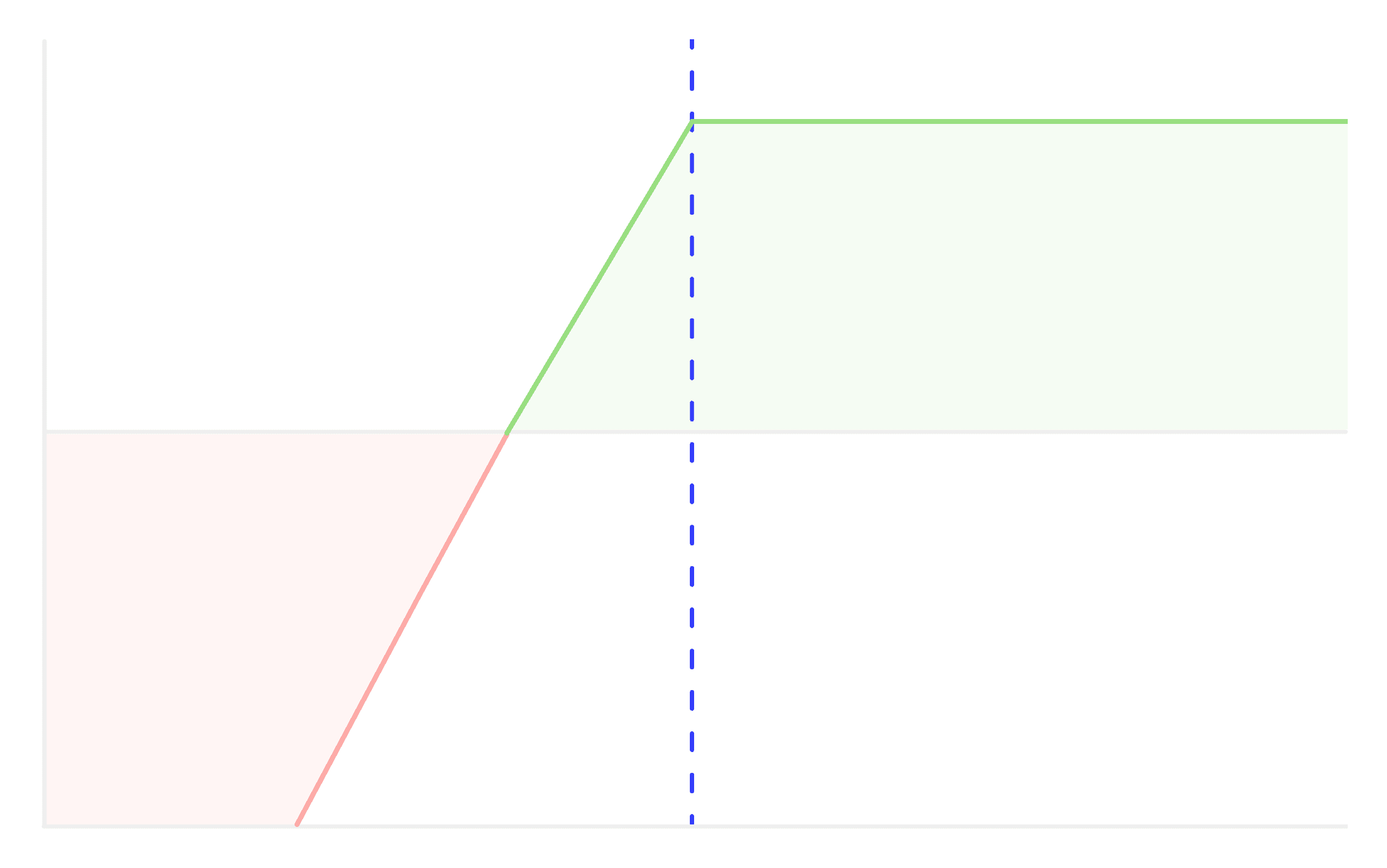

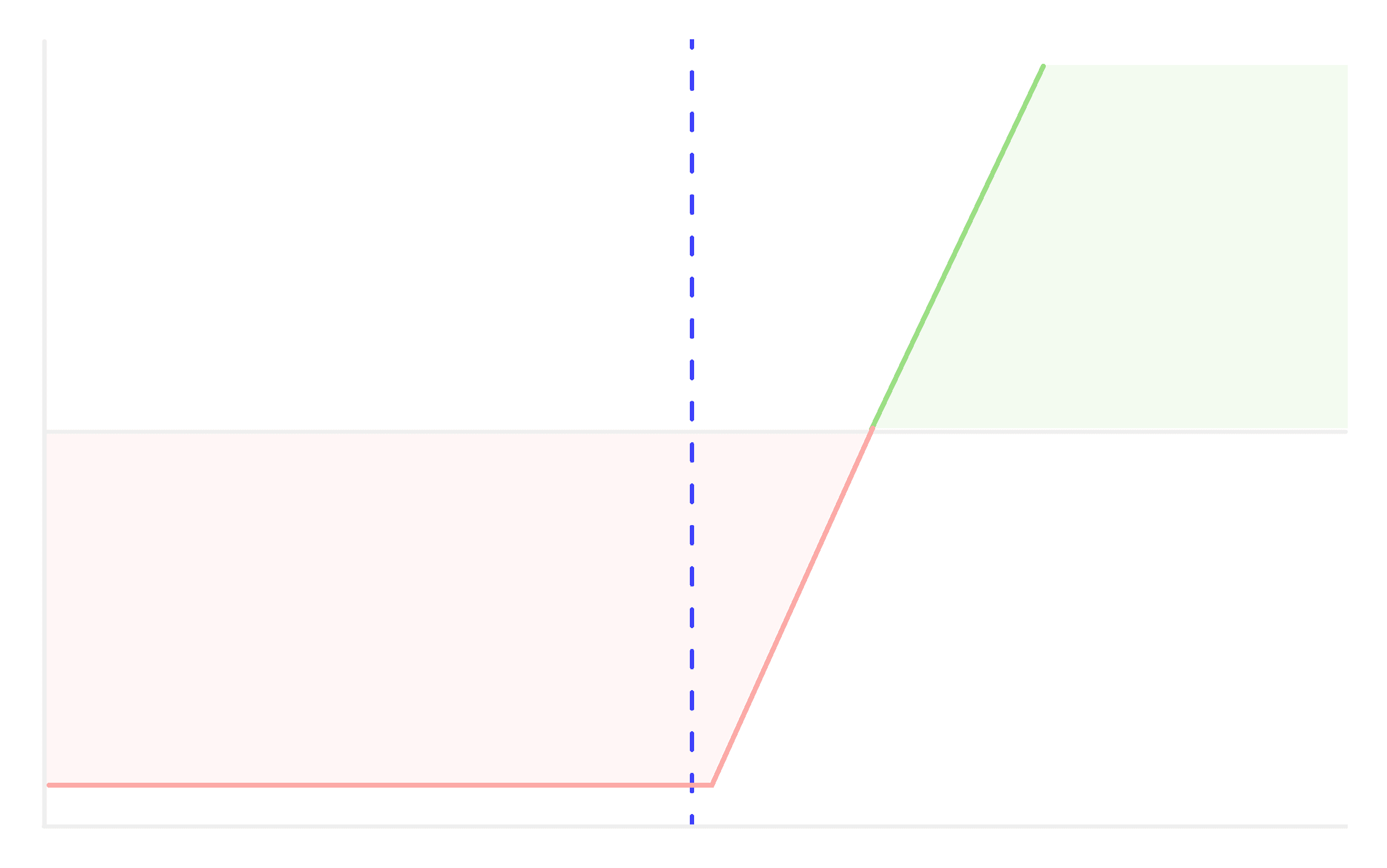

Potential Profit and Loss:

- Maximum Profit: Limited to the net premium received when establishing the spread. This profit is realized if the stock closes upon expiration at or above the higher strike price.

- Maximum Loss: The difference between the strike prices minus the net premium received. This loss is incurred if the stock closes upon expiration at or below the lower strike price.

Benefits:

- Premium Income: By selling the higher strike put, the trader earns a premium that can offset some or all of the cost of the bought lower strike put.

- Defined Risk: The Bull Put Spread has a clearly defined maximum potential loss, unlike naked put selling where the loss can be substantial if the stock plummets.

Drawbacks:

- Capped Profit: Profit potential is limited to the net premium received.

- Margin Requirement: Some brokers might require a margin when you sell the higher strike put.

Example:

Let's assume a trader believes Nifty Index, currently trading at ₹19,996, will stay above ₹19,900 for the next month. The trader could:

- Sell a 20000 put option for a premium of ₹210.

- Buy a 19750 put option for a premium of ₹138.

The net premium received (or maximum profit) is ₹72 (₹210 - ₹138). If Nifty stays above ₹20,000 at expiration, the trader keeps the ₹72 premium. If Nifty falls below ₹19,750, the maximum loss of ₹178 will be incurred (₹250 difference between strikes - ₹72 net premium).

In summary, a Bull Put Spread is a strategy favored by options traders who have a moderately bullish stance on a stock or believe the stock will remain stable. It allows them to earn a premium with a defined risk while benefiting from a moderate price increase or stability in the underlying asset.

Other Strategies

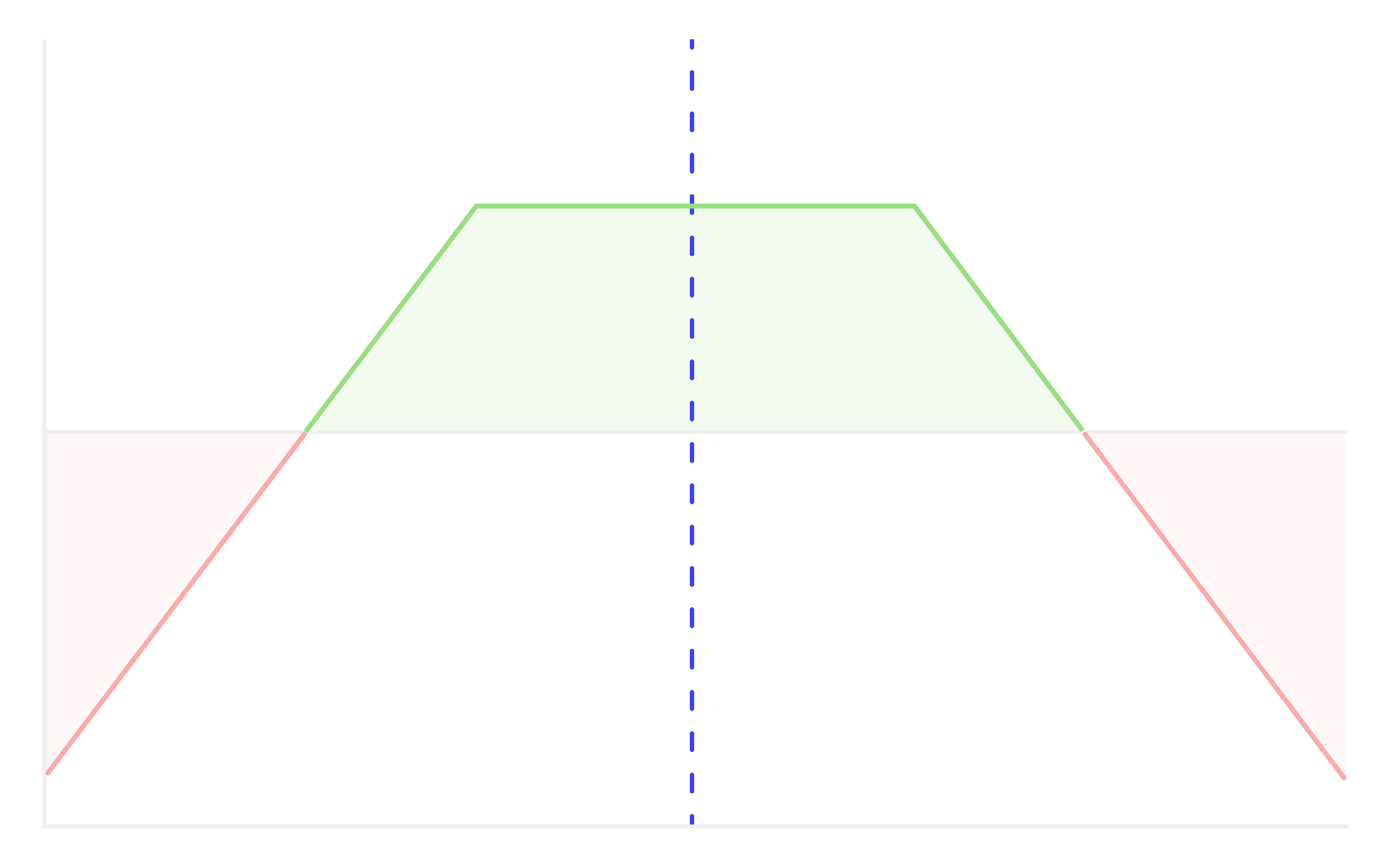

Iron Condor

A strategy designed to profit from low volatility in the underlying asset, combining a bullish put credit spread and a bearish call credit spread to it.

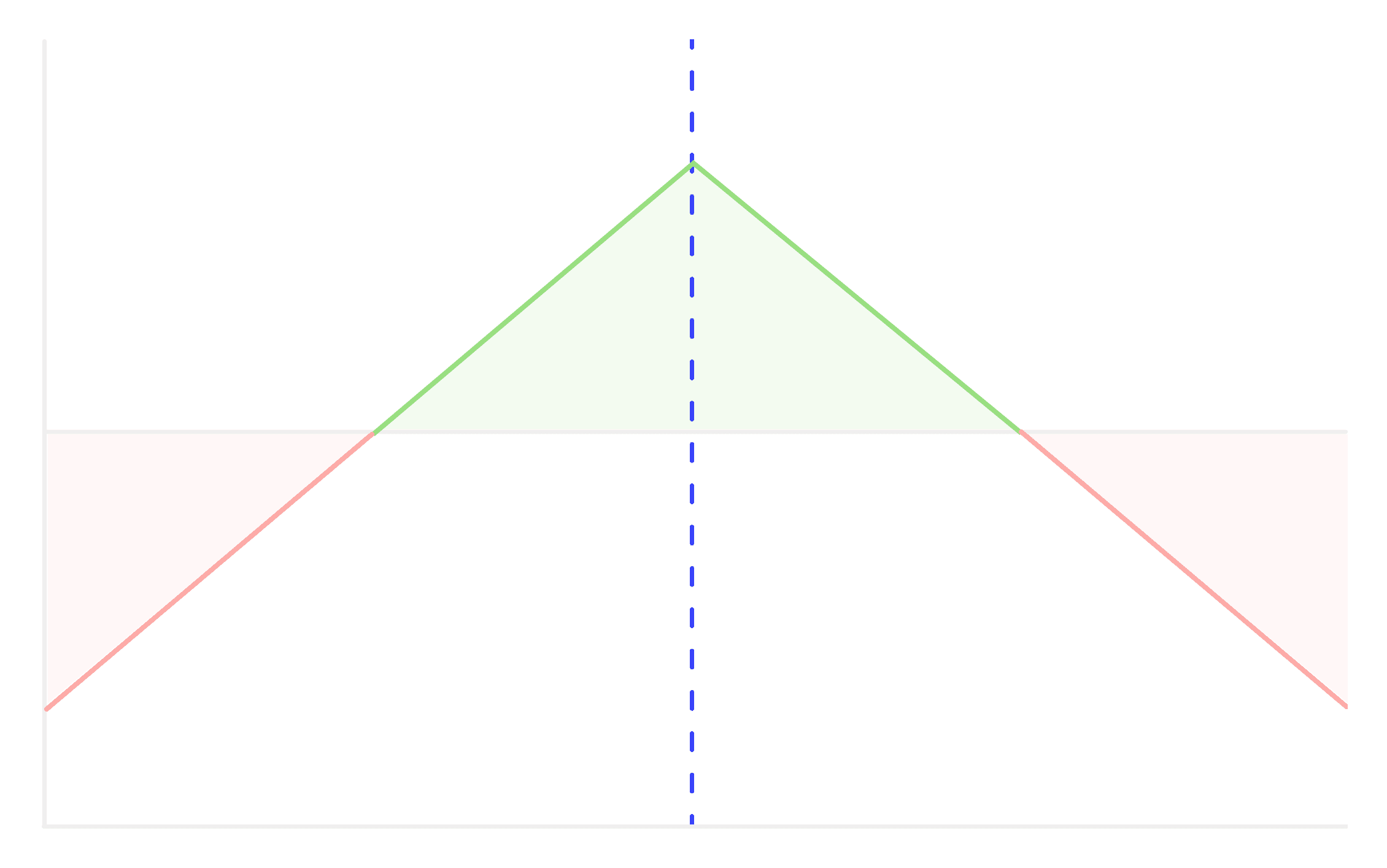

Iron Butterfly

This is a strategy which profits from low volatility in the price of the underlying asset while minimizing risk.

Short Strangle

A short strangle is a non directional trading strategy where an investor sells an (OTM) call option and put option on the same underlying asset simultaneously.

Short Straddle

A Short straddle is considered neutral or non-directional because it profits from minimal price movement in the underlying asset.

Put Ratio Backspread

The Put Ratio Backspread strategy involves selling and buying put options in a specific ratio.

Bear Call Spread

A Bear Call Spread is an options trading strategy that's used when a trader believes the price of an underlying asset will go down, but not significantly.

Bear Put Spread

A Bear Put Spread is a type of vertical spread strategy used in options trading.

Long Put

Long Put option is the most basic & simplest strategy. It is recommended or implemented when we expect the underlying asset to show significant downside move.

Short Call

Short Call strategy is employed in a bearish or neutral market outlook, where the underlying asset's price is expected to remain stable or fall.

Call Ratio Backspread

The Call Ratio Backspread strategy involves selling and buying call options in a specific ratio.

Bull Put Spread

A Bull Put Spread is a type of vertical spread strategy used in options trading

Bull Call Spread

A Bull Call Spread is an options trading strategy that's used when a trader believes the price of an underlying asset will go up, but not significantly.

Short Put

Short Put strategy is employed in a bullish or neutral market outlook, where the investor believes that the underlying asset's price will remain stable or rise.

Long Call

Long Call option' is the most basic & simplest strategy. It is recommended or implemented when we expect the underlying asset to show significant upside move.

Don't let emotions take over your trades, take control now and become a tactical trader with 1lyOptions